Power outages force businesses across Africa to rely on expensive, dirty diesel generators. Price caps block improvement, but removing them isn’t easy.

Many countries in sub-Saharan Africa have prioritized cheap but unreliable power, forcing their citizens to rely on expensive, dirty diesel generators. Western development charities have focused on off-grid solutions, like solar mini grids, but this is merely tinkering around the edges of a broken system. If these NGOs support governments by helping shoulder the cost of price rises in electricity – so they don’t fall on badly off citizens – they may be able to kick start a virtuous cycle of higher prices, more investment, and better reliability. Robust economic development and wage growth will follow.

Right now, the power is probably out in most cities in Nigeria. Estimates differ about just how bad the problem is, but according to Nigeria’s National Bureau of Statistics, the country’s national grid is only fully up and running for seven hours a day, and according to the World Bank’s survey of 2,916 Nigerian firms, there are 32 outages per month, each averaging 11.6 hours. A review by Opeyemi Kehinde, a Nigerian journalist, concluded that a government claim that Nigerians enjoy electricity for 18–24 hours daily was mostly false.

Outages are so common that the utility companies have stopped trying to keep track of them. The Human Rights Writers’ Association of Nigeria described grid collapses as ‘incessant’ and said they would mar current president Muhammadu Buhari’s legacy after a massive collapse in July 2022. And although Nigeria is one of the worst-suffering countries for this issue in sub-Saharan Africa, it is not alone.

Businesses across sub-Saharan Africa struggle to deal with unreliable power. On average, African firms deal with over a week of outages a month (Nigeria is worse than average), and 40 percent of businesses across Africa identify lack of electricity as a major constraint to growth. In Ghana, where the problem is less acute, companies still have had to send their workers home, fire their most expensive employees, and suspend production in response to frequent power outages. Outages have meant that grocery stores, hotels, and restaurants can’t reliably keep food refrigerated and sometimes have to throw out what they had planned to sell. The outages were so common that Ghanaians have developed new slang terms for unannounced extensive ‘load-shedding’ – when power outages are conducted intentionally to cope with electricity demand that outstrips supply.

Indeed, many firms never even get set up because of the high cost of power. In developing countries like Ghana or Nigeria, the use of external finance is much lower than in the USA or Western Europe and it is difficult to get loans to start a business. This means that if a new firm needs a 100 kVA generator – what you might need to run a bank – it must come with the roughly $17,000 needed to pay for it up front. This prevents many new firms from starting at all, and limits who can start businesses.

A few small businesses rely on off-grid solar to keep running through the night, but most just buy a generator. Nigeria’s towns and cities hum with the sound of generators; nearly every street is home to a cord snaking to a buzzing diesel generator in an alley. A 2014 World Bank survey estimated that 71 percent of Nigerian firms use generators, as do nearly half of households.

No one likes running a generator. They’re incredibly expensive, for both businesses and private citizens. One survey of 500 Nigerians in Ibadan in 2015 found the average respondent Nigerian spent almost a quarter of their income on power – ten times more than the average American.

