This post is to explain the concept of 'mission-correlated investing' and how the idea of 'mission hedging' is just one version of this concept.

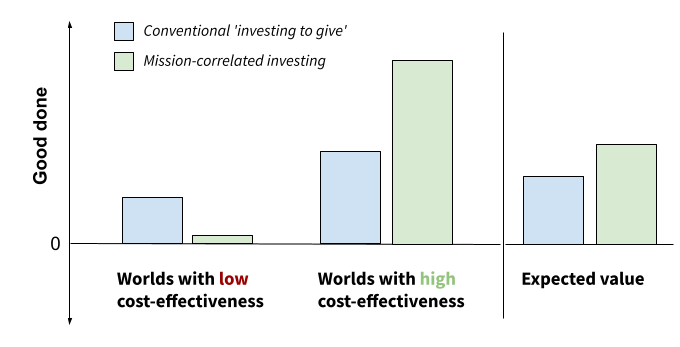

As Holden Karnofsky describes in this doc, it is good for investors to make "investments such that they end up with more money in worlds where money is relatively more valuable". That is, investments with returns that are correlated with the relative cost-effectiveness of future giving opportunities.

Investments that do this are 'mission-correlated' in the sense that their returns are correlated with how successfully the investor's mission of doing good can be achieved (i.e. cost-effectiveness).

Mission-correlated investing increases the expected amount of good. This is because the contribution of an altruistic investor to the total good can be thought of as the amount of money they donate multiplied by the impact per dollar of the opportunities they fund[1]. All else equal, increasing the correlation between the amount of money and the impact per dollar increases the investor's expected contribution.

As pointed out by Neel Nanda, however, mission-correlated investing may not result in 'hedging'. 'Hedging' generally means making investments that reduce your risk. In an altruistic context this would mean reducing the volatility of the total amount of good in the world.

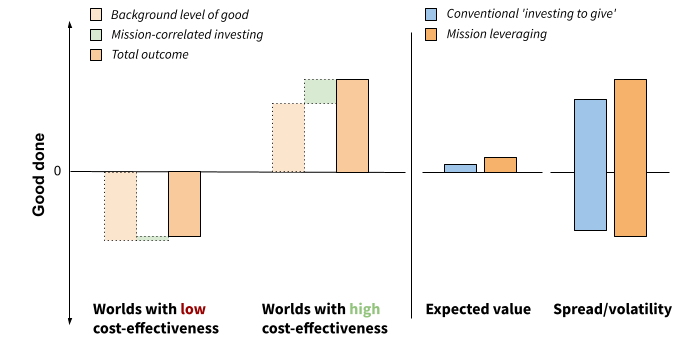

A mission-correlated investment will thus be 'mission hedging' if it reduces this volatility. If it instead increases the volatility we might call it 'mission leveraging'.

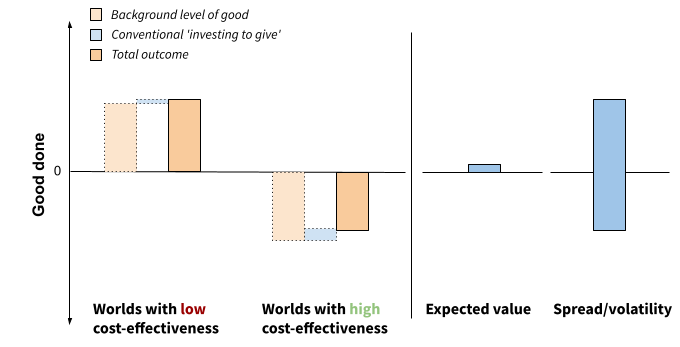

We can think about this in terms of the total 'background' level of good done in the world. This defines the 'state' of the world. The state is 'good' if the background level is relatively high and 'bad' if it is relatively low.

The good done by the altruistic investor then adds to this background level to produce the total outcome. The spread in total outcome between low/high impact per dollar worlds is then a proxy for the volatility of the total outcome. This is illustrated in the following figure.

Note that the world state does not have to have a relationship with cost-effectiveness for mission-correlated investing to be important! It's possible that the background level of good varies little between the average world with high/low impact per dollar. Related to this, the total outcome spread may not always be an accurate proxy for the volatility. There may be much more volatility within the set of high impact per dollar worlds than the spread between low/high average worlds.

But, if there is a strong correlation between cost-effectiveness and the world state then we can develop some intuitions about what leads to hedging/leveraging.

