TL;DR: In summary, if fossil fuels decline, economic growth will likely decline as well. Investment can help but will be limited. Consequences of a decline might mean a decline in food production and a disruption of supply chains. This also makes space colonization and the overall continuation of our growth-based society unlikely. You can check the short version of the post.

Note : This is part 2 of 3 posts on energy depletion as an important topic for EA. I recommend reading part 1 before this one, or the short version. This part will address whether investment and innovation can prevent energy depletion. It will also address the consequences of an energy descent on economic growth, the financial system, society as whole and, finally, what this implies for EA causes.

Part 1 indicated that fossil fuels, being finite, were close to the start of a decline, within a few decades. It also indicated why an energy transition to renewables contained so many challenges (time, materials, rehauling of the manufacturing system) that it likely induced a decline in energy availability. A good summary is the conclusion of the GTK report (the one that assessed the feasibility of switching away from fossil fuels):

“Current thinking is that European industrial businesses will replace a complex industrial ecosystem that took more than a century to build. This system was built with the support of the highest calorically dense source of energy the world has ever known (oil), in cheap abundant quantities, with easily available credit, and unlimited mineral resources. This task is hoped to be done at a time when there is comparatively very expensive energy, a fragile finance system saturated in debt, not enough minerals, and an unprecedented number of human populations, embedded in a deteriorating environment. Most challenging of all, this has to be done within a few decades. It is the author’s opinion, based on the new calculations presented here, that this will likely not go fully as planned”.

With prices rising, won’t more investment solve the issue?

There are many answers commonly given to the prospects of an energy depletion. Let’s look at the current view of EA on the subject, which also reflects that of economists. I managed to find only one post from 2016 on the EA forum about that (plus some sparse references), but I suspect it reflects a common point of view. The main argument was that when prices rise, people and infrastructure are redirected towards getting more of a resource, and people look for alternative ways of doing things that require less of a specific resource (for instance, solar panels are getting cheaper, and we are finding ways to access fossil fuels that were previously unavailable). There is an incentive for technology to improve, and for substitution to occur. If one resource is lacking, we’ll just switch to another: for instance, rare earth neodymium in offshore wind turbines can be substituted by using wound-rotor generators. A switch toward alternatives is done, and human ingenuity and technology will find a way.

Note that all of this worked in the past, to some extent - and this nullified the predictions of many people that anticipated depletion too early. For instance, following the 1970s oil shocks, many diesel electricity plants were replaced by coal and gas plants. Additionally, scarcer resources led to higher prices, which led to more investment (like in Alaska and the North Sea), which led to more oil being produced in the end.

However, just because there was a switch to other resources doesn’t mean that this was of no consequence. Indeed, since the oil shocks, there has been a regime of lower economic growth and more debt. We’ve never experienced a growth rate like in the 50s and 60s, when the growth rate of oil was sky-high. See the detailed section on the causes and consequences of the 1970s oil shocks.

An important element was that most of the alternatives were comparatively worse than conventional oil (which was dirt-cheap and abundant), or at least with a more constrained growth potential. This is an important limit of substitution. As shown in the book Extracted, “very often, it involves substituting a resource that was once relatively clean and cheap —as long as it was available— with a more expensive and dirtier one”. For instance, shale oil eased oil depletion in the short term, but it won’t last forever. Once it’s over, “we are back to square one, having just squandered a lot of resources and created a lot of pollution”. Most examples of substitutions involve higher cost (otherwise, it would be done already), and, most importantly, lower performance - so we need to use more energy to do the same thing. See the “Substitution” section for more details.

We will switch to other sources, yes, but this will still mean a decline in energy, at least if we keep the same level of investment. A common answer is that we should invest more, in order to compensate for the lower performance. However, there are several reasons that prevent prices for going too high, putting a limit on investment.

Limits on investment

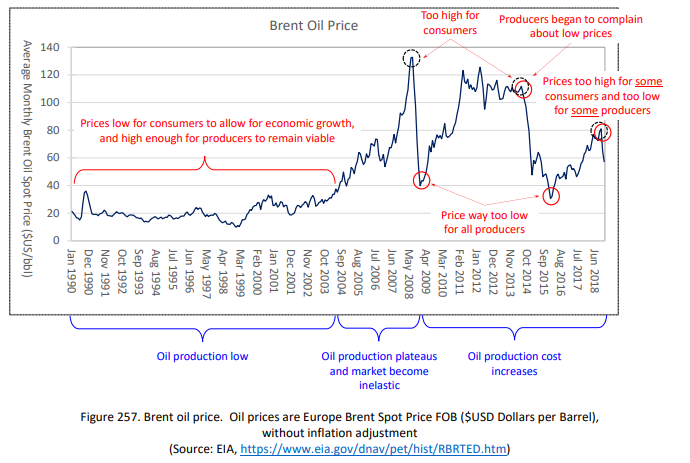

First, the energy industry won’t extract resources so expensive they’re impossible to sell. Consequently, there’s a limit to the low-grade resources the industry can exploit. This could help to explain the weird trends in oil prices:

See also the section on the 2008 financial crisis.

