A friend recently asked:

I am considering increasing my donation amount to a 2-digit percentage of income, and was wondering about the logistics of federal/state income tax withholdings.

Do you have your employer reduce withholdings upfront? Was it simple to have them do so? Or rather ask the IRS for a refund a year later?

This is a good question! When you start a job in the US, your employer will generally withhold Federal and State taxes. Their goal is that when you file taxes you will be close to neutral: neither owing the government additional tax nor getting a large refund. Since the amount of tax that you owe will depend on your individual tax situation, however, your employer needs some information from you to figure out how much to withhold, and they'll have you fill out Form W4 (pdf).

This used to be pretty awkward, with a system of "allowances", but a few years ago the form was reworked and is much better. There is now a section for "deductions", and you can put your planned donations there. The IRS has an online calculator that is pretty good.

Since you normally only fill this out when you start a new job, if you're making a big change to your taxes, like a large increase in donations, you should ask your employer for a new W4 to fill out.

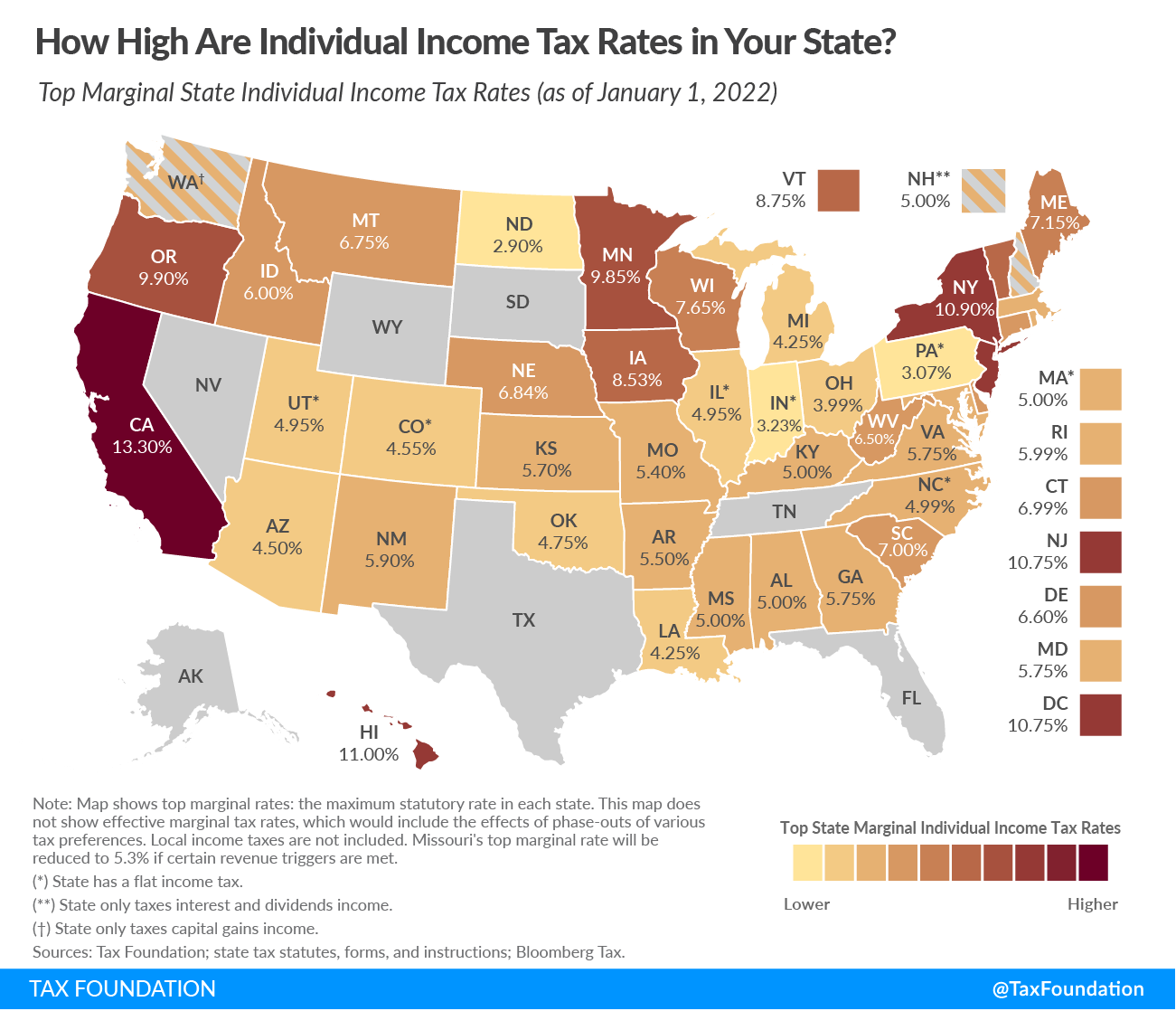

If your state also has an income tax (most states) then it likely has a different form, (ex: in MA it's Form M-4, in CA it's DE 4), and unfortunately they generally still use an "allowances" system. If your state doesn't allow you to deduct donations (ex: MA and NJ) these forms are relatively easy to figure out because you just put down your information like anyone else. If your state does (ex: CA, NY), it probably has a much lower limit than the federal government (table), so when following the instructions only consider the amount that you plan to donate that your state will count.

Overall, if you've done this correctly, when it's time to file taxes next year you should be looking at a small bill/refund. If you are off, however, as long as you adjust for next year you should be fine: the rules for underpayment are relatively friendly as the IRS goes.

Comment via: facebook

Surprising a ~dozen states don't recognize charitable deductions, wonder how tractable it'd be to lobby for in those states:

especially since they're mostly larger economy states:

https://en.wikipedia.org/wiki/List_of_U.S._states_and_territories_by_GDP

The ones that do typically have very low limits, which makes this seem less promising to me.

The mean donation also isn't all that valuable, which also limits impact of trying to incentivize more.

Excluding the 10 states and D.C. with cap footnotes, it's unclear to me if that interpretation of low limits is correct if you're referring to the right column percents since they exactly coincide with the top marginal income tax rate in most of the states I've checked. That makes it seems likelier that charitable contributions are just deductible in those states

Just want to say thanks for posting this. I donate a substantial portion of my income, so I just filled out a new W4 with my employer. I'll get a more even cash-flow and money earlier instead of $10k+ annual refunds.