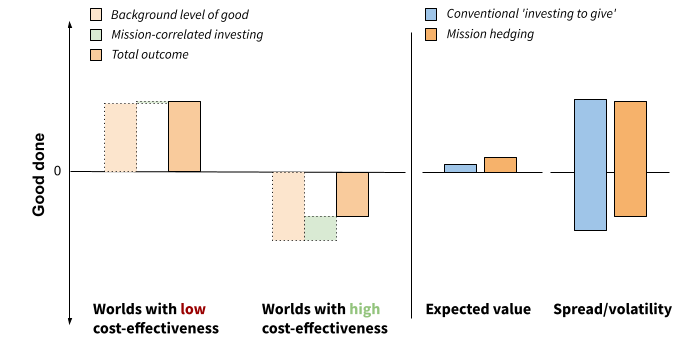

A rule of thumb for whether an investment is 'leveraging' or 'hedging' is whether impact per dollar depends positively or negatively on the world state.

'Mission hedging' arises if high impact per dollar worlds are expected to have a relatively low background level of good. Then a mission-correlated investment will generate higher returns and lead to a higher amount of good done in these worlds, partially offsetting the fact that these worlds are relatively worse.

Mission hedging makes the good worlds a bit worse and the bad worlds a lot better. By increasing expected value and reducing volatility it is a 'win-win'. This was indeed the type of investment Brigitte Roth Tran described in her paper that introduced the idea.

It is a win to reduce the volatility of the total outcome. But exactly how much of a win it is, compared to the increase in expected value, is a question that goes way beyond this post. It depends on one's cause area / world view / approach to uncertainty. So it also seems worth considering mission-correlated investments that have the opposite effect on volatility.

'Mission leveraging' arises if high impact per dollar worlds have a relatively high background level of good. This means mission-correlated investing will make the good worlds a lot better and the bad worlds a bit worse. The increase in expected value makes this valuable even if it is just a 'win' and not a win-win like mission hedging.

Note that a lot of existing discussion of mission hedging seems to emphasize the 'mission correlated' benefit of higher expected value, not the 'hedging' benefit of volatility reduction. This includes use of language that suggests the expected value increase comes from correlation with the world state. The main point of this post is that this is not correct. There is an important difference between correlation with the world state and with cost-effectiveness.

It is the correlation of returns and cost-effectiveness that drives the increase in expected value. What Holden's quote describes is 'mission-correlated investing'. It is ambiguous whether it describes 'hedging' or not.

The practical importance of this is that a better understanding of the distribution of future cost-effectiveness is key for mission correlation research. The challenge for modellers and forecasters is not just to develop good/bad scenarios for the future, but also to forecast cost-effectiveness in these scenarios. For example:

- What AI timelines are most likely to lead to scenarios of relatively high impact per dollar for alignment work?

- What biotechnology developments are likely to lead to scenarios with relatively effective opportunities for pandemic preparedness?

- How about for global health & development?

- ^

Technically this is an approximation. This can all be framed much more precisely using algebra, as I do in this working paper.

Thanks for disentangling this concept. Also, I think a more extensive summary of your working paper (congrats, it's pretty good, for what I've seen so far) would be convenient, with more examples.

Thanks for the kind words, Ramiro. Yes, it's on my to do list both to write more short posts on the key ideas in that paper (in posts) and to revise it to make it easier to follow (it's too ambitious).

Could you add some concrete examples? This sounds promising, but I found it hard to follow in the abstract.

I agree with Michael that concrete examples would be very helpful, even for researchers. A post should be informative and persuasive, and examples almost always help with that. In this case, examples can also make clear the underlying logic, and where the explanation can be confusing.

For example, let's think about investing in alternative protein companies as a way to tackle animal welfare. Assume that in a future state where lots more people eat real meat (bad world state), the returns for alt-proteins in that state are low but cost-effectiveness is high. This could be because alt proteins have faced lower rates of adoption (low returns) but it's now easier to persuade meat eaters to switch (search costs are now low since more willing-switchers can be efficiently targetted). The opposite situation is true too. In a good future state with few meat-eaters, alt protein returns are high but cost-effectiveness is low. So this scenario should put us in your table's upper left quadrant (negative correlation btw/ World State and Cost-Effectiveness + negative correlation btw/ Return and Cost-Effectiveness).

This example illustrates how some of your quadrant descriptions may be confusing or even inappropriate:

So as you can see, an example makes clear where table descriptions may be inappropriate and where a clearer description can be helpful. It also makes more concrete what various correlation signs mean and how to think about them.

Thank you Wayne and Michael for the helpful nudges and encouragement.

I agree that the table at the bottom of the post was at best ambiguous. I have now deleted it from this post, revised it and turned it into this new post with several examples.

This current post then, without the table, remains to make the point that 'mission hedging' is just a subset of 'mission correlated investing'. And that mission correlation research needs to focus on forecasting cost-effectiveness, not whether the world is 'good' or 'bad'.