This is Rational Animations' second video about prediction markets. We answer a number of questions such as: what are prediction markets? What is Manifold Markets? Are the probabilities displayed calibrated, and how? But most importantly: will Writer overtake Memestiny in the referral rankings?

I include the script below, but there have been, uh, unexpected additions in the last third.

In a previous video, we talked about how Prediction Markets work and some ways in which they could be used to improve institutional decision-making.

Prediction Markets allow people to bet on whether an event will happen, financially rewarding them if they’re right. Prediction Markets are a way to use the wisdom of the crowd to produce calibrated guesses about the probability of future events.

Suppose you have a prediction market that asks “Will Rational Animations reach 200k subscribers by the end of 2023?” the aggregate probability displayed is 90%. That means that buying “YES” shares costs 90 cents, and if the market resolves “YES” you gain 1 dollar per share, otherwise your shares become worthless. If you want to bet on “NO” instead, you only pay 10 cents per share and gain 1 dollar per share if Rational Animations doesn’t reach 200k subscribers by the end of 2023. If it does, your shares become worthless.

That 90% probability, if calibrated, means that you can actually expect the question to resolve “YES” nine times out of ten. In other words, out of 10 markets with a probability of 90%, you can expect, on average, 9 of them to resolve YES. Usually, markets become better calibrated the more predictors bet on them.

Due to the use of money, prediction markets are highly regulated. That makes it very hard for companies to start prediction market platforms that allow betting on a wide range of outcomes.

In the previous video we mentioned Metaculus, a prediction platform that sidesteps this problem by using internet points instead of money. Metaculus doesn’t work like a prediction market, but has the same aim of using the wisdom of the crowd to produce calibrated guesses about the probability of future events. Metaculus lets users directly state their subjective probabilities, while actual prediction markets, instead, work by allowing people to bet on whether the actual probability of an event is higher or lower than the market’s probability.

Since our 2021 video, a new prediction platform was born: Manifold Markets. Manifold works like an actual prediction market platform, except that it uses only internet points called “Mana” instead of real money.

Manifold lets you create your own markets and resolution criteria.

Here’s an example:

Let’s say I want to know the probability that this video will reach two-hundred-thousand views by the end of 2024. Then I can simply create a market, and users on the website will be able to bet on it.

All the bets of the users, in aggregation, result in a probability displayed on the market’s page, which also reflects the cost of the shares. If someone believes that the actual probability is higher than the one stated by the market, they should buy “YES” shares, otherwise “NO” shares.

Using internet points instead of money lessens the incentive for predictors to be accurate. Why would users provide good guesses if they don’t really have strong reasons to care about whether they’re right or wrong? And yet, if you study this question empirically, it seems like internet points work well enough to produce calibrated probabilities.

