This post is my attempt to answer the question, what happens if you retroactive optimize funding mechanisms for perfect incentive structure, at the cost of comprehensibility. I suspect there is some dealbreaker exploit, or perverse incentive. This post is published in the hope someone can find it, and on the off chance there isn't.

This would be a good idea if all funders and investors were able to understand it. Or if most people don't understand it, but can be told what to do. After all, many people buy bitcoin without understanding the cryptography. This post was inspired by https://astralcodexten.substack.com/p/impact-markets-the-annoying-details

Discretization error has largely been ignored. It is somewhat assumed that $1 is a negligible amount of money, and anyone can round their funding needs to the nearest $1. The actual discretization units used in a working system may be larger.

Terms used

Dollars

Unit of money. Self explanatory.

Funders

Have dollars, want utility. Can perfectly measure the utility of any charitable project retrospectively. Have no idea how to predict utility. The funders give out money in proportion to utility generated. Without loss of generality, they give out $1 /util. If a project with shares generates util, then the funders give $ to each shareholder.

Investors

Have money. Want more money.

Utility

Measures whatever funders want more of in the world. Just sits there in the world, so can't be exchanged. All utility can be replaced by expected utility, given investors perfectly neutral to financial risk. Risk averse investors will tend to avoid ventures whose payoffs are hard to predict. For situations that involve small chances of high payoff, but where the final dice roll is largely out of human hands, and where the utilities involved in that final roll are easily predictable, it may be wiser to fund expected utility. For example, a functioning asteroid telescope has a small, predictable chance of producing a large utility. The funder would pay for a functioning telescope.

Shares

A partially fungible token representing a particular charitable venture. Owners of the shares get paid when the venture generates utility.

Venture

The unit of responsibility. The funders can know the utility created by each venture. But have no idea of any internal structure.

Version

A venture can have many mutually exclusive versions. At most 1 version happens in reality. Each version has a maximum cost bar, in dollars.

Cost Bar

The most money a version of a venture could use. Different versions of the same venture can have different cost bars. This must be manually set by the person setting up the venture. Making it a bit high is ok, but making it far too high means moving money back and forth for no good reason. In the limit of perfect markets, this can be infinity without actually wasting funder money or reducing utility, but reality is not a limit of an oversimplified model.

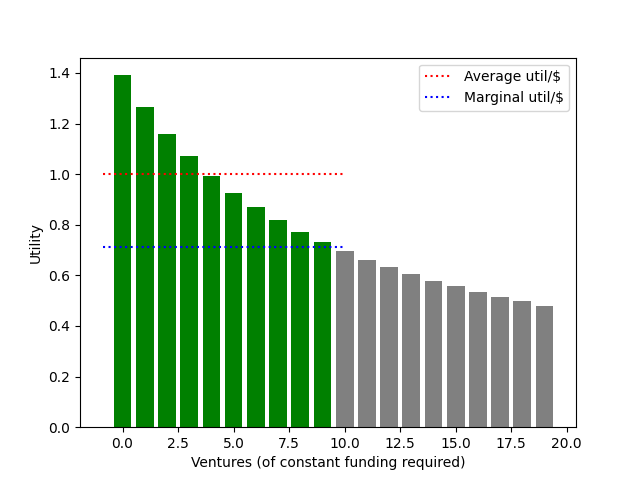

Average and Marginal util/$

Each bar represents a venture available. The area of the bar represents the utility produced. Width of the bars represents cost. The high of the bars represents util/money. The bars are sorted tallest first. The green bars are the ventures that actually get funded.

Subsidy market

A subsidy market is a market that converts money into more money. The basic operations are.

Scale Up

Converts $1 into $ . A mechanism for scaling up that doesn't increase the amount of money should be available, but not used in a functioning system. Obviously allowing anyone to scale money up with no conditions is a bad idea.

Scale down

Convert $ into $1.

