Our latest study

In 2014, GiveDirectly partnered with academic researchers to launch our largest study ever in Kenya. The ultimate goal: find out how cash transfers affect local economies, including nearby non-recipients, enterprises, and markets. Now, in 2019, the results of this research have been released.

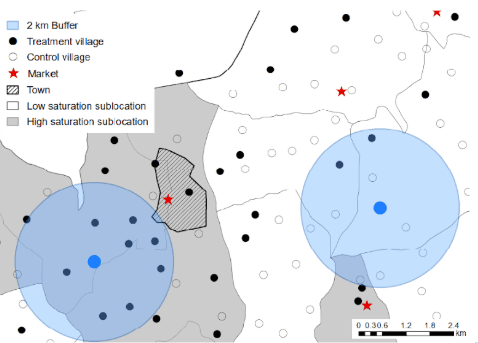

We delivered $1,000 to each of 10,500 households across 328 villages in Siaya, Kenya, ultimately distributing as much as 15% of local GDP one year. In parallel, 5 economists from Berkeley, Princeton, and UCSD (including GiveDirectly co-founder Paul Niehaus) led numerous surveys of recipients, non-recipients, and local business owners to understand the broader, macroeconomic effects of large infusions of cash across a total of 653 study villages.

You can read the full paper here.

Key takeaways

The authors’ abstract, which we’ve shared below, sums up the results well:

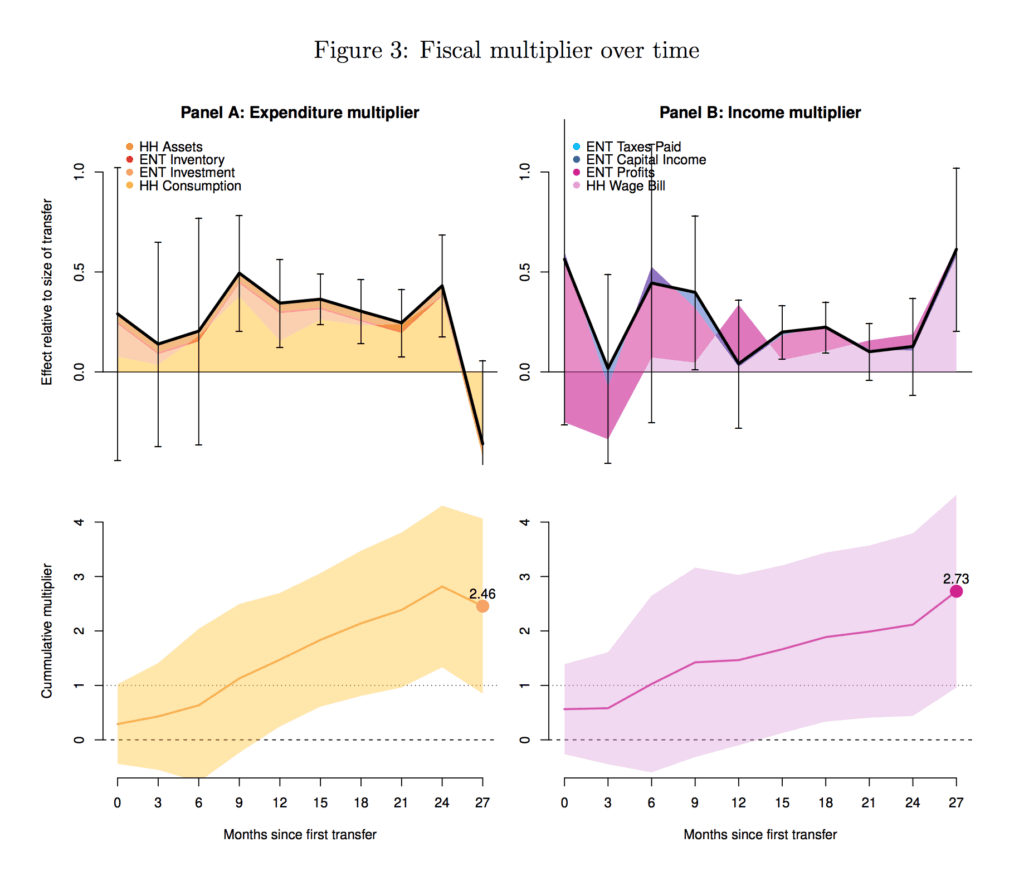

How large economic stimuli generate individual and aggregate responses is a central question in economics, but has not been studied experimentally. We provided one-time cash transfers of about USD 1000 to over 10,500 poor households across 653 randomized villages in rural Kenya. The implied fiscal shock was 15 percent of local GDP. We find large impacts on consumption and assets for recipients. Importantly, we document large positive spillovers on non-recipient households and firms, and minimal price inflation. We estimate a local fiscal multiplier of 2.6. We interpret welfare implications through the lens of a simple household optimization framework.

Stepping back, this study is an exciting example and extension of the “experimental approach to alleviating global poverty” recognized by this year’s Nobel Prize in Economics. Randomized controlled trials often focus on programs’ individual direct effects, but this study varied cash transfer intensity by whole groups of villages and constructed estimates of broader macroeconomic effects.

For example, to understand the effects on inflation, researchers conducted monthly surveys for 2.5 years across 61 markets and 72 products. And researchers surveyed enterprises and households (both recipients and non-recipients) to estimate the “multiplier” effect, finding that $1 of cash delivered generated $2.60 in additional spending or income for the local economy.

As with most studies, not every finding was positive. Health and female empowerment measures did not change significantly for recipients or non-recipients, and while there were large economic gains for recipients (targeted as the poorest), gains for non-recipients were so substantial that the gap between the poorest and least-poor within villages widened slightly.

The usual caveats

The study is among the first to use randomized control trial methods to measure the macroeconomic impacts of cash transfers, including the total effects across recipients and non-recipients. But it’s also just one study. There are well over 150 high-quality studies on the direct effects of cash transfers. And while the literature on inflation, economic multipliers, and spillovers is much smaller, that wider literature is still important to consider in interpreting these results and especially in extrapolating to new contexts.

What we’re thinking about

We’re still mulling a number of questions about the implications of these results for GiveDirectly’s work and the broader evidence on cash:

- How should these results inform GiveDirectly’s regional and village