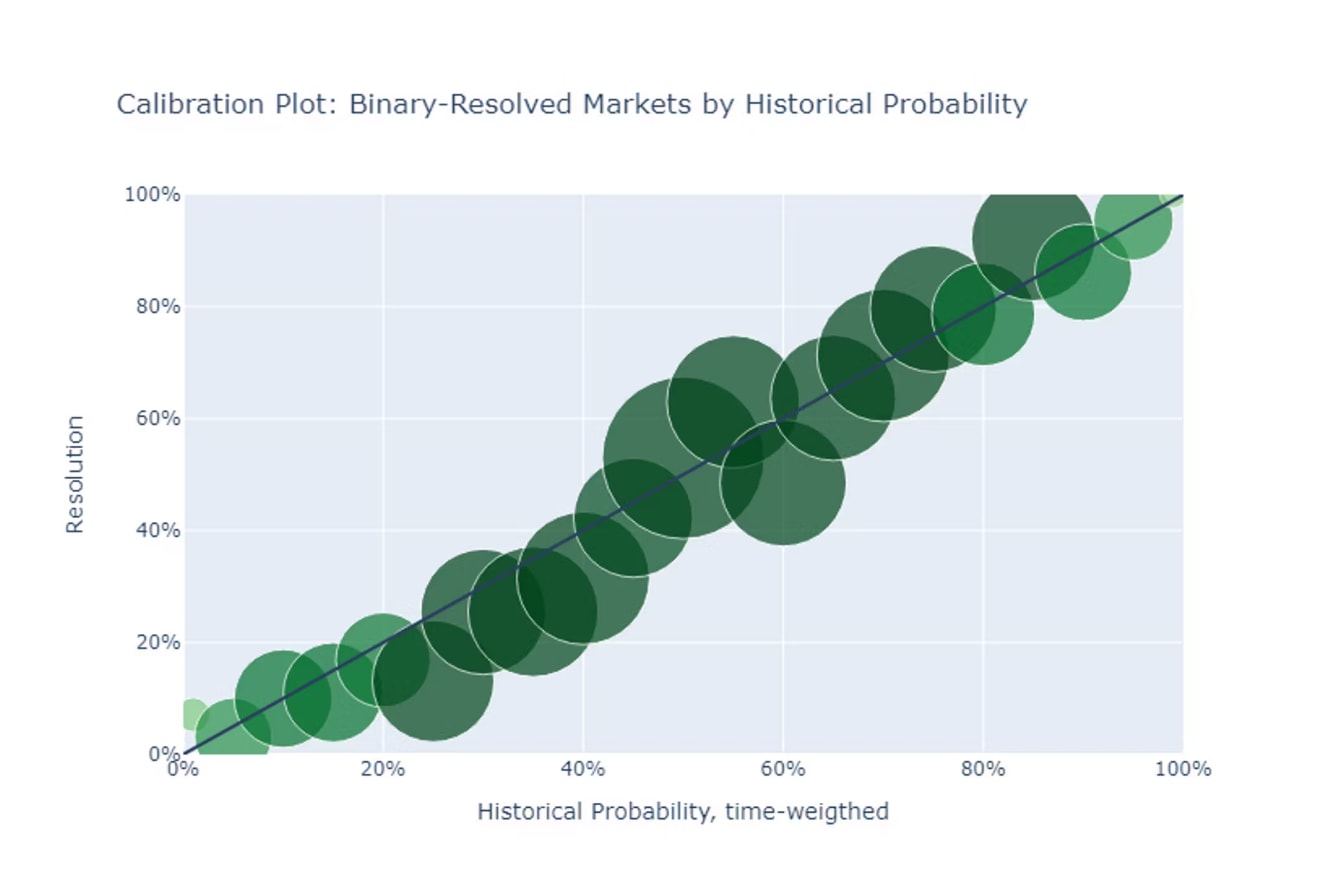

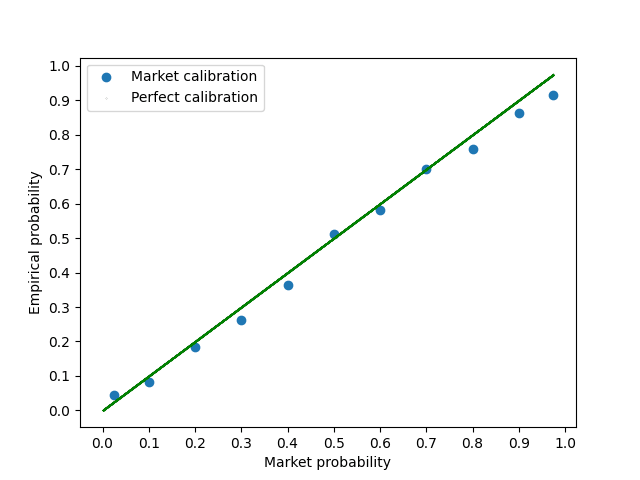

In October 2022, Vincent Luczkow, a user on Manifold Markets, ran an experiment in which he analyzed all of their binary markets at the middle of their lifespan. The objective was to check whether at that point the markets were calibrated. That is, markets that displayed a 10% probability resolved “YES” 10% of the time, markets that displayed a 20% probability resolved “YES” 20% of the time, and so on.

