The promise of impact investing

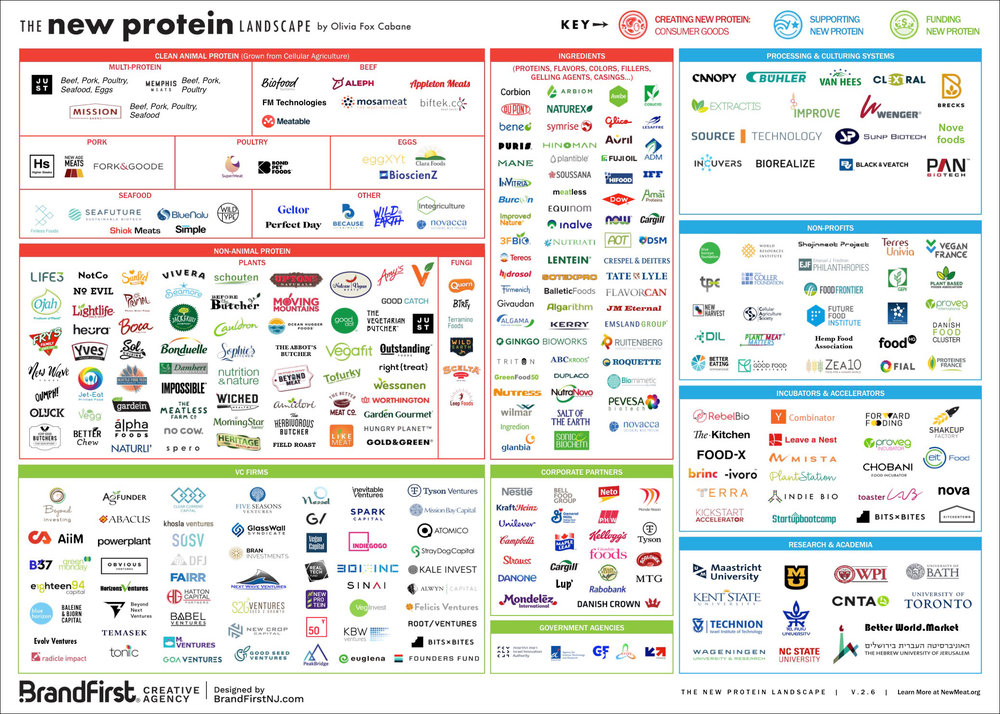

Some of the most exciting developments for farm animals are happening in the private sector. Over 100 companies are selling ever better plant-based meat and dairy to an expanding market, while another two dozen are racing to sell the first animal products grown directly from cells. These companies’ products could one day eliminate farm animal suffering entirely.

This exciting trend has prompted another one: impact investing to support these startups. The premise is simple: instead of investing your money in amoral (and at times immoral) corporations, invest it in startups working to end factory farming. It’s a win-win: you can do good by replacing animal products, while doing well by earning financial returns.

There’s much to be said for this. The first investors in Beyond Meat were critical to its success and, with its imminent $100M IPO, are likely to make handsome returns. Startups have some inherent advantages over charities: they typically have clearer and easier-to-measure goals (sales), find it easier to attract talent (thanks to prestige, stock options, and often higher salaries), and are subject to more market pressure to be efficient.

So should supporters of farm animals focus our financial resources more on impact investing and less on philanthropy?

