Charles He

Bio

You can give me anonymous feedback here: https://forms.gle/q65w9Nauaw5e7t2Z9

Posts 2

Comments948

Yes, I think we're agreed.

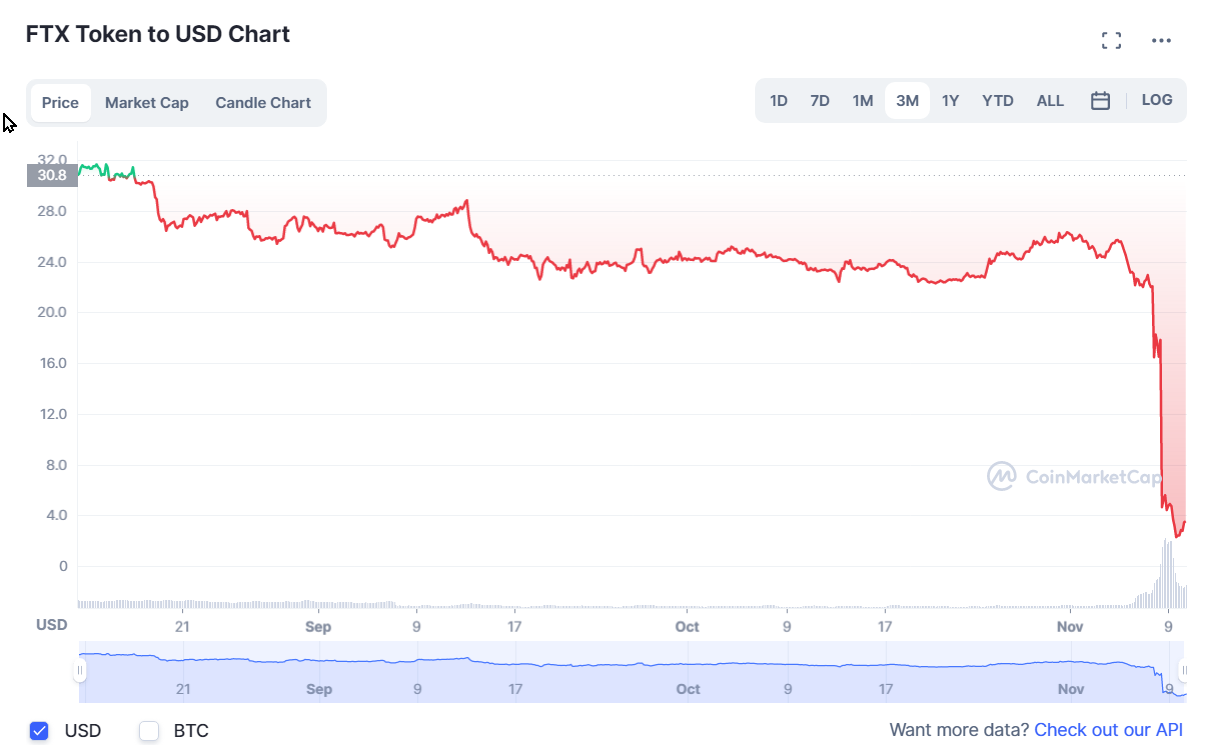

it's misleading to think of FTT price dropping as "the thing that was life or death for them." (Or maybe it was in a "proximate cause" kind of way, but the real problem was the reliance on FTT in the first place.)

It's more like FTT was a quasi peg, they needed to keep it up at $>20. The fight that was life and death was keeping it that high with their resources.

Yes, as you say, the FTT token wasn't worth anything even before the crash, the FTX/Alameda money to prop it up is what was operative, and is gone now.

We haven't discussed anything that would contradict the overwhelming evidence that FTX has a gap of $4B or more.

Low information threads seem undesirable if there are people who are less informed and had very high/trust in SBF, partially due to EA associations.

For Alameda, other "coins" were covered in the link in my first post, it's pretty clear that they aren't worth anything, even if there was no crisis.

https://dirtybubblemedia.substack.com/p/is-alameda-research-insolvent

This is probably true of any "projects" on FTX that the entities control.

This is very sad and terrible, but I think the relevant companies are bankrupt and rescue seems unlikely. Maybe if it's helpful in some way, the newspapers Reuters and NYT contain information, if you want to read it.

Onlookers: Guys, it's a highschooler, I think there might be special duties here to people of different ages and backgrounds.

For onlookers:

Basically the tweets promote the narrative that it is a short term liquidity crisis and there is a future for FTX.

As someone who strongly supports SBF, it’s perfectly clear that FTX, and Alameda is in the beyond dire position of insolvency as reported. This tweet is performative and misleading but is the best narrative the CEO can do, this fact is also is expected and normal at the same time.

What I think: I think that FTX was insolvent such that even if FTT price was steady, user funds were not fully backed.

Yes you are right, I disagree. I think this collapse happened because of the FTT "attack" (or honestly, huge vulnerability) and Alameda was forced to defend. Without this depletion, SBF or FTX could cover these funds in a routine sense and we wouldn't hear about this.

That is, they literally bet the money on a speculative investment and lost it, and this caused a multibillion dollar financial hole. It is also possible that some or all of the assets - liabilities deficit was caused by a hack that happened months ago that they did not report.

This was very crisp and helpful, yes, you are correct, we definitely disagree here, I don't think there was a major gaping hole like a major speculation or hack that was being concealed.

Is there any bet you'd take, that doesn't rely on a legal system (which I agree adds a lot of confounders, not to mention delay), on the above claim? Could we bet on "By April 2023, evidence arises that FTX user funds were not even 95% backed before Binance's FTT selloff?" Or maybe we could bet on Nuno's belief on the backing?

Thank you for thinking about this! I agree with this bet! With the addition that includes any major selloff/attack on FTT (it's possible Binance actually was in the minority of sales on this week's events). I will accept this bet very happily at 50/50 that no such evidence will merge that is substantiated (e.g. not a rumor).

(This can still be hard to operationalize, because the forensics or seeing what happened can be difficult, especially if FTX is restructured in some way. E.g., it could have happened but we don't hear about it. This is to your disadvantage.)

So FYI the most likely outcome is that I wake up tomorrow and pretend it was all just a dream. Sorry to disappoint and thanks for indulging me a bit in the end.

I will only accept bets on escrow, so we're both clear that it's active. I will honor any bets discussed, if you want, and you can leave it or not mention it again, if you don't want to take them.

You are extremely thoughtful and helpful. Have a good night! Thank you and sorry again.

Hello, if you plan on making further interactions on the forum, you might consider it useful to add your role to your profile, this would make your interactions more clear to a wider audience.

The link is probably here: https://forum.effectivealtruism.org/profile/molly/edit (this only works for you obviously).