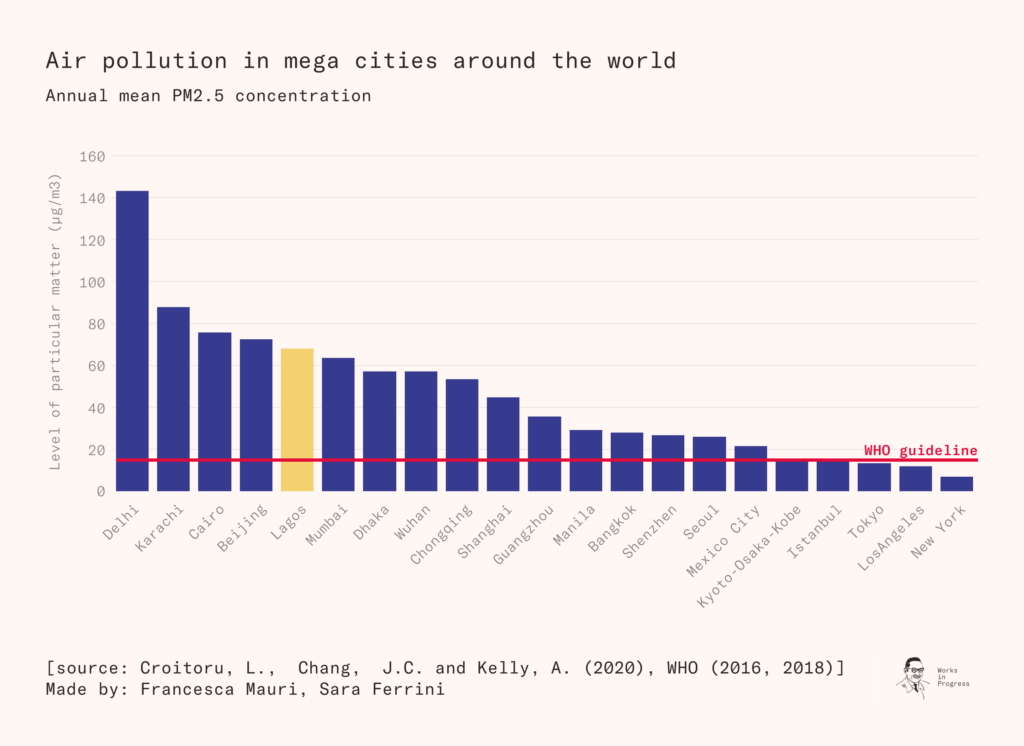

Even ignoring the cost, diesel generators are inconvenient and unpleasant. Their toxic fumes kill some 1,500 Nigerians a year, damage the hearing and health of those nearby, and are a significant part of the reason that Africa’s megacities have extremely hazardous levels of PM 2.5 emissions – particles that are small enough to enter the bloodstream when inhaled.

But diesel generators are the only solution people have. It’s difficult to run a business on today’s battery packs – you constantly risk running out of charge and having to shut down until you can recharge. Businesses need to run a variety of different appliances – not only lights but computers, ovens, stoves, machines – and for that, they need power that just works, whenever they need it. Solar panels are out of reach for many firms because they require an even larger up-front investment than a generator – perhaps 20 times higher per kilowatt. So generators it is – expensive and inconvenient as they are.

This is a major policy problem. The lack of reliable energy means that businesses spend incredible amounts of time and money simply keeping the lights on – and have fewer resources to spend on their actual services. It functions as an invisible tax, sapping resources from nearly every business in the country. Perhaps it’s not a surprise that no country has reached middle-income status without a reliable electricity grid – and being able to turn off the generators.

The cost of electricity in sub-Saharan Africa

Electricity use in sub-Saharan Africa has lagged behind the rest of the world. About half the continent still has no access to electricity. Both African and developed-world governments are keen to fix that – it’s one of the UN’s Sustainable Development Goals for everyone on the planet to have access to electricity by 2030.

In order to expand access to electricity, African governments have tried to make it very cheap, usually through a government-owned energy company. For example, Ghana’s Volta River Authority runs the lion’s share of the Ghanaian grid, generating 2.6 GW largely from hydroelectric dams and thermal power. Another state-owned entity runs much of the remainder. And state-owned companies are largely responsible for transmission and distribution as well. The situation is similar across Africa.

This drive for cheaper energy makes some sense: Ghanaians have less disposable income than Americans or Brits, so energy should be cheaper in Ghana in order for people to access it. Instead of charging $0.12/kWh, roughly the rate in the United States, the government caps the price at a much lower level.

There’s just one problem with this. The price that electricity utilities are allowed to charge is not sufficient to cover the cost of generating and distributing electricity. For instance, in 2014, Nigerian energy companies only collected about $0.06 for every kilowatt hour they provided, even though they spent around $0.20. That is: Utility companies are losing money on every unit of energy they distribute.

What is a loss-making company to do? Utility companies are typically highly regulated and have to fulfill certain conditions. Few are permitted by governments to simply stop providing electricity, and as state-owned companies they do not have a choice. But since reliability is much harder to measure than number of people connected to the grid, it is usually impractical to impose requirements for how reliable that power should be.

There often isn’t official data about how many outages there are, or where outages occur. Without this data, governments remain blissfully (or deliberately) ignorant of how bad the situation really is for households and firms. People might be listed as ‘connected’ when they first get connected to the grid, but fewer than 20 percent of Lagos residents report that their power, once connected, works ‘most of the time’.

Even when companies know about outages, though, they can’t always do a lot to reduce them. The demand for power in Nigeria is at least four times what is available at the current price – but at that price, the four companies that provide Nigerian power don’t have the money (or the incentive) to build four times their current capacity. Indeed, they’re already losing so much money they require periodic bailouts; they can hardly invest in any new equipment at all.

These continual losses create a very different dynamic from that in rich countries. Generally, utilities in rich countries turn a profit; indeed, in some, utilities are so profitable that it is a political liability. But in Africa, the opposite is true. Every new customer, every village that is connected to electricity for the first time, is a liability to the utility. They have no incentive to expand coverage; indeed, they would lose less money if their customer base shrank. They do not want to increase the number of hours of electricity supplied; that, too, just increases their losses. They are less ‘companies’ that attempt to provide a service and more ‘endless money pits’ that are better off the less electricity they actually provide.