The limits to impact investing

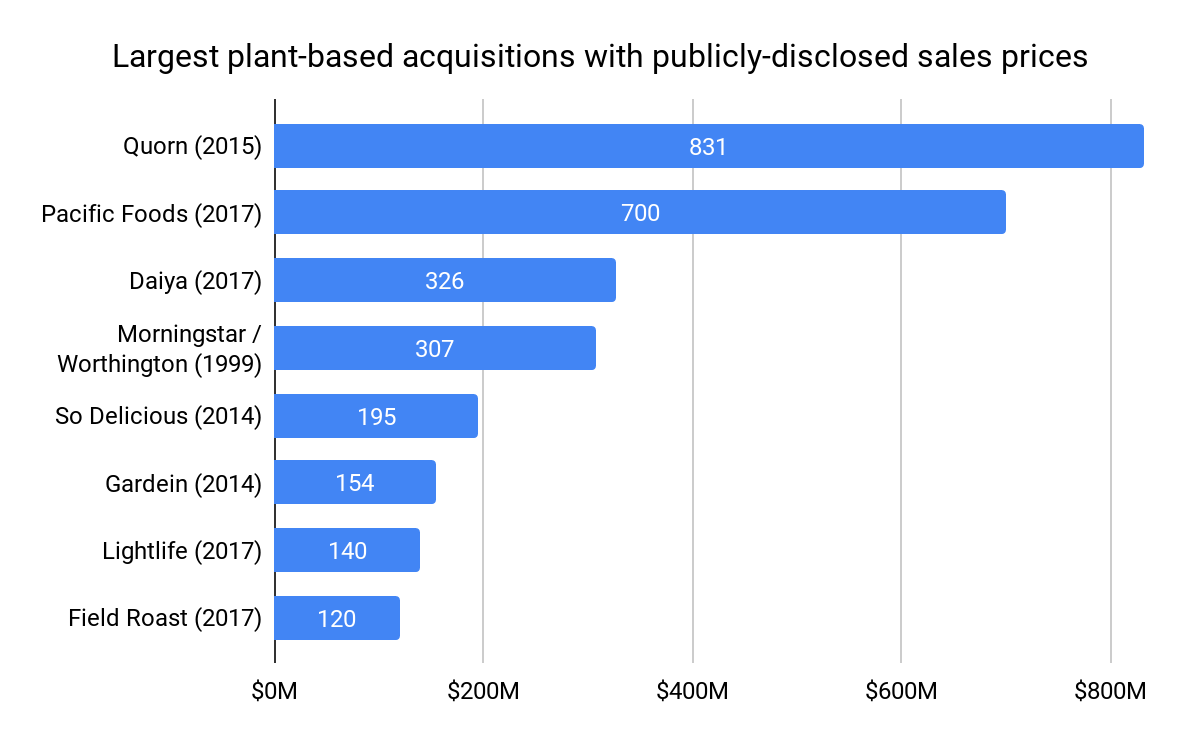

The key question is our counterfactual impact. In the early days of vegan brands Silk, So Delicious, or Vega, the counterfactual to investing $1M may have been that they got no money at all. But the counterfactual of buying $1M in the shares of Danone, the $44B corporation that now owns all three brands via its WhiteWave subsidiary, is likely just that another investor will buy them instead.

But how to know the counterfactual impact ahead of time? One good proxy is neglectedness. When mainstream investors were neglecting alternatives to animal products the counterfactual impact of impact investors was clear: without their funds, exciting startups like Finless Foods and Memphis Meats may never have gotten off the ground.