The most important limit for energy extraction, then, is not "is it theoretically possible to extract?" but "will people be able to afford it?". For the same reason, prohibitive price rises for clean energy technologies (or the metals they need) could stall the energy transition.

There are others trends taking place here:

- Then again, scale is a very important variable here. The transition could require as much as $173 trillion in energy supply and infrastructure investment over the next three decades, according to research provider BloombergNEF. As a comparison, world GDP amounted to $87 trillion in 2019.

- Another example: the Energiewende, Germany's vast buildout of solar and wind energy, has cost around $400 billion so far, yet the share of fossil fuels in the country's primary energy supply has fallen just slightly, from 84 to 78%.

- Short-termist thinking could prevail, and deciders and companies may shy away from long-term investment in the context of a crisis. Currently, US oil producers are reluctant to drill more oil, despite sky-high prices, as they have been thrown off by the volatility. For the industry, building a billion-dollar plant that takes 30 years to pay off requires trust in the future.

- There is already a lack of investment right now, especially in the road and electricity sector. Globally, there is a $18 trillion gap to be filled, and infrastructure is decaying in many places.

- Technology and innovation can help, but also face diminishing returns - new discoveries are costlier and costlier. Even with higher prices and better technology, most countries are still seeing declining oil production. High-tech advances also usually require scarcer materials, for instance in alloys.

- If too many resources (money, energy, materials, people) are invested in energy production, then you have less resources that you can use to run the rest of society (for food, goods, buildings and so forth). This was a core finding of the Limits to Growth report: that at some point, so many resources were needed to compensate for resource depletion and pollution that it limited reinvestment in maintenance and capital, and in the end on growth. Some papers point out that it’s possible that the net energy returns of renewables could be too low to allow for a complex civilization like ours (although there’s quite a lively debate on that).

This above is just a summary of the complete “Won’t more investment solve the issue if prices go up?” section in the additional doc. I recommend checking it out as this is one of the most underrated limits of the energy transition. In practice, it prevents prices and investment from growing too much. The full version also explains why what matters for societies is a high energy surplus, and why energy sources that don’t provide a lot of surplus (low EROI), like many renewables, cannot provide the same services as those we enjoy today.

However, it is true that most people really will try their best to adapt when faced by negative consequences. Indeed, there are quite a lot of wasteful things that we can do less of:

- Make ships go at half the speed, maybe with kites or sails

- Make lower speed limits on roads, and boost public transport

- Make planes fly slower to save on fuel

- Lower the mean temperature in houses and buildings

- Buy less single-use products and repair items, stop planned obsolescence

- Waste less food and eat less meat

However, while all these things are pretty reasonable and do not take a high toll on human well-being, most of them would be bad for the economy.

Economic growth is likely to stop and decline

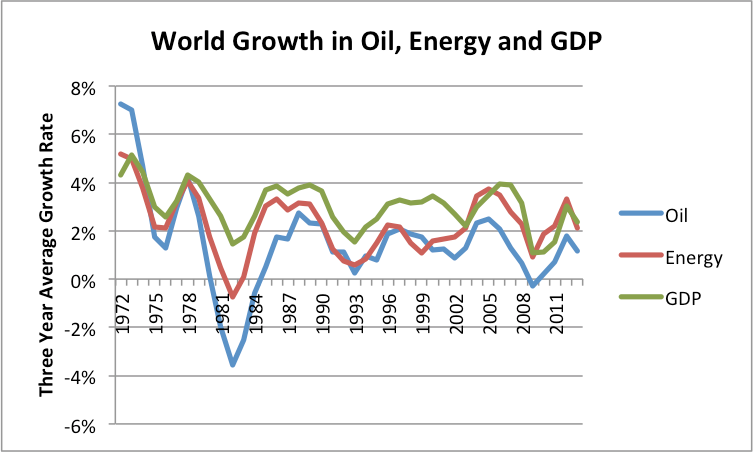

Now, let’s look at the relationship between energy and GDP:

Source: this Our Finite World article (see point 10)

It sounds like we are onto something here. And indeed, Giraud and Kahraman, 2014 come to the conclusion that there is a strong link between energy consumption to economic growth in both the short and long-run. [Note: Commenter Robin pointed out that this is not a peer-reviewed paper, so be careful here. However, Fizaine and Court 2016 come to the same conclusion. There is some debate on whether there is a causality, but several other papers listed here also show that there is a strong link between the two]. None of the other factors they reviewed, including capital and labor, showed the same dependency ratio. Energy efficiency also plays a strong role here, but it has slowed down in recent years. This makes sense, as energy allows for everything we do, especially for the transport and manufacturing of almost every product. To simplify, one way to put it would be to see money as a “claim on a product made with energy“.

