alt_protein_vc

Bio

Work in venture capital and invest in alternative protein.

Comments3

Hey Lewis,

Sorry for the delayed and long-ish reply here.

Distribution and retail inefficiencies:

I would concur that those are issues. For example, retailers and distributors typically take higher margins on plant-based products vs animal-based ones. I can't really give a good benchmark number here because it changes a fair bit based on country, how the retailer is positioned etc.

That being said, I think the question worth asking is whether this is a tractable issue at all. My own take is that it isn't particularly tractable (at least in the next decade or two). In my opinion, there are largely two broad scenarios (neither near term) in which a retailer/distributor/foodservice player would have downward margin pressure on plant based meat products:

i) The product's price, in particular, is literally bringing people into the store that otherwise wouldn't be there (so essentially operating somewhat like a "loss leader" product). Realistically, I think it's unlikely that the average American/European (not the vegans and vegetarians) is going to be picking their retail store based on plant-based meat's price any time soon.

ii) The production prices come down to a point where it enters the consideration of consumers with higher price elasticities of demand. In other words, today's plant-based consumers are relatively price-insensitive so there's little incentive to drop margins as an intermediary because you're not really losing significant sales from keeping margins high. If one can get the base product prices to a point where the people considering purchase are more price-sensitive, then intermediary margins start to come under more pressure (but more on getting the base product price down below). In the case of beef in the US, I suspect that the key price point where it realistically enters this price elastic consumer's mind is probably a little under the price of retail store beef. I'm fairly uncertain about whether that price point is attainable though I would lean towards the proposition that it is (with just beef though)

Important innovations:

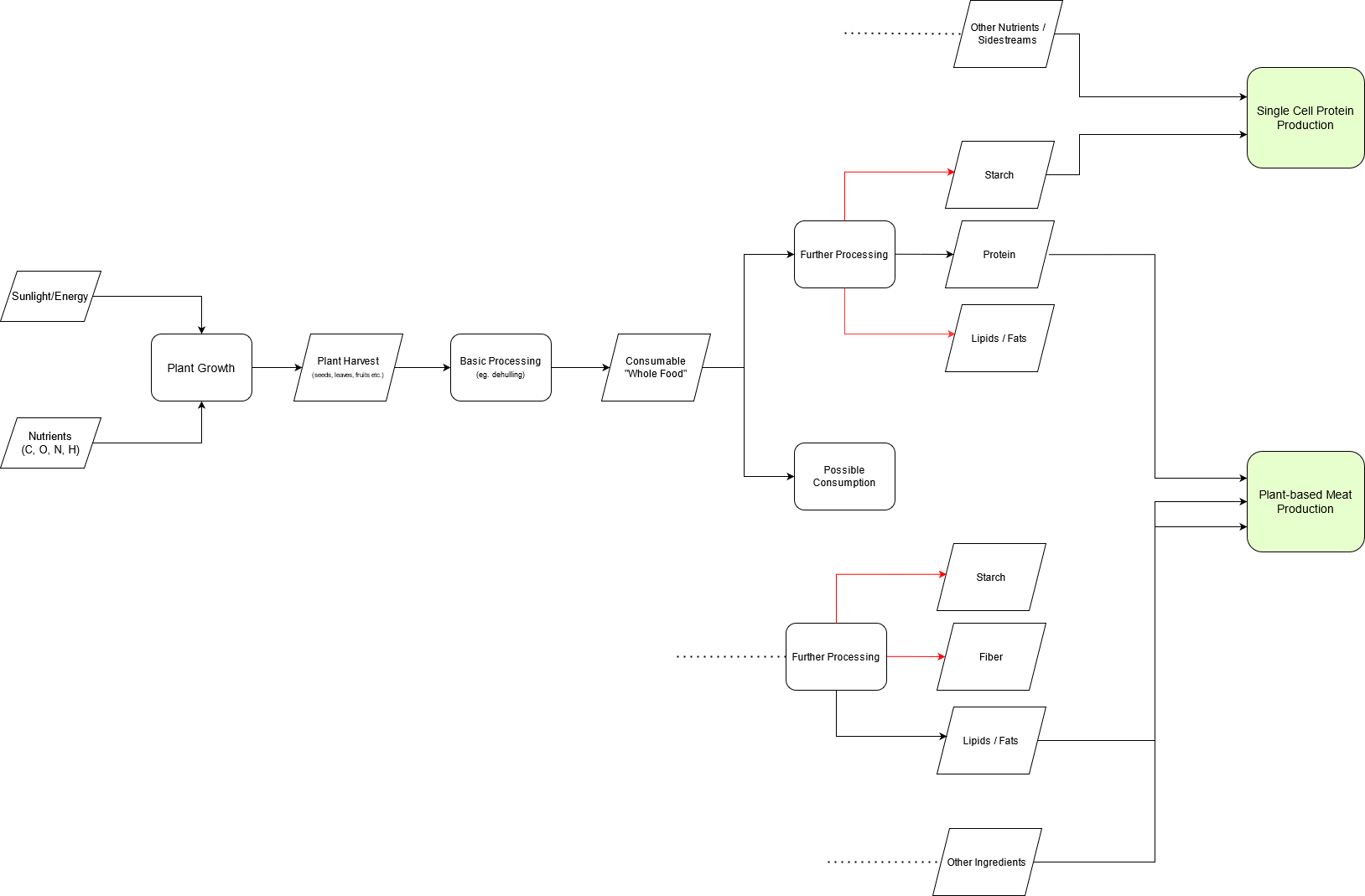

I'll preface by saying that while I think it's possible that plant-based meat can undercut beef on price in the next decade, I also think it's fairly unlikely that plant-based in the rough form of Beyond/Impossible will ever be price competitive with something like chicken in the US (even at scale). That's largely because of what I informally call "sidestream inefficiencies". Here's a quick sketch of how I see the larger system working. (simplified so please forgive any minor omissions though please let me know if you think I've majorly missed something)

Even in my conception of the most "efficient" system, the price of your plant-based meat (let's ignore non ingredient costs for the moment) is actually fairly dependent on how your ingredient provider is monetizing the sidestreams of your ingredients [This issue has already been highlighted by both McKinsey and Breakthrough with the case of pea starch].

So to price compete with chicken in the US, ultimately you need one of two scenarios to play out (I can't think of other ways but anyone else who looks at this area, please feel free to add):

i) Find a plant that with minimal side stream creation and additives can be processed straight into a good chicken analogoue (maybe this plant exists but I'd deem this fairly unlikely naively). I'm skeptical that a simple soy/wheat flour product can do a good enough job here in terms of product performance but I could be wrong.

ii) Find a strain of fungi/algae/bacteria that happens to taste like chicken with minimal processing and side streams, is high yielding, isn't a very "picky eater" when it comes to feed AND/OR chance upon a high quality feed which is currently a sidestream that is produced in large quantities, and maybe hated by the producer of the sidestream (for regulatory or other reasons) to the point where they may even pay you to take it off their hands (or at least give it away for close to free). This is a really high bar to reach but more likely than i) in my opinion.

Summary:

In summary, I think it's worth having more explicit conversations about waste sidestreams/cheap feed pathways and associated organisms that might work well with them. Often people working on these kinds of pathways can be hard to fund from a venture capital perspective because with a totally new organism that the consumer is eating as a whole (in other words NOT Perfect Day's whey or Impossible's heme) the regulatory pathway can be quite challenging/long/uncertain in many jurisdications because there's just no safe history of consumption of the organism.

TLDR

Humans are really picky eaters and tend to create inefficiencies/waste or low value streams when they eat plants posing as alternatives (making it expensive). So we need to find another relatively not so picky eater (like chicken but not sentient) that can turn low-value things into delicious protein with little waste to compete with animals on price.

In a recent newsletter, you suggested getting plant-based meat cheaper would revolve around cheaper ingredients and production efficiency.