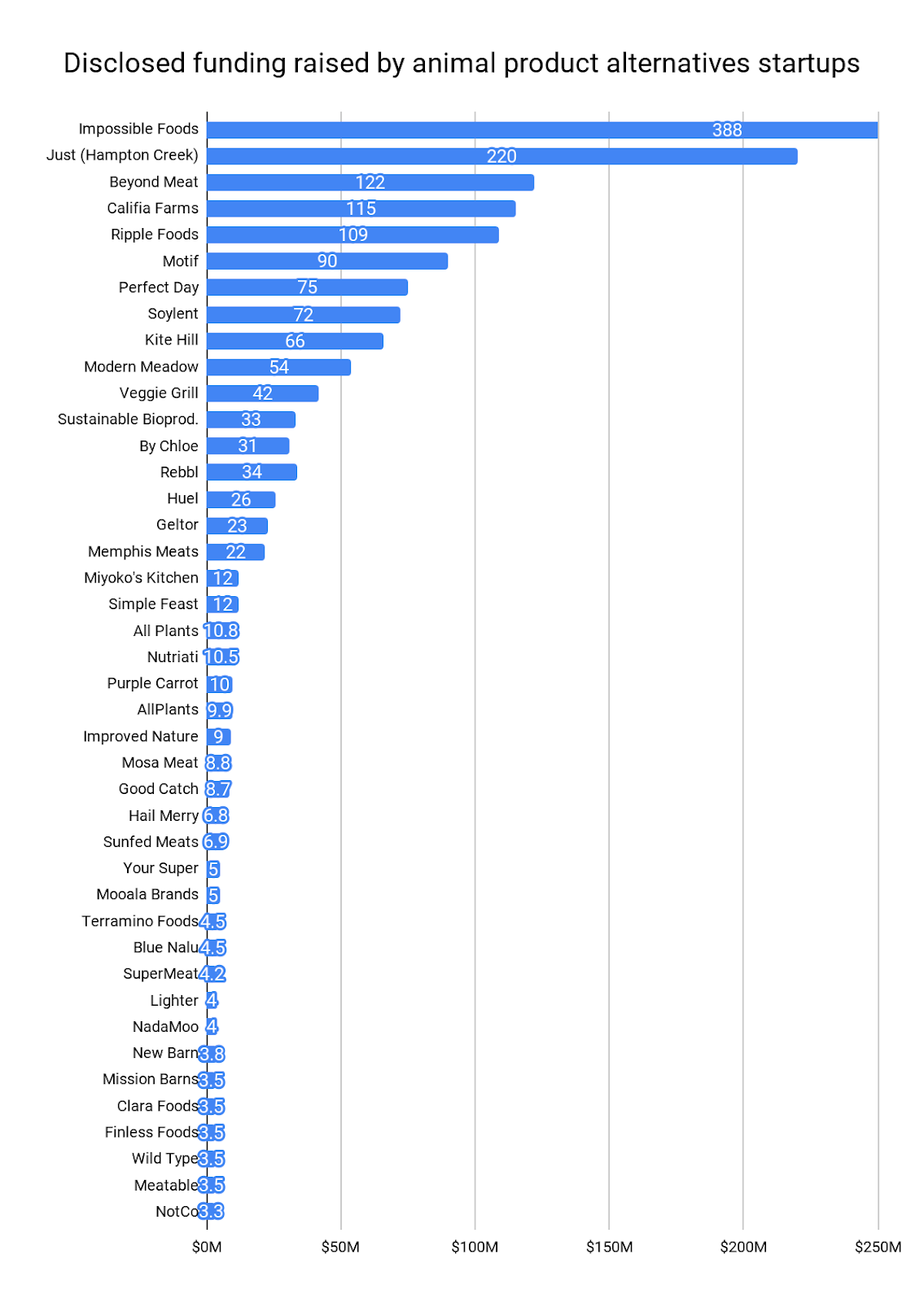

But in recent years the space has happily gotten a lot more crowded: at least 55 funds are now investing in alternatives to animal products. Singapore’s sovereign wealth fund, major venture capital firms, and even agribusiness giants Cargill, Tyson, Fonterra, Danone, and Archer Daniels Midland have all invested in the space (as have we). They’ve injected more than $1.7B into the space, while corporations have spent another $2.8B+ acquiring some of these startups.

Indeed, non-impact investors have become so interested in the space that the most promising startups now find themselves in an enviable position: having to turn away investors because their funding rounds are oversubscribed. In these cases, the impact investors’ common promise of market-rate returns seems plausible. But their promise of impact seems less so: given the startups will get funded either way, their impact is probably just to jack up valuations a bit. (This could be good if less equity dilution allows companies to grow faster, or bad if inflated prices scare off investors in future funding rounds.)

Impact investors reply that their mission alignment and long-term focus mean that they’re better for the startups than non-impact investors would be. But most startup founders I’ve spoken with don’t see it this way: they’d often rather gain the credibility and deep pockets of a big name venture capital firm than a well-meaning impact fund. And in practice non-impact investors typically share impact investors’ goals —for startups to grow rapidly and sell more products — and their time horizons, since both usually adopt the same term sheets and fund durations.

By contrast, the counterfactual impact of donating is typically much simpler to predict because farm animal philanthropy remains so neglected. I estimate that for every dollar invested in plant-based startups and acquisitions over the last three years, about 15 cents was donated to farm animal advocacy groups. Even if you think alternative proteins are more promising than farm animal welfare advocacy, you may still find it easier to maximize your counterfactual impact via nonprofits in the alternatives space, like the Good Food Institute, the Plant-Based Food Association, New Harvest, Food Frontier, and the Cellular Agriculture Society. All five have raised less than $10M to date (most much less), and all have room for more funding.