This is not the only paper with this conclusion, there’s more literature than I had thought on that. You can check the “Is it possible to grow the economy with less energy?” section, that goes into more detail about what they say on the topic (for instance, why the small share of energy in GDP is not representative, and why apparent decoupling in a few rich countries does not translate to the global level).

Companies will start to look for alternatives if prices increase considerably, but there is a common misconception that prices will rise gradually and continually, giving time to adapt and invest in alternatives. If we look at the actual relationship between oil production and oil price (see the graph above), it seems that the evolution of oil price is everything but linear: it behaves with quick and brutal changes, oscillating between too high for consumers and too low for producers. If we focus on oil prices right now, we can’t know what their value will be in one year — and whether we should prepare for a sudden increase. So I advise we don’t focus too much on prices, more on quantities.

While it may be theoretically possible to have an economy that grows with much less energy, there is little real world data to indicate this is possible. A sudden shift in the way the economy works may not be impossible after a few years of recession, but we should not assume this will be the most probable outcome. When it comes to economics, very few relationships have been as tight as this one (even during crises), so the default scenario we should expect would be that this will continue in the future.

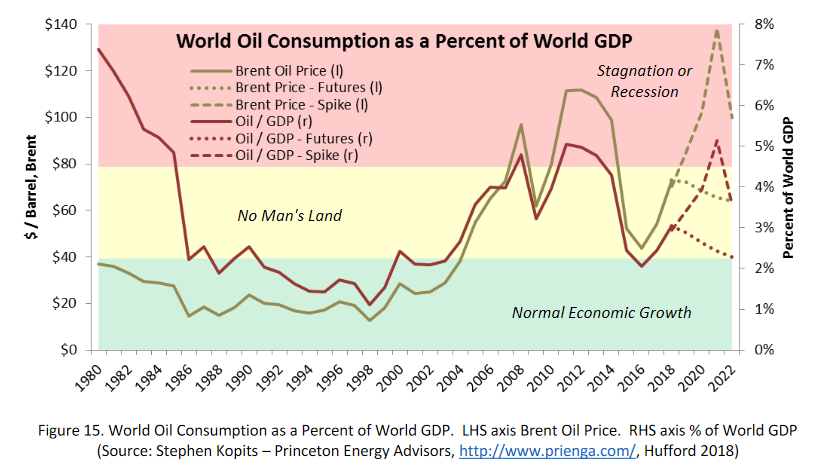

This is why the consequences of a sudden rise in energy prices are, most of the time, a recession: a spike in oil prices has preceded or coincided with 10 out of 12 post-WWII US recessions, and played a significant role during the 2008 crisis (which might be the third oil shock - see the section dedicated to it). A useful rule of thumb is that in the last 50 years, when energy prices reached about 8-10% of GDP, a recession ensued:

Right now, during the current energy crisis, we are seeing a rise in prices for industrial metals (zinc, copper, aluminum), cars, tech products (including solar panels) and, most importantly, food. We can expect to see the amount of production and services plummeting at some point, as almost everything will be harder to do with less energy. Tellingly, a paper commissioned by the UN Secretary-General’s group of scientists pointed out that “the driving force of the transition to postcapitalism [whatever this is] is the decline of what made ‘endless growth capitalism’ possible in the first place: abundant, cheap energy.”

Modelisation of the energy and GDP decline

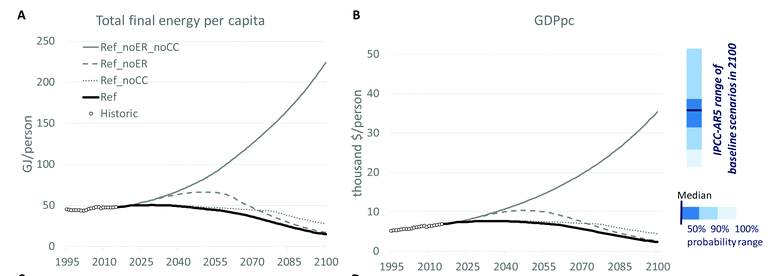

Now, has someone tried to quantify all of that? I’m aware of very few papers that tried to model all these things. Most IAMs, the models used by most energy transition models (including those of the IPCC), do not model limits on fossil fuels or minerals, or declining energy returns, assume perfect substitutability, model poorly environmental damage (see here), use prices as indicators of scarcity, etc. See the beginning of this article). So these IAMs rarely take into account most of what is discussed above. The only model that I am aware of that tried to model all that is MEDEAS. I recommend checking it out, it’s quite interesting (although I must note that Dave finds it pessimistic, he thinks they give too much importance to land use and climate impacts, and that the model should have higher efficiency and growth of renewables). This model includes:

