From 2015-17, advocates secured pledges from over 300 US food companies to eliminate battery cages for the more than 240M egg-laying hens in their supply chains, mostly by 2025. (Advocates also secured another 800+ pledges from non-US food companies — the subject of a future newsletter.)

This was a big win for the farm animal movement. Fewer than 50 full-time advocates pushed the $9B US egg industry to commit to eliminate its core business practice — confining hens in tiny cages — at a cost to the industry of $7B-$9.5B. A 2016 Washington Post front-page story declared a “victory for the animal welfare movement”, noting that even egg producers think a “cage-free future is a fait accompli.”

In an excellent new post, Rethink Priorities’ Saulius Šimčikas assesses the cost-effectiveness of these campaigns and the global cage-free ones that followed them. He finds that, even accounting for the millions spent on investigations and other advocacy that only indirectly supported the campaigns, they affected 12 to 160 years of animal life per dollar spent.

But that only applies if companies follow through on their pledges. And, two years on, there are worrying signs that some may not. Marriott and Burger King postponed their 2015 and 2017 pledges, while Disney and Hilton only partially fulfilled their’s. Some egg producers have halted cage-free conversion plans, citing weak demand. A new survey finds the largest US egg producers think most hens will still be caged in 2025.

A great new report by Charity Entrepreneurship’s Karolina Sarek reflects this concern. She reviews historical and industry evidence that weighs on the topic, for instance finding that four major food companies kept only about half of their corporate social responsibility pledges since 2000. She concludes that we should expect just under half of companies making new animal welfare pledges to follow through on them.

Even legislative bans are under threat. Michigan egg producers, who in 2009 supported a compromise cage ban to take effect in 2019, have been lobbying to delay the ban’s implementation. And while the King Amendment is now happily dead, 13 factory farm states are continuing a federal lawsuit to strike down California’s and Massachusetts’ cage bans.

So are we doomed to a future with battery cages?

The good news

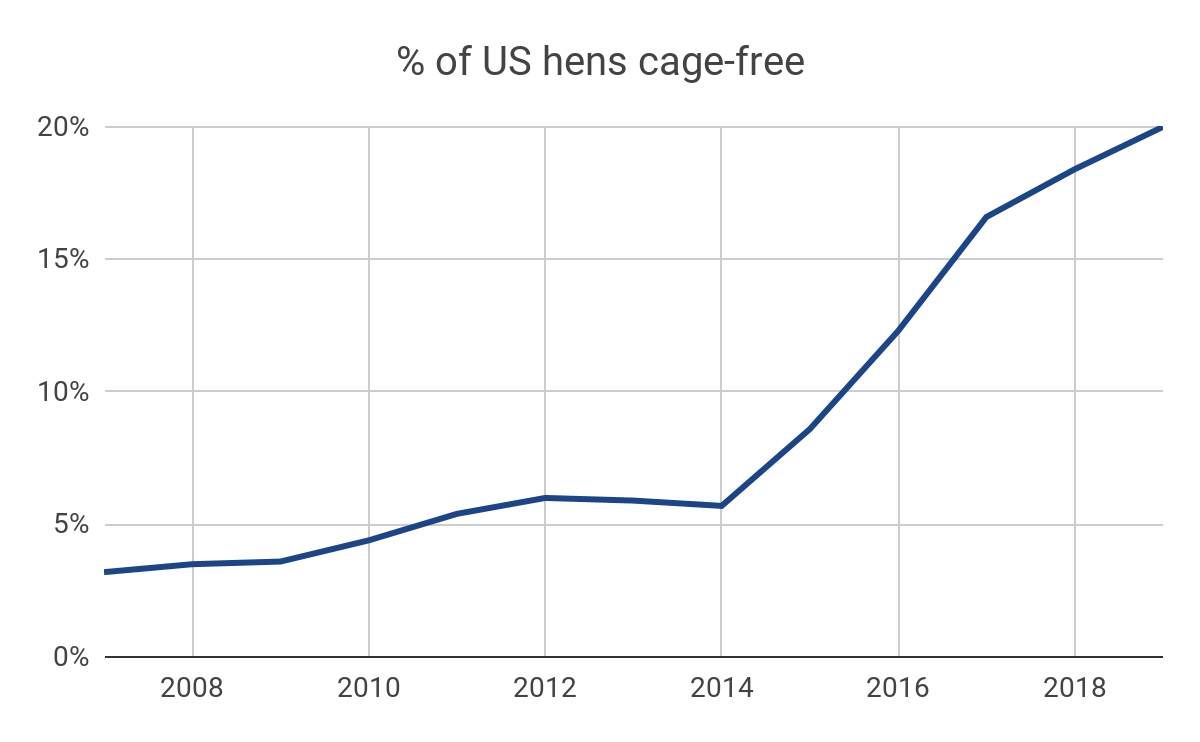

I don’t think so. US egg producers aren’t scrapping cages fast enough, but they are scrapping them. In 2014, the year cage-free corporate campaigns began in earnest, 17M hens, or 6% of the US flock, were cage-free; today 67M hens, or 20% of the national flock, are. That trend should continue: egg producers say they plan to add or convert cage-free housing for 12M hens in 2019 (though they also plan to add cages for 1M). Given most pledges only come due in 2025, it’s surprising there’s already been this much progress.