When can impact investing be impactful?

So is all hope lost for impact investing? I don’t think so. Impact investing may be valuable for farm animals in seven scenarios.

First, when impact investors are willing to absorb lower expected risk-adjusted returns than other investors. For instance, impact investors provided the early “risk capital” to support cell-based meat startups until they were within regular investors’ risk tolerance. But my sense from investors is that the riskiest stage of alternative proteins investing — seed and Series A — is actually now the most crowded. And it’s not obvious that ever riskier startups should get funded — this could just mean more failures later.

Second, when impact investors can support startups with advice, connections, or prestige. For instance, Memphis Meats has received mentoring from veteran impact investors, and prestige from investments by Bill Gates and Richard Branson. New Crop Capital has helped to seed new startups like Good Catch, to fill the need for plant-based seafood. But it’s not enough to provide any non-monetary benefits: impact investors need to offer advice, connections, and prestige better than the next investor in line — who might be a seasoned, well-connected, and prestigious Silicon Valley VC.

Third, when impact investors have unique information that they can’t easily or credibly share with a non-impact investor. For instance, the earliest investors in Seattle Food Tech were impact investors who knew both the need for a low-cost chicken product focused on institutions and the talents of founder Christie Lagally. They provided enough support for Seattle Food Tech to get into Y Combinator, at which point other investors picked it up. Of course, in many cases it’s cheaper to share information about a promising area with non-impact investors — as the Good Food Institute does — than to invest in it ourselves.

Fourth, when impact investors are willing to offer better investment terms. Debra Schwartz, head of impact investing for the MacArthur Foundation, notes five ways that impact investors can offer better investment terms: price (overpaying), pledge (guaranteeing loans), position (subordinating their equity or debt position), patience (longer terms before exit), and purpose (flexible capital terms). My sense is that most impact investors are currently only offering the last two benefits, if they’re offering any at all.

Fifth, when investors are willing to buck the market. For instance, impact investors are more likely to be critical to new startups in plant-based seafood, a nascent category, than in plant-based dairy, a trendy space that big-name investors like Goldman Sachs are already in. Similarly, impact investors will be critical if the alternative protein sector ever crashes — for instance if cell-based meat doesn’t arrive on investors’ impatient timelines. Impact investors willing to buck the market could then keep many startups afloat.

Sixth, when investors are willing to back less-sexy enterprises. Fully 38 out of the 42 animal product alternative startups in the chart above are consumer brands. Few impact investors have gone further up the food value chain — to the companies optimizing plant-based proteins, media, extrusion equipment, and other inputs (last month's $90M launch of Motif is a noticeable exception). Similarly, almost no impact investors are looking at companies reducing suffering within the factory farming system, for instance by developing stunning equipment for fish or immunocastration for mammals. (Of course, these businesses are neither vegan nor harm-free, but they may reduce more suffering than many that are.)

Seventh, when impact investors can keep startups focused on impact. For instance, they can help keep startups focused on alternatives to products that harm the most animals (fish, shrimp, prawns, eggs, and chicken), instead of more profitable products that affect far fewer animals (beef and dairy). And they can help startups to resist pressure to adopt a high-margin strategy that could result in their products displacing far fewer animal products than a low-margin strategy.

The final take

There’s still much to be said for impact investing. It aligns your investments with your values, and may deliver good returns. And in some cases, like the seven scenarios above, it may have a counterfactual impact in helping animals.

But impact investing should be viewed as a complement to donations, not an alternative. Founders Pledges’ Hauke Hillebrandt and John Halstead, after surveying all the ways that impact investing could have impact in a great new report, conclude “effective impact investing is very hard and, to maximize social impact, it is usually much more effective to donate.” That’s been our experience: we’ve found lots of exciting donation opportunities that we’re confident won’t be funded without us, and we’ve already seen great progress from that work. (If you’re looking for large donation opportunities that won’t be funded without you, please contact me.)

A number of funders I know have struck a balance by donating a dollar for every dollar they invest, or by donating all proceeds from impact investing. That seems like a good compromise. Impact investing done well can help us end farm animal suffering — it just can’t do it alone.