- Representation of biophysical constraints to energy availability (with EROI)

- Modeling of the material and energy investments for the energy transition

- Consistent representation of climate change damages with assessments by natural scientists

- Integrated representation of economic processes and biophysical limits to growth

- Energy shifts driven by physical scarcity

- Impact on water, land use, and social impact

Ref is the base model, in bold, where both energy depletion and climate impacts weigh in. The dotted lines represent scenarios with unlimited energy resources (Ref_noCC) or with no climate impacts (Ref_noER). The line going up is for a world of unlimited energy resources and with no climate impacts (Ref_noER_noCC) - this is what is used in mosts energy transition models - IAMs - and the IPCC.

Except for the scenario used by IAMs, all scenarios show a plateau and a decline. Of course, such a strong change would have wide consequences on the economic and political system, and no model can integrate what these “‘unthought futures” would imply.

Impacts: What might happen when energy declines?

Note: from now on, this article will get really speculative, as nobody really knows what will happen. There is also much less litterature on the topic. As the article “Energy descent as a post-carbon transition scenario” puts it, “The nature of the envisaged transition means that we are entering entirely unexplored territory, and the pathways that we walk into existence are subject to inherent, irreducible uncertainty. It is impossible to know up front just how these pathways will unfold, the full range of challenges that will be encountered along the way, and where the novel responses to them will take us. As such, there is very good reason to think that the situations that emerge will be very different from the expectations created by any model constructed or plan conceived today. It seems prudent to conclude that global-scale transition away from fossil fuels leads humanity into the post-normal realm of ‘unthought future(s)’ (Sardar & Sweeney, 2016). Here actors will do better to anticipate complex, uncertain and chaotic conditions as typical, rather than extreme outliers.“

This is still a work in progress and bound to change, but here are some elements I found that could happen. Note that what follows assumes the case here an energy descent is undergone involuntarily, without any serious anticipation of the topic from companies and government, like rationing or degrowth (we’ll discuss that more in the next post).

Systemic risks - Danger of economic collapse

A word of warning: what is following might be rather uncomfortable to read, so if you want to take a pause before going ahead, please feel free to do so. Remember that this is an exercise that tries to anticipate realistic bad scenarios - this is not necessarily the most likely one, but it has a significant chance of happening.

What might happen then? Economic and political systems are geared for growth, which is why they respond poorly to recessions. The order of events that will unfold is unclear, and so is the timing. However, it might be useful to see what armies honestly think will happen. An internal report on the subject by the German Armed Forces, the Bundeswehr, was leaked a few years ago. This is a prospective work aimed at anticipating worst-case scenarios, so keep in mind that what follows is not necessarily the inevitable development:

[Start of the quote from the report] "The transmission channels of an oil price shock involve diverse and interdependent economic structures and infrastructures, some of which are of vital importance. Its consequences are therefore not entirely predictable. Initially, it will be possible to measure the extent of these consequences, although not exclusively, by a reduced growth of the global economy. [...] Economies, however, move within a narrow band of relative stability. Within this band, economic fluctuations and other shocks are possible, but the functional principles remain unchanged and provide for new equilibriums within the system. Outside this band, however, this system responds chaotically. [...] An economic tipping point exists where, for example as a result of peak oil, the global economy shrinks for an undetermined period. In this case a chain reaction would destabilize the global economic system [...]. The course of this potential scenario could be as follows:

- Peak oil would occur and it would not be possible, at least in the foreseeable future, to entirely compensate for the decline in the production of conventional oil with unconventional oil or other energy and raw material sources. The expression “foreseeable” is very important in this context. Ultimately, it leads to a loss of confidence in markets.

In the short term, the global economy would respond proportionally to the decline in oil supply.

- Increasing oil prices would reduce consumption and economic output. This would lead to recessions.

- The increase in transportation costs would cause the prices of all traded goods to rise. For some actors, this would only mean losing sources of income, whereas others would no longer be able to afford essential food products.

- National budgets would be under extreme pressure. Expenditure for securing food supplies (increasing food import costs) or social spending (increasing unemployment rate) would compete with the necessary investments in oil substitutes and green tech. Revenues would decrease considerably as a result of recession [...].

In the medium term, the global economic system and all market-oriented economies would collapse.

- Economic entities would realize the prolonged contraction and would have to act on the assumption that the global economy would continue to shrink for a long time.