What they found was that their markets are very well calibrated. Check out this graph they produced:

The closer the points are to the line, the better the calibration. As you can see, they are almost perfectly on top of it.

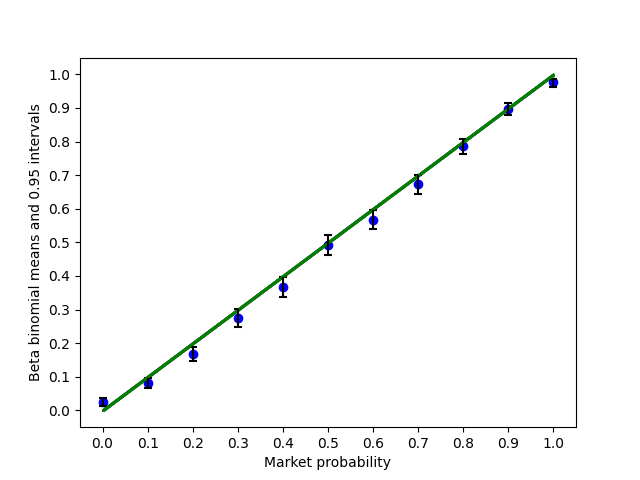

In June, Vincent provided more updated calibration data that looks even better!

The code Vincent used to generate this data can be found on GitHub, and you can try it yourself!

There are other methods of checking markets’ calibration, such as analyzing their probabilities at market close or using a time-weighted average of their displayed probabilities. Running these experiments also shows that they are pretty well calibrated.

Isn’t all this a bit magical? The wisdom of the crowd results in actual probabilities! Instead of reading the news you could just go on Manifold and read the probabilities of future events! You basically have a real-life crystal ball, except that it shows probabilities instead of a certain future. But there is one caveat: be careful about markets with low activity. Usually those are not as accurate. You want to get your probabilities from the markets with many traders. In fact, Manifold’s live-updating calibration graph only samples from markets with 15 or more traders.

Here are examples of important newsworthy markets on Manifold.

Will a nuclear weapon be detonated by the end of 2023?

Will Donald Trump be arrested before 2024? This question resolved YES. If you hadn’t followed this event an early probability of 30-40% would have surprised you.

Will Ukraine have control over Crimea by the end of 2023?

Will TikTok be banned in the US?

Will either Donald Trump or Joe Biden be elected president in 2024?

Now, let’s have some fun!

In November, the epistemically degenerate writer of this video proposed to Manifold to do a sponsorship in Mana.

Here’s a selection of Markets the writer created on manifolds since then. He’ll leave the links in the description and pinned comments:

- Will AI create utopia for humans by the year 2100?

- If AI wipes out humanity, will everyone fall over dead at the same second?

- Is Bing Chat Conscious?

- Will Rational Animations’ video “The Power of Intelligence” accrue 1 million views by the end of 2023?

And finally, the most important question of all:

Will I be the Manifold Markets user responsible for the highest number of referrals by 2024?

That’s right. The single most important reason this video exists is for Writer to climb Manifold’s referrals ranking. It’s absolutely fundamental to the continuation of human civilization that Writer surpasses the user Memestiny. So give a look at the pinned comment and subscribe to Manifold through the referral link.

[fart noise]

(Written on screen:

Seriously though, Manifold Markets is full of interesting questions, both short-term and extremely long-term. Check out the video description or the pinned comment for a bigger selection of them. Betting internet points on Manifold will train you to be more calibrated in your personal predictions).

Executive summary: Manifold Markets is an online prediction platform that uses virtual currency to produce calibrated probabilities about future events through the aggregated bets of its users.

Key points:

This comment was auto-generated by the EA Forum Team. Feel free to point out issues with this summary by replying to the comment, and contact us if you have feedback.

Thumbs up to this summary. My only nitpick is that I wouldn't call Mana "virtual currency" since it could be confused with cryptocurrency, while it's mere internet points.