Accept

Any source of money can give money to the subsidy market. This could just be scaling down repeatedly until you are left with practically nothing. This is actually a good place to input arbitrary little bits of money, if you want the money to go to a good cause, but want the investors to do all the hard work of figuring out which good cause.

is considered to be a variable, like an exchange rate between 2 currencies. In particular, is considered to be . This isn't something someone is expected to manually estimate, but the natural equilibrium value of the market. Scaling up will reduce , while scaling down and accepting money will increase it. In order to smooth over time, investors are welcome to scale money up, store that money for a period of their choosing, and then scale the money down. They can use any money they happen to have for this, and take away the money to do whatever they like afterwards. To the investors, (scale up; wait; scale down) is an atomic operation. Just make sure the investors can't sneak away the scaled up money. (scale down; wait; scale up) is a similarly atomic operation. You might or might not want to allow negative waits (ie loans)

How auctions work

Serial Ventures

One thing investors might want to do is invest in one venture, but if that fails to get started, invest in another. This produces problems when investor 1 wants to invest in venture A, or failing that, venture B. Investor 2 wants to invest in B, or failing that C, and investor 3 wants to invest in C, or failing that A. If each venture needs the money of two investors to start, which venture happens? This sort of cyclic behaviour shouldn't exist in a functioning market where investors have similar ideas of the value of ventures, but any system should handle it gracefully.

While my scheme could hold conditional auctions, it is simpler to just conditionally hold auctions. Remember, in a modern context, everything is computerized and all the actual human thought has happened beforehand (possibly a long time beforehand). So auctions can be held within fractions of seconds of each other, and still give the investors computer a chance to decide their behavior in this auction based on the results of the previous auction.

Simple auctions

Suppose there is only one possible version of the charitable venture. Bidders bid for the shares. The bid can be open or closed, it doesn't really matter. Bidders can enter as many bids as they like. After the bidding, the bids are sorted, and the value per share is . The first bidders all pay , the value of the 'th bid.

All bids are scaled up through the subsidy market. The shares get sent to the bidders.

The version has a maximum funding bar, the most money this version of the venture knows how to use. Any money in excess of this is the surplus. The surplus gets sent to the subsidy market, which accepts it.

If the venture decides it doesn't need all its money, some will get sent to the shareholders, being scaled down first. If a project needs at least $1 million to do anything, and only gets half that, it can immediately refund the bidders. (Or you could short circuit this and never ask the bidders to pay. Its the same thing, just more efficient).

If the venture sits on its money and thinks for a year, and then decides it has no use for the money, the investors may get more or less money than they started, depending on how the subsidy market exchange rate has changed.

Multiple conditional auctions

An auction is held for each version of a venture at the same time. Different versions can have different maximum funding bars. Different versions can have different numbers of shares. The version with the greatest surplus is picked. The rest of the auctions are canceled.

A few examples

High return

A venture has a price bar of $3.4 million. They will predictably only spend $0.9 million. They will produce 3 million utility. Currently, meaning the average dollar is 2.5x more useful than the marginal one. The bidding happens. The investors pay $4 million in the bidding, which gets scaled up to $10 million on the subsidy market. Then the surplus of 10-3.4=6.6 million gets sent to fund the subsidy market. Of the $3.4 million, the venture actually spends $0.9 million, generating 3 million utils. The funders pay $3 million for those utils. The rest of the money gets refunded to the investors. The remaining money is $2.5 million, which gets scaled down to $1 million. This means the investors walk away with 3+1=$4 million total. Exactly what they invested.

The subsidy market scales $4 million into $10 million, costing it $6 million then received $6.6 million from the surplus. Then it scales $2.5 million down to $1 million, gaining $1.5 million.

The total gained by the subsidy market is $6.6+1.5-6=2.1 million. The project actually used 0.9 million to fund something that got $3 million of reward. So this is where the entire value created has ended up.