- Tipping point: In an economy shrinking over an indefinite period, savings would not be invested because [most] companies would not be making any profit. For an indefinite period, companies would no longer be in a position to pay borrowing costs or to distribute profits to investors. The banking system, stock exchanges and financial markets could collapse altogether.

- Financial markets are the backbone of the global economy and an integral component of modern societies. All other subsystems have developed hand in hand with the economic system. A disintegration can therefore not be analyzed based on today’s system. A completely new system state would materialize. [...]

Here is an outline of some theoretically plausible consequences:

- Loss of confidence in currencies. Belief in the value-preserving function of money would dwindle. This would initially result in hyperinflation and black markets, followed by a barter economy at the local level.

- Collapse of unpegged currency systems. If currencies lose their value in their country of origin, they can no longer be exchanged for foreign currencies. International value-added chains would collapse as well.

- Mass unemployment. [...] During the oil crisis in the mid-1970s, unemployment in West Germany increased fourfold although all actors were aware that this crisis was finite. The latter would not be the case in a crisis induced by peak oil.[...]

- National bankruptcies. In the situation described, state revenues would evaporate. (New) debt options would be very limited, and the next step would be national bankruptcies.

- Collapse of critical infrastructures. Neither material nor financial resources would suffice to maintain existing infrastructures. Infrastructure interdependencies, both internal and external with regard to other subsystems, would worsen the situation.

- Famines. Ultimately, production and distribution of food in sufficient quantities would become challenging.

- [...] In order to prevent a restriction of capabilities and deployment options of the Bundeswehr, alternative solutions to oil-based fuels would be necessary in the short term. While these solutions, such as coal liquefaction or in some cases natural gas liquefaction, are possible and conceivable in principle [and some already exist], they would entail considerable political and economic efforts. They would require considerable investments and radical industrial policy decisions. Considering the challenges society as a whole would face as a result of peak oil, it seems unlikely that this could be accomplished even in case of an emergency. [...]

In view of their degree of globalization, all industrialized countries – including Germany – face a high systemic risk, regardless of their individual energy policies.

[...] Psychological barriers cause indisputable facts to be blanked out and lead to almost instinctively refusal to look into this difficult subject in detail. Peak oil, however, is unavoidable. This study shows the existence of a very serious risk that a global transformation of economic and social structures, triggered by a long-term shortage of important raw materials, will not take place without friction regarding security policy.”

[End of the quote] These conclusions should explain why governments and international institutions do not like to talk openly about this subject. The fact that they did not plan for such an eventuality could also bring about a loss of confidence in institutions: “People will experience a lowering of living standards due to an increase in unemployment and the cost of oil for their vehicles. [...] Setbacks in economic growth can lead to an increase in the number of votes for extremist and nationalistic parties.” Authoritarian regimes that promise an easy way out and put the blame on scapegoats could also rise to power.

Consequences - Risk of supply chain disruption

Note: what follows is even more uncertain, as very, very few papers got into real detail on this topic. I am mostly putting together what I managed to find, so please take into account that there are many, many unknowns here.

A report by the Risk/Resilience network went into more detail about systemic risks, and also pointed out that this could disrupt our ability to produce more energy. Indeed, a systemic crisis could disrupt long supply chains as they rely heavily on monetary confidence and bank intermediation. This could affect the ability to produce and transport food, but also parts for the maintenance of energy infrastructure (photovoltaic panels and windmills require many parts and metals shipped over the world). No one nation state has everything it needs to manufacture a single advanced technological unit like a computer (except maybe China), so a contraction of international trade could mean shortages of all kinds. Loss of long-term confidence in purchaser solvency and monetary stability could also prevent the development of many costly and complex energy projects that need a huge upfront investment. The list includes digging Arctic oil or Siberian natural gas, building smelting plants that can work with hydrogen, nuclear power or fusion… All of this would accelerate the energy descent.

It’s possible that the global economy could reorganize itself in some way to prevent such paralysis, and there would be attempts to put in place economic and political systems that would rely less on material growth to prevent worst-case scenarios. I personally think it’s a real option, but it’s really unclear how this would take place. Nations could go into “war-economy” mode, stepping in if the private sector cannot invest enough in energy sources, possibly nationalizing the sector. On the contrary, oil companies could acquire influence similar to that of countries. It is possible that a collapse of the economic system is halted by a quick reaction from governments, and affects only limited sections (like the financial sphere). Even then, the return to a business as usual economy is not very likely since the issue of declining energy returns would still be a thing.

What will nations do? Many countries will try to keep their hands on the resources necessary for their economy — richest nations could buy them at a high price, like with masks and vaccines today, leaving little for other countries that cannot compete. Energy diplomacy could get really intense. Some oil producers could decide to keep their resources for domestic uses (for instance, the EU would be in trouble if the USA or Russia were to do that). Countries with a lot of energetic resources could face wars over these resources, especially in the Middle East, as happened over history. That would add to the political instability and importing these resources would get even harder for other nations. Such wars, if they end up blocking some chokepoints used by oil tankers like the Suez canal, could disrupt global trade even more.