Couple of questions around that since it felt like there was some abstraction for brevity in that newsletter

First, some data to work off. According to Beyond's latest filings for nine months up to Sep 2020, their per pound price is probably more like $3.97 per pound vs your $3.5 per pound estimate (I'm including outbound shipping and logistics as well which is probably more accurately a cost of goods sold item but an SG&A item for Beyond). Meanwhile, they seem to be selling at around $5.6 per pound (revenue / volume in pounds) giving them a 31.8% gross margin.

Being generous, I think this gross margin is probably a Covid related impact (overspent on fixed costs) because their gross margins have been higher before so I think there's probably room for another 600 basis points of gross margin improvement (look at Sep 2019 quarter filings). In that particular quarter with higher gross margins, the cost per pound (same method as above) was $3.9 per pound, and the selling price was roughly $5.74 per pound.

Again being generous, without covid and therefore better fixed cost leverage within the cost of goods sold, let's say they could've done the same margins with $5.6 cost per pound. That means a production cost of $3.6 per pound (again emphasizing that I include outbound logistics whereas Beyond don't)

$3.6 per pound is still 33% more than farm prices for beef in the US in Jan-21. So that's where (in my opinion) where we're currently at.

---

Questions:

1) Production efficiency: Practically, this means increasing the amount of product you can produce per unit cost. As I see it, in plant-based meat, this means being more efficient with your direct labour, equipment costs even ingredients (ie reducing wastage). These are all relatively small cost items. My own estimate would be less than 25% of total cost. For a more outside view, depreciation and amortization expenses (largely fixed costs) as a % of Beyond's cost of goods sold is only 4.5% of cost of goods sold (9 months upto Sep 2020) and direct labour is ultimately going to be dependent on where you're producing.

So how much of that 33% gap do you think can really be closed with production efficiency (more automation, higher throughput equipment, less wastage etc.)? Because to me, it really looks quite small.

2) Cheaper ingredients: As per my estimate, this is likely a much bigger piece of the pie and ~40% of the cost base. Unfortunately, I can't find any good external data on this (just based on my estimate seeing several plant-based meat startups over the past couple of years in venture capital). Typically the two biggest fractions of cost there are the protein fraction (concentrate, isolate etc) and the flavours (as well as other functional ingredients). To me, it seems relatively low impact to innovate and bring down the prices of major and already cheap proteins like soy because in most cases that's likely to positively correlate with feed costs (and therefore bring those costs down as well).

So with respect to flavours, what do you think is the scope to bring down flavour (and other key functional ingredients) costs over the next couple of years/decades and how much can that contribute to closing that 33% gap to beef prices in the US? (I have no view on this)

Note: I don't like being anonymous but I think it makes it easier for me to be honest and candid.

Hey Noa,

Thanks for writing this up!

As someone who's worked on similar stuff, I just wanted to pitch in with two thoughts (hopefully helpful!):

On extrusion modeling, I (& others) looked into something similar about 4-5 years ago and I personally I came away quite pessimistic for 2 reasons.i) The search space is practically a lot narrower than it seems (very limited by ingredients accessible and "suppliable" at scale).ii) Furthermore, an extrusion expert I spoke to thought that more of the variability probably came from ingredients rather than actual extrusion parameters so a model alone seemed unlikely to create "big" improvements to the texture / product quality.

Somewhat confirming this: I spoke to a senior researcher at a well known plant-based company + and an ex-one from a mainstream CPG company and they both confirmed that they'd tried something like this and came away from it without any real product improvements.

On the second idea, I have less to add but it may be worth checking out AMII's recent collab with New Harvest. More general hot take though: My (the low confidence) general impression has been that solving "big" fermentation / cultivated problems with an AI-ish approach has been somewhat bottlenecked by the ability to get good data and iterate (in other words, the "sensors" aren't great and limited). In-silico modeling is seemingly pretty far away too for most cell lines/platforms that I've heard folks talk about in recent years but unsure where that will go.

Other interesting things from an ML/AI perspective may be looking at areas like ingredient functionalization & processing for ingredient companies (ADM, Roquette etc.). The idea here would be to tweak processes to get better functionality or lower prices. There was some interest in this work 4-5 years ago but I haven't followed it much since.

Anyway, hope some of that is useful and that you find an interesting problem & funding!