Lower returns

This project has a price bar of $7 million. It receives bids of $3 million, which get scaled to $7.5 million. Then $0.5 gets sent to the subsidy market as surplus. The project spends all its money, producing 3 million utils. These get funded to the tune of $3 million, which gets spread amongst the investors. The subsidy market looses $4 million, which is where the money it gained from the first project ended up.

Lowest returns

A project puts out a price bar of $5 million. They receive $0.1 million, which is scaled to $0.25 million. They can't do anything with this, so they immediately return it to the investors. (Their project obviously wouldn't work at all with < $3 million, so they signed a deal saying they would refund in the event of any total of <$3 million.) The investors get their money back. Time has been wasted. Nothing much has happened.

Known Problems and solutions

Suppose a venture has a price bar of $10 million, it will predictably spend the first $1 on creating 20 million util, and squander the rest. The venture as a whole will get its $10 million funding. The solution is to add a second version of this project. A version with a $1 million price bar. Both versions produce $20 million for investors, so investors bid $20 million for both. This would get scaled up to $50 million. (if ) So one version has a surplus of $40 million, and the other has a surplus of $49 million. The latter has higher surplus, so is selected as the version that actually happens. The investors get back their $20 million, the project actually gets $1 million, and the subsidy market gains $19 million.

Suppose there is an election, with Alice and Bob being equally likely to win. The venture has a bar of $1.5 million needs to spend $0.5 million before the election, and then another $1 million after it. The investors realize that the whole project will be pointless if Bob wins. If Alice wins, the project will make 1 million utils. So add a version that has "if Bob wins, refund investors and give up" in its contract.

For this version the investors put in $0.7 million, which gets scaled to $1.75 million. Then $0.25 million gets given to the subsidy as surplus, leaving $1.5 million. If Alice wins, the investors make back $1 million. If Bob wins, the version spends $0.5 million, and then gives $1 million back. This gets scaled down, leaving investors with $0.4 million. So on average this version nets investors the $0.7 million they put in, and has a surplus of $0.25 million.

The version that steams ahead regardless of the election will make 1 million utils, and so $1 million if Alice wins, nothing if Bob wins. This nets it $0.5 million on average. This means it won't get the $0.6 million funding it needs to scale up to 2.5*0.6=$1.5 million.

So the version with this election based clause wins.

In both these situations, adding extra versions of a project that only spent money on the useful stuff and not on the useless stuff fixed the problem. Adding versions that waste money shouldn't be a problem, those versions shouldn't be selected. I can see no reason to avoid spamming every possible version, except of course complexity and communication overhead. (Ie no one wants to read a list of a trillion almost identical versions)

Problem: Silly money

Suppose one of those investors is actually an idiot, and wants to waste money on a homeopathic medicine charity, which does nothing. For each $1 of their own money they waste, the subsidy market will waste $. On the margin, this reduces slightly, and means that the marginal charity receives $ less funding. At least that funding is being taken from the least effective charities barely worth funding. And donation matching schemes provide a much easier outlet to such moneywasters. And should probably not be bigger than 2 0r 3. In the limit of an infinite amount of silly money, tends to 1. This makes the system no more efficient than standard retroactive funding, except that the excess value gets sent to the silly charities instead of making the fast investors rich.

Remaining work

How can ventures auction off only part of their impact and keep some impact to auction off later? How can all this be fit within legal and technical frameworks? Ideally without loosing huge amounts of money to taxes just because money is shuffled about a lot.

Hey! Thanks for writing this up, I'm a huge fan of weird funding proposals haha. Let me try and summarize the proposal to see if I understand it. I found some of the terms to be confusing, so refer to the Donald's terminology in "quotes" and my personal interpretation in (italics)

None of the examples seem to illustrate the investors actually earning positive return, so I'll draw one up:

So in total:

which all balances out.