The consequences will vary depending on the country. For instance, China is able to plan long term with a population that can accept sacrifices, with local resources and industry, and may already be preparing. Russia, with its large energy resources, could also do well. More surprisingly, some populations that are already “energy poor” could fare much better than rich countries in the long term because they still have the critical social and technical skills to handle this, as the gap is smaller (depending of course on the country and political situation). Current trends of urbanization and industrialization may even be counterproductive in this sense for them, because it could make them lose these skills. On the other hand, rich countries, which are more used to their energy-intensive lifestyles, could try to cling to their way of living and might suffer a stronger fall in the long term.

Several things would be less available for most. High-tech hospitals need a lot of energy to run: the US healthcare system consumes as much energy as the country’s entire renewable energy production. Many other things could become much harder in the future: moving quickly over long distances, transporting water by truck to water-deprived zones, making use of heating in cold countries and HVAC systems in hot countries…

Impacts on food production

As the Risk/Resilience network underlines: “Global food production is already straining against a rising demand and the stresses of soil degradation, water constraints, overfishing, and the burgeoning effects of climate change. It is estimated that between seven and ten calories of fossil fuel energy go into every one calorie of food energy we consume. [for the highly-mechanized US, less for other countries] It should be clear even from the above overview that a major financial collapse could not just cut actual food production, but could result in food left rotting in the fields, an inability to link surplus production with those in need, and an inability to enact monetized food transactions. [...] Our critical reliance upon complex just-in-time supply-chain networks mean that there is little buffer to protect us from supply shocks. In the event of a global shock, and without any planning, it is likely that unrelieved hunger could spread rapidly. Even for a country that could be food independent, and even a potential net exporter, it may take years to transition as old systems fail and new ones put in place (rationing systems, education, re-location of farm laborers, horse breeding, nutrient recycling systems, seasonal re-adjustment of production, tool production, storage and preservation skills and products). In the interim, the risks are severe”.

For instance, Synthetic fertilizers feed about half the global population today (4 billion people), and since making them is done with natural gas 95% of the time, it’s uncertain how we can feed so many people with less of them. The current rise in natural gas prices meant an increase in fertilizer price, which translated into more expensive food and more hungry people. ALLFED points out that it’s possible to use solar panels to produce that (more on the next post), and we should push for it, as it’s not known enough so far.

How might societies react to this?

How societies will react matters immensely, and this is very hard to predict. Lessons can be learned from either Cuba or North Korea, who both faced massive reduction in oil imports after the collapse of the USSR. What happened to North Korea and its harsh climate is what we want to avoid: “Without Soviet aid, the flow of imports to the North Korean agricultural sector ended, and the government proved too inflexible to respond. Energy imports fell by 75%. The economy went into a downward spiral, with imports and exports falling in tandem. Flooded coal mines required electricity to operate pumps, and the shortage of coal worsened the shortage of electricity. Agriculture reliant on electrically-powered irrigation systems, artificial fertilizers and pesticides was hit particularly hard by the economic collapse." The following famine killed hundreds of thousands.

Cuba, however, managed to survive by promoting a decentralized and ecology-based agriculture, and they made a remarkable recovery. If you feel all of this was quite gloomy, I highly recommend you watch ‘The Power of Community’, which is actually very inspiring. There was a lot of effort both from the people and the state. Social services, healthcare and education were maintained, land was reclaimed from conventional agriculture, cooperatives kicked in, carpooling and hitchhiking were common, decision making was localized with less state regulation. Of course, it’s important to recognize this was a difficult and unprepared transition — people were hungry — and not enough - they still depend at 60-80% on food imports. Things are not perfect and hard to reproduce elsewhere. They also have a good climate, which helps immensely. But if overall, things unfold like in Cuba and not North Korea, I’d be happy. I especially like this quote from a Cuban: "The people cooperating with and caring about each other are the main factors that we need to encourage. We can all plant fruit trees, we can all have water catchment devices on our roofs. It's not the technology, it's the human relationships."

A good question to ask could be “What can we learn of Cuba? And what could have been done so that the energy descent of North Korea would have been less bad?”. This question could also be asked of Venezuela, that some observers called a “window into how the Oil Age will unravel”. Or Sri Lanka.

