I recently participated in an effective altruism personal finance discussion group. I loved the discussion, but I felt the problems were phrased as too unsolvable. I feel like many problems that people label as inherently unsolvable or difficult have very simple sub-optimal solutions if you think about a model for a small amount of time.

So I present to you a very short post on a painfully incorrect, uninformed, inconsiderate and simple way to manage your personal finance as an effective altruist. It hopefully should be better than nothing.

There are two classic approaches to giving:

- Giving a percentage of your income, where you choose a percentage such as 10% and give that percentage of your income.

- Allocating a budget for yourself, and any money you earn above that budget you give.

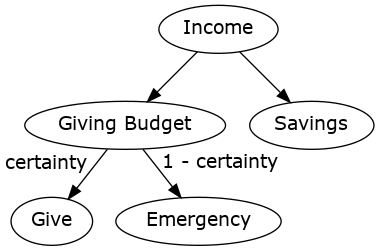

Choose a giving strategy and put that money from your income aside into your giving budget and put the rest into your savings. You can kind of think that you are "giving" this money. We'll call it your "giving budget", but then...

Choose a certainty percentage. This percentage represents how financially certain you are about your future. Basically "How sure am I that I can sustain myself at this level of giving". If it's 100%, then you are certain this level should be fine, if it's 0%, you're certain that giving this much would mean you can't sustain yourself. We will call this percentage .

Then, create an emergency savings account. This emergency savings account cannot be used for normal purposes, and is only used to make sure that you can survive if everything goes terrible. Money in this account is meant to give you financial security and nothing else. Give % of the your giving budget to effective interventions, then put the rest in your emergency account.

You're done! Benefits of this model:

- Considers uncertainty about the future and your financial situation, allows saving for the future while giving as an effective altruist.

- Similar to conventional advice. (The emergency account is similar to the Barefoot Investor's "Mojo account")

- Really darn simple

Notes

The certainty percentage might increase when you have lots of money in your emergency account. So your emergency account will likely have some form of cap, where once you have a certain amount of money there you have much less to worry about, will be 100%, and then you can give your entire giving budget. Certainty can also help with things like "Certainty about how I should spend my money given longtermism and current moral information" so that you can save money to give later.

Extensions

- If you want, you can also save for an early retirement this way, just put a portion of your giving budget into a "save for the future" account.

- If you want to give more around tax season, do so and it shouldn't mess with this system.

If this model is totally useless to you and you are still at a loss on how to manage your finances, I would love to know! Hopefully we can work out how this can be extended to be more general.