I am an early-retired EA that decided to work in the field in Malawi Africa to try to create new interventions that could be as cost-effective as GiveWell top charities. I recruit some of my retired friends to help. And some of my retired friends support the work. See:

https://www.solar4africa.org/newsletters

For details. I also mentor EA students from UC Berkeley on projects that can help them become better, more skilled and excited EAs. The projects are here:

https://www.solar4africa.org/technical-details/fall-2023-student-projects

But what I think would be most impactful for us retired EAs in the US to do is to start mentoring young EAs to save up for retirement in tax-deferred individual retirement accounts (IRAs) so that in 30 to 40 years they can give a lot more to effective causes than you and I will be able to do. Here is the idea:

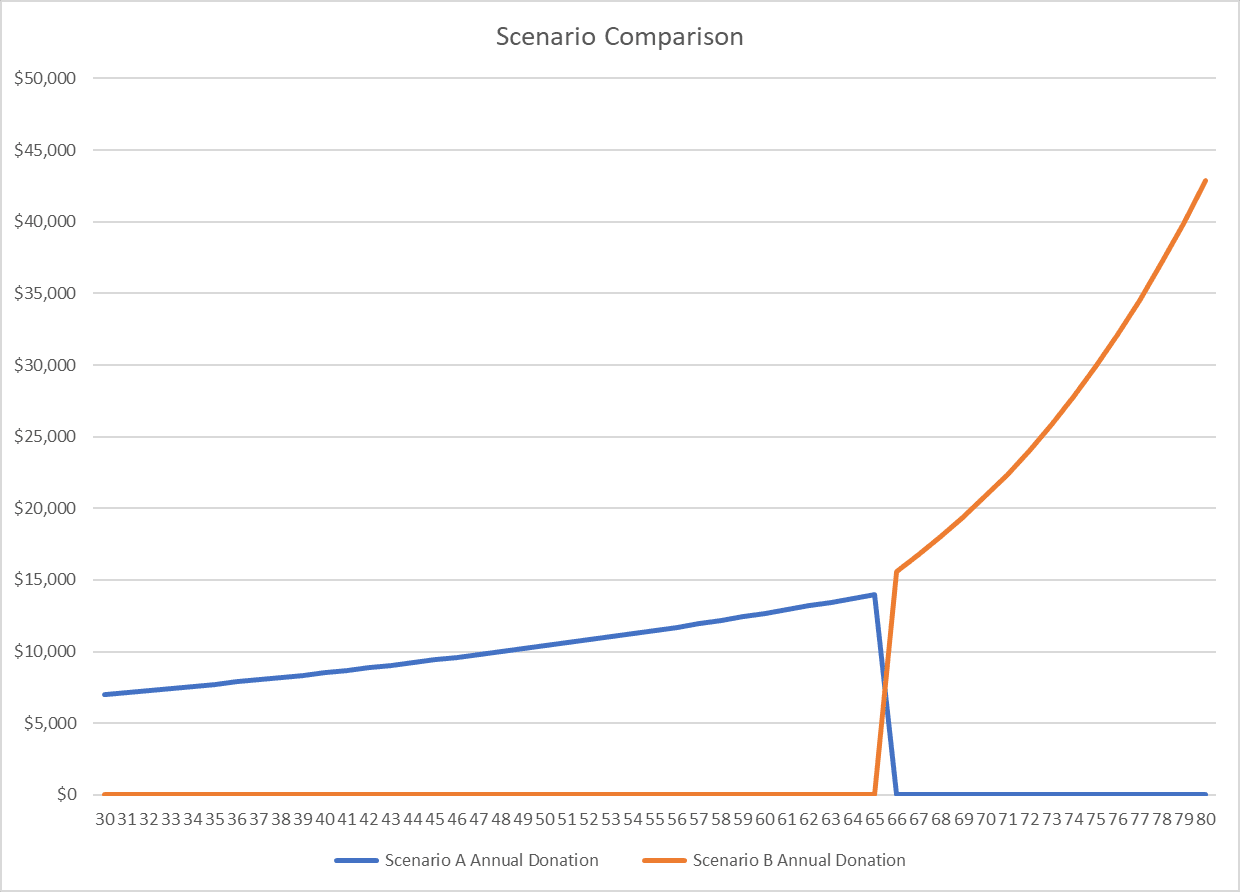

We might call the concept something like "retirement savings for max impact." which is similar to "earning for impact." But the idea is that people would take advantage of current US tax code and devote an IRA account to create giving fund when they reach retirement age. The earlier you start the greater the advantage at retirement.

In the US, contributions to an IRA get deducted from your gross income for tax purposes, and if invested in the best growth funds available, could earn average returns of over 13% per year over the long term. That means that a young EA that puts $50K in an IRA by the age of 30 could turn that into a $50K x (1.13)^(30) = $3.6M by the time they are 65. And if they keep it invested in growth until they are 75 years old, their retired EA endowment could have an expected value as high as $12M. Note that since the best EA charities can be 10 times more cost-effective than cash transfers, this can create $120M in benefit to the world from one retired future EA. (with inflation adjustment this benefit has an inflation-adjusted value of probably only $30M. Still pretty good). And this can be done by any young EA that can figure out how to save $50K in an IRA invested for high-performing long-term growth by the age of 30.

I think that a project that has retired EAs, teaching younger EAs how to be much richer when they are retired so that they can give much more when they are retired to really good causes, might be a very impactful project. Get thousands young-EAs to do this, and this could create potentially hundreds of billions of new benefit for the world in the coming decades.