It’s important to note that many people will try their best to adapt. People will react when negative consequences start to appear in their lives. They would start to cut down on wasteful behaviors, especially food waste (a third of food globally). Much of the edible food currently given to farmed animals (about 41% of cereals) could also be redirected to humans - that would greatly increase the available biomass. This could also mean the end of single-use products, planned obsolescence, single-occupancy vehicles, and other non necessary habits geared toward comfort (like lawn mowing). All these things would certainly alleviate many of the difficulties that will be faced. For some countries, there’s a considerable margin before getting to life-threatening hardship, but that depends widely on how the energy that remains is shared among the population: will a minority accaparate a large part of the wealth for itself? To what end will the remaining resources be used?

Rationing could become a very real option, like in the 1970s. This wouldn’t necessarily be a bad thing: it just means directing scarce resources toward what’s vital versus what’s discretionary. We need energy for food, critical supply chains and hospitals; not so much for vacation travel and product packaging. Moreover, rationing reduces inequalities - and inequality has a tight relationship with health and social problems. In Cuba, it prevented the wealthy ones from taking all the food while leaving the poor starving. If everybody faces the same difficulties, it will be hard, but this is when strong social cohesion arises - during WWII, rationing actually improved health and life expectancy of people in the UK, as food was shared more equally. However, if present tendencies continue, and times get harder while wealthy people continue living wastefully, then we can expect a lot of social unrest. While everybody has a chance of getting richer, inequality is bearable - but it gets really tough if we feel on the losing end while others have it better. This article about the situation in Sri Lanka, which collapsed, can give an example of how terrible this can feel.

Now, all the effects above are not necessarily unavoidable, but they are possible consequences of a rapid energy descent, following a shock strong enough to expel the global economy out of its narrow band of relative stability. The current pandemic and its consequences is an on-going demonstration of such a shock (albeit a smaller one).

Anyway, as the German army report points out: “While it is possible to identify specific risks, this does not conceal the fact that the majority of the challenges we are facing are still unknown. Besides adapting economic and energy supply policy at an early stage and not only in highly industrialized countries, the probably most effective solution strategies are thus not concerned with specific countermeasures but with systemic “cardinal virtues” such as independence, flexibility and redundancy”. The better we develop our ability to adapt, the better it’ll go.

Impact on other EA causes

Here is how we see the impact of the energy descent on some of the major EA causes:

- Climate change: This is still an important issue, but if what is exposed here comes true, there is a reduced probability of reaching the worst-case scenarios of hothouse earth, where billions of people simply die of heat exposure. IPCC scenarios do not take into account actual fossil fuels reserves - their most pessimistic scenario, RCP 8.5, assumes a x6 increase in coal consumption. When geologists use realistic reserves in climate models, they have a more optimistic outlook, predicting an outcome ranging from RCP 2.6 to RCP 4.5. scenarios, between a 2 and 3°C increase (see Ward et al. 2011; Höök and Tang 2013; Mohr et al. 2015; Murray 2016; Wang et al. 2017, MEDEAS model).

- For instance, Capellan-Perez et al 2016 suggests a 15% probability of getting a 5°C increase by 2100, given fossil fuel reserves. This would be much less in a rapid energy descent. They suggest a 63% probability for 3°C, and 88% for 2°C. Of course, such an increase is still very dangerous, and there is still is the possibility of hitting a fast tipping point that worsens the results. Yet, we’ve seen how extremely hard it is to get out of fossil fuels willingly (which is why activists and governments have failed to curb emissions down for 30 years), so it might be good news that there is a hard limit here — infinite fossil fuels might have spelled total climate breakdown.

- Environmentalism: We may also have less energy available to destroy the Amazon, overfish oceans or produce single use plastics. From the point of view of the indigenous people that suffer directly from the destruction of the environment, the energy descent is a good thing at first. Of course, we should be careful and watch out what courses of action will be chosen. For instance, replacing oil by biofuels can imply deforestation, if not properly managed (see the biomass section).

- Long-termism — catastrophes: On one side, research on existential risks that seek how to handle sudden crises is precisely what we need — especially on themes like “Feeding everyone if industry is disabled”, as ALLFED does. This is the closest we’ve found in EA on the current subject (see more in the next post). However, I’d argue that “can industrial civilization recover“ is not a very good criteria for the severity of a crisis, because it’s uncertain how an industrial civilization could re-emerge without accessible fossil fuels (and even then it would still face the same energy issue).

- Long-termism — others: On the other side, research on causes that assume the availability of a lot of energy in the long run are unfortunately not as promising as expected, as they could only be applied to a short timespan (if at all). This includes preventing meteorites, space exploration, lab-grown meat and reducing wild animal suffering (that last one really saddens me).

- Poverty and global health: Societies that are dependent on fossil fuels will be more vulnerable. Some research should be done on whether current interventions contribute to increasing this dependence or not. For instance, do they contribute to trends like overpopulation, urbanization and industrialisation that disrupt the ability to live in a low-energy world? Also, interventions that aim to increase economic growth could have limited value in the long-term.