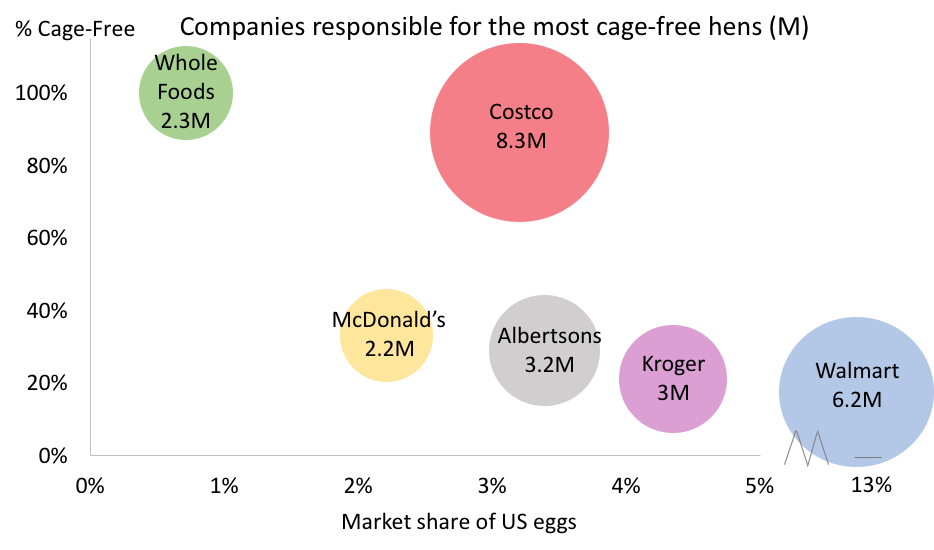

The progress has been driven by major retailers. Costco has achieved the most impressive gains: when advocates waged a major campaign against it, in 2015, 26% of its eggs sales were cage-free; today 89% are. The four biggest grocers in America — Walmart, Kroger, UNFI (Supervalu), and Albertsons — are less far along, at 12 - 29% cage-free, but still collectively account for about 14M cage-free hens due to their scale.

Prices suggest this progress will continue. The egg industry has pitched numerous media pieces on weak consumer demand for cage-free eggs. But USDA data shows that retailers are selling cage-free eggs for 2-3X the price of caged eggs, even though they only cost about 36% more to produce. This is likely because retailers are using caged eggs as loss leaders and cage-free eggs for price discrimination. As cage-free eggs become the default, this should change.

Transparency should also aid this progress. Although most companies are not reporting publicly on their progress in going cage-free, that’s changing. Following McDonald’s and Walmart’s recent reports (33% and 14% cage-free respectively), eight of the ten biggest egg buyers are now reporting in some form on their progress in going cage-free. Public reporting and progress in going cage-free are correlated, though causation likely flows both ways.

New state laws will speed this transition. Barring a court loss, Massachusetts’ Question Three and California’s Proposition 12 will require all eggs sold in both states to be cage-free by 2022. Washington state just passed a similar law after HSUS threatened a ballot measure, while Oregon’s Legislature followed suit last week (the bill awaits the Governor’s signature). Assuming these states are already using about 20% cage-free eggs, their 58M residents will require another 46M more hens and pullets to be cage-free by 2024.

What can we do?

I think a few strategies are particularly promising for holding companies accountable to their pledges.

First, we need to get retailers — which the USDA estimates account for 81% of all eggs covered by pledges — to decrease their sale of caged eggs. Although some big retailers like Costco are on track, most are not. Some are even trying to weasel out of their pledges; Publix warns that weak demand “may impact our ability to reach our stated goal” to go cage-free. We should call out this nonsense. Retailers pledged to go 100% cage-free, not to wait on individual consumers, who surveys show expect retailers to enforce welfare standards. And simple changes — like charging equal markups on caged and cage-free eggs — could make a big difference to sales.

Second, we need to get companies to publicly report on their progress in going cage-free. The eight biggest egg buyers that are publicly reporting collectively account for about 105M hens, or one in three US hens. But of the next 50 biggest egg buyers — which together account for another 70M hens — only nine are publicly reporting. CIWF USA’s EggTrack and HSUS’ new scorecard are critical tools to change that.

Third, we need to get companies to set milestones toward going 100% cage-free. The egg industry is right that if buyers all wait until 2025 to go cage-free there won’t be enough eggs. Instead, companies need to set earlier dates by which a certain percentage of their eggs, or all eggs used by certain brands, will be cage-free. Ahold Delhaize (which owns Giant and Food Lion) is a good example: it pledges that four of its US retail chains will go 100% cage-free by the end of 2022, with the final two going cage-free by 2025.

Fourth, we need to keep pressure on producers to transition sooner, and to better systems. New Zealand egg producers can’t keep up with rising demand for cage-free eggs they didn’t prepare for, while UK egg producers are now removing “enriched cages,” installed only a few years ago at a cost of £400M, because the market for caged eggs is collapsing. US egg producers risk making similar mistakes: some are delaying cage-free construction, while others are installing “combi systems,” which can swap between cage and cage-free. We can point out to these producers’ investors and lenders that cages and combi systems could both become “stranded assets,” worthless in a world where all big buyers only want cage-free eggs.

Fifth, we need to campaign against companies that miss their deadlines. The Humane League has now done so with Marriott and Hilton, in each case securing new, much-expanded pledges on tighter timelines. The biggest foodservice companies — Aramark, Compass Group, Delaware North, and Sodexo — all have pledges that come due this year or next, and present obvious targets for enforcement campaigns if they’re not yet 100% cage-free.

Advocates need our help in this fight. If you can contribute time, you can join these campaigns through the Fast Action Network or Hen Hero Network. If you can contribute money, you can donate to to one of the groups leading this implementation work: The Humane League, Mercy for Animals, or CIWF USA.