Of course, they do provide some electricity, and lose money doing so. As mentioned earlier, utilities in much of sub-Saharan Africa only stay afloat through periodic government bailouts. Since the bailouts are funded by the very same citizens receiving ‘cheap’ electricity, this means that citizens do – in an extremely roundabout way – end up paying the full price to generate electricity. They may not pay it directly to the electric company at the end of the month, but their tax dollars will eventually make up the shortfall.

Thus, by subsidizing electricity to below the generation cost, governments have simply created a very elaborate scheme in which citizens still (indirectly) pay the full generation cost of electricity. Unlike in a system where the company charges the customer the full price and the company makes a small profit on each additional hour of power provided, though, these utilities have no incentive to improve either their coverage or reliability. After all, governments are unlikely to ask them about reliability when they decide on bailing out a company; they will only care about the cost of rescuing the indebted utility.

Thus, Nigeria – and much of sub-Saharan Africa – have found themselves in the worst possible equilibrium:

- Electricity companies provide low-cost electricity.

- It is so low-cost, though, that electricity distribution companies provide extremely low-quality service and reliability to limit their losses.

- Government bailouts (barely) cover distribution companies’ losses from the low prices.

- The cycle repeats.

Crucially: At no point in this cycle does grid reliability improve.

The real cost of electricity in sub-Saharan Africa

Powering a business by running a diesel generator is expensive. It costs about $0.44 to generate one kilowatt-hour of electricity with a small diesel generator. Not only is that many times the grid price in Africa, it is more expensive than the retail price of grid electricity anywhere in the world.

In order to have reliable electricity, then, a Nigerian firm does not really pay the $0.09/kWh the electricity company is charging them (or even the $0.06/kWh firms actually get around to paying). They pay that when the grid is up; for the rest of the time, when they’re running a generator, they are paying about $0.44/kWh, plus the cost of the generator. The think tank Energy for Growth estimates that Nigerian firms run generators 59 percent of the time, so the average price they pay is thus a whopping $0.24/kWh across the workday. This is not only almost three times the official price, it is almost double what the average American business pays.

This is also true in other sub-Saharan countries with artificially low ‘official’ energy prices. In Liberia, the reliability-adjusted price for power that includes the cost of generator-produced energy is $0.45/kWh, nearly three times what an American would pay. In Ghana, it’s $0.22/kWh; in Kenya, it’s $0.17/kWh. So businesses in some of the poorest countries in the world pay considerably more for electricity than they would in one of the richest – and, of course, business owners in sub-Saharan Africa have considerably lower revenues with which to pay these high bills. Business owners often then pay their staff less so that they can still pay their electricity bills – leaving employees worse off than they otherwise might be.

And even once they’ve paid for fuel and a generator, firms still receive a worse product than that provided by rich-country utilities. They cannot just flip a light switch and expect there to be light; the work and nuisance involved in buying, housing, maintaining, and refueling a diesel generator is significant. For a start, a generator must be turned off to be refueled, so a single generator cannot not provide uninterrupted power. Any business owners who require continuous power must own at least two (expensive) generators.

All of these costs add up. With so much spent literally keeping the lights on, many businesses have little leftover to make longer-term investments. Most firms will end up hiring fewer workers than they would if they spent less on overhead, and will have less available to invest in R&D and innovation. Firms cut their hours, and limit their customer base. Global companies that might take advantage of lower wages and costs will choose to locate elsewhere, where the infrastructure is better and energy supply is more reliable. And many businesses just can’t afford the high prices – one study estimates that 400 firms a year go under in Nigeria just due to the high electricity costs, and many more simply never get started to begin with.

The low official cost of energy in many countries in sub-Saharan Africa is thus having the exact opposite of the intended effect for many users. The price caps mean that the cost of ‘cheap’ energy is unreliability, so everyone suffers from power outages, and the true cost to those who need reliable power – using generators – is much higher than the notional price.

The policy solution to this bad equilibrium seems obvious: Utilities should be allowed to increase the grid price of electricity such that they can provide electricity without losing money doing so. Even, say, doubling the grid price would only be an increase in comparison to the current grid price, not the current total cost of energy including the cost of backup power. If increasing the grid price reduced or eliminated the need for generators, total energy costs could decrease. Many African firms would jump at the chance to pay more at the meter in order to pay less for diesel, though some people who prefer unreliable but cheap power may lose out.

Solutions

Though they are aware of the problems described above, and the difficulty many African governments are having in shifting to a new equilibrium of better service but higher prices, most Western NGOs have focused on piecemeal solutions. This approach appears to be in part driven by worries about expanding fossil fuel usage – and the climate impacts this would have – and in part driven by pessimism about shifting a lumbering beast like a whole grid, meaning a preference for smaller, local solutions. And so hundreds of millions or more have been poured into off-grid or mini-grid solutions.