- Animal welfare: Every life that does not have to go through the horrors of factory farming is a net win, regardless of the long run — so in this regard, progress in this area is as valuable as before. Moreover, since current meat eating is really energy intensive, scaling it down will be very important for future diets. In the future, we may end up using more animal labor to compensate for the lack of fuel, but not in a factory farming setting (research could be done to find if there are better solutions, or at least ensuring that their life conditions are acceptable).

Might this reduce extinction risks?

On Artificial Intelligence, it’s harder to make predictions. It is a very small fraction of energy use. However, it depends on a stable social and financial environment, and on long supply chains. Depending on the timing, things could go different ways, and I need more input from experts in the field. If an AGI is likely to appear within 10 years, this shouldn’t change a lot of stuff. However, if it took a longer time to appear, it’s possible that severe financial crises could hinder the investment capacity of the field, and, more importantly, slow down the exponential growth seen in computing.

The field is currently making a lot of progress because there is a strong interest and high hopes on this topic. If there are more immediate crises to handle (energy, food, debt, social unrest), then the interest in the field could diminish, and many companies would cut down on stuff that has no immediate payback. Indeed, the overall funding of these companies could go down if discretionary spending is reduced (more on this point here). Depleting resources could also drive up the cost of components, and make supply chains more vulnerable, like microchips, which are really complex to make (a minute-long blackout can interrupt a process that took weeks). In my opinion, all of this could make the development of an AGI less likely, if it does not appear before the start of the energy descent. More research is clearly needed, but seeing how some AI folks aren’t especially hopeful right now, this might be good news.

Is space exploration still an option?

As for space exploration, it appears unlikely that we’ll colonize the galaxy someday (or even the solar system). Space exploration is energy intensive and requires very long supply chains with a lot of specialization. Moreover, we’re already close to the maximum speeds we can get with chemical reactions, so entirely new breakthroughs (like fusion or maybe antimatter) would be required. There are immense challenges, and for most of them the most common answer is “maybe they’ll become solvable after a few centuries of energy growth and technological innovation”. If growth were to continue for centuries, then why not. But this sounds really unlikely - we’re not even sure it can continue for a few decades.

A common argument is that we may have to leave Earth to find new resources, but I do not think that, in a context of scarcity, societies will decide that the best thing to do is to bet on a decades-long trip to an unknown destination with highly uncertain payoff. Additionally, almost all the resources for such a trip would have to be found on Earth, since asteroids and other planets have less concentrated ores than on our home planet. The energy cost of space mining is extremely high (not to mention Dyson spheres).

Note that we’re probably not the only species in the universe that got in this very situation, of finding extremely concentrated energy sources and spending it in a few centuries. This could be a reasonable explanation for the Fermi paradox, and why no interstellar civilization has ever been observed. The simplest answer would be that space colonization is not possible.

My probability estimates

Here are all the probabilities I give these numerous assertions:

- A long-term energy descent would cause a long-term recession: 95%

- Energy investments and energy prices cannot increase considerably without a sharp drop in availability: 95% (there already signs of this for oil)

- We will not colonize other solar systems: 99%

- There is going to be at least a great energy-induced financial crisis in the next 30 years: 95% (for the next 10 years, 70%)

- All societies and nations will suffer a sudden and brutal collapse within the century: 20%

The last one comes from Nate Hagens, who thinks the complete collapse scenario (or Mad Max) is not the most likely option, as we’ll try to reorganize the way society works given the situation. It’s more likely that things will be progressive - we may bend and figure out something. But this is highly dependent on the country (some could collapse, some others not, depending on social cohesion), and our efforts to prevent this scenario matter a great deal. The other 80% still means having less energy and wealth, and facing difficult challenges, though - but within a wide spectrum of societies adopting new political and economic structures. Feeling of loss will prevail at the start, but we’ll get used to the new situation. I highly, highly recommend listening to the following intervention to better understand our prospects - he also points out that the time humans really thrive is when we have a common challenge to overcome. Future pathways may have less energy and materials, but more human capital.

Conclusion

Of course, the impact on most EA causes should be reevaluated more thoroughly than done here by experts in these fields. It appears that certain causes could probably be deprioritised, to some extent, especially long-term causes, leaving more room for others. Given that long-distance transport will get harder and harder, that also means that effective altruism might not be able to exist in the future as it does currently, because societies could see a great shift in their priorities if they get less and less resources each year. They may not be able to sustain such a high number of service workers (including developers like me, or scientists - see the graph at the end of this article). They would increasingly devote their resources toward providing basic needs, like food, energy or medicine. We should try to maximize our impact right now, while we still have the means and tools to do it.

What we can do on that topic, and what we can’t do, is the subject of the next post.