The main new thing in this proposal seems to be the "subsidy market" which 1) pays out as a matching pool for projects which counterfactually wouldn't have been funded, and 2) absorbs surplus when a project is overfunded? And 2) is an attempt to solve Scott's question of "who gets the surplus from a profitable venture"? It's this part I'm most confused about

It's not clear to me that this subsidy market leads to better outcomes -- specifically, it seems to mess with the incentives such that the people running the venture don't care about spending the money well? Your first counterexample with the 20m utils seems to address this, but it's not very reassuring - the case where "the fact that $10m and $1m buy the same thing is known up front" is a pretty big ask, IMO.

Also, with the way the system is set up, the subsidy market seems to earn money when projects don't actually need its funding (in the High Returns example), and lose money when its funds are actually useful (in my example). This is deeply weird to me -- if I were viewing the subsidy market as a lender, it would seem "fair" somehow to pay it back extra if its funds were actually used, rather than when it sits by twiddling its thumbs.

One adjustment/framing that makes more intuitive sense to me is to make the subsidy market as just another shareholder; e.g. if it scales up T to 2.5T and thus is bankrolling 1.5T/2.5T = 60% of the operation, it should just get 60% of the total profit among all investors.

1)The subsidy market is a buffer of money, not a long term source. R should be adjusted so the amount of money flowing in and flowing out are the same.

3) I was trying to generalize a Vickrey auction, but I think I messed that up. Just use whatever kind of auction you feel like.

5) If the amount raised is less than the cost bar, the project can try to muddle through with the money they have, or can refund the investors/ cancel the thing.

7) Yes, and scaled down to reverse the scaling up.

None of the examples illustrate the investors making positive returns. The scheme is delibirately set up, so that in the limit of ideal markets, the investors make nothing. In practice the investors would probably make something, but hopefully not much. Well the investors sometimes win, but its counterbalanced by a loss.

This scheme should pay any project that produces at least 1Rutil/$, and not pay any other projects, always selecting the highest util/$ variant if there are multiple variants. If we assume project managers are paid a fixed fair salary, there is nothing to threaten them with, unless you want to threaten to cut off funding to an effective charity, because you think it could be even more effective.

This lack of incentive (so long as your util/$ is above some threshold) is what would happen in a regular retroactive system, where all shares are sold, or where you didn't in practice care how much "credit" you ended up with. (Because you couldn't turn that credit into money)

Giving the project manager 1% of the shares would produce some incentive in the right direction. Or you could just hope they are all altruists.

I was kind of thinking like the subsidy market more as a currency exchange.

You could replace the scaled down and scaled up money with 2 different kinds of crypto token.

The whole point of the subsidy market is to move money from the easy wins with loads of money, to the marginal cases that are just about worth doing, while leaving the no hopers behind.

Ah, I wasn't sure whether this was a core principle of the proposal or not. In that case: why do the investors bother to participate at all? What incentivizes them to do a good job?

This is the problem you're pointing to under "Silly Money", I think -- that investors have no skin in the game.

In a competitive market, the investors make a tiny amount of profit. Suppose widgets cost $100 to make. All widget buyers always choose the cheapest widget. If you start selling them for $200, someone else can undercut you by selling them for $180. The only equilibrium is selling widgets for $102 or something. Just enough to make a slim profit, but not enough for anyone to try undercutting you. Of course, if you and you alone have a way to magic widgets out of nothing, then you can make fat profits. This is roughly how a lot of markets work. Its why there are commodity prices, and those making commodities have slim profit margins.

Note that it is easy for investors to loose money by being stupid. And they can potentially turn a large profit if they are a unique source of exceptionally good info. They just can't turn a large profit in a large pool of similarly competent investors.

The investors have skin in the game, and as long as the investors maximize money, the system should work. The problem is that if people are prepared to burn their own money, they can burn other money with it. (Ultimately meaning some charities get less funding if the silly money gets added in the wrong place than if the silly money had just directly burned their cash at home)