There is some case for going off-grid and creating mini grids. These are small, new networks, almost exclusively driven by solar power, connecting the power users in small hamlets or villages. International institutions largely contribute the start-up cost, and ongoing upkeep is covered by the new users. In countries with huge rural hinterlands, it is more likely to bring power to the powerless than waiting on extensions of the national grid. It also means immediate impact, rather than tangling with the politics of the existing generation and distribution systems.

One big downside is cost. Right now, the World Bank reckons mini grids can deliver electricity at a levelized rate of $0.38/kWh. This is almost as expensive as diesel generation (though without the environmental and health costs), and quite a bit more than the cost the national grids could provide it at. For areas that centralized energy grids cannot reach this may make sense – but in Lagos or Nairobi, it is far more expensive than conventional power could be, and only offers a marginal cost improvement on diesel generators.

Scalability is also limited. A typical mini grid only provides enough power for two US households – they can hardly power a modern factory, or even an office block. As a stopgap anti-poverty measure, they may be useful, but they are unlikely to be deployed widely enough or cheaply enough to solve the systemwide problems described above.

By contrast, many areas already have the distribution network for grid electricity – some 85 percent of Ghanaians are connected to the grid– especially those in some of Africa’s fast-growing cities. People in this position just need the electricity those grids carry to be reliable, and for that they need policy change.

Policy change is difficult, and foreign NGOs may not be the appropriate voices for this in any case. But they might be able to help in making necessary policy change easier, by cushioning the blow that such a change could have on the poor. Africa’s utility companies and governments know they must increase their prices to the point where they at least break even, but it has been politically difficult to actually do this because some people are better off with unreliable, price-capped energy. And even if they eventually lead to more supply, price increases do harm citizens in the short term; it takes months, if not years, for price increases to allow a utility company to invest in increased supply. In the meantime, people would pay higher prices for no obvious gain.

When Nigeria’s government tried to increase prices by a relatively small amount in 2020, protests erupted against the move. The increase did eventually stick, but it didn’t solve the problem. Residents are still deeply unhappy with the continued increases – and the new, higher price still isn’t enough for power companies to break even. At best, they are collecting about $0.12 per kWh – nowhere near the $0.20/kWh they would need to stop losing money.

Western aid organizations could help to cushion that blow, either by covering some of the gap in prices that opens up as investment is made or by providing some of the start-up capital needed to actually build the energy capacity that would justify high prices, easing the transition between an unprofitable energy sector and a profitable one. Alternatively, they might provide the poorest with assistance for paying the newly increased utility costs during the transition period, or they might even work with governments to improve failing infrastructure and better monitor outages so that governments can better fix problems when they occur.

This is all likely to be tougher than starting up new mini grids, but also more fruitful, since reliable grid electricity has the potential to transform Africa’s economy. One academic paper surveyed all small and medium-sized manufacturing firms in the four biggest cities in Ghana to try to work out how these firms coped with the major outages in that country between 2012 and 2015; 885 firms responded. Looking at the adjustments firms made to deal with power shortages, they estimated that productivity in Ghana would increase by 10 percent if there was reliable power.

Another academic paper looks into the longer-run equilibrium that results when power is expensive and unreliable. The key issue is that other capital – machines, buildings, computers, and even some transport – tends to run on power. If you accurately expect in the long run that you won’t be able to get hold of electricity when you need it, then you plan for lower productivity – more traditional and less efficient working methods, more resilience, less capital invested. They find that these effects are costing workers in Nigeria – one of the worst-affected countries in Africa – some 20 percent of their wages.

Put another way, eliminating outages could raise living standards in Nigeria by as much they have risen over the last 15 years. And the air pollution benefits, although not quantified, could also mean that affected places became much healthier and cleaner. If Western aid can make this kind of shift easier by reducing or eliminating the transition costs on the citizens of these countries, it could do profound good.

Conclusion

It is true that none of this would be instantaneous. Eliminating outages would take time and sustained investment, and it is likely that the transition to higher official prices would be difficult, especially for the poorest people. NGOs may have a role in supporting this transition, but it would still likely be many years before Nigeria’s grid reached the stability of Honduras’s, let alone that of the United States.

But every additional hour of grid electricity provided would have benefits. Lagos would become a quieter, less polluted place long before the last generator vanished from the streets.

And eventually, utilities would build enough capacity that outages would be eliminated almost altogether. An Africa free of generators, with the same reliable electricity grid that the developed world can take for granted, would be a more productive, less polluted, more prosperous place. It would be a place where it would be easier to attract foreign investors, and where businesses would no longer have to work around infrastructure limits.

To be free of generators, Africa needs reliable, sustainable grid power. This should be a focus, both for African governments and for development aid agencies. Africa’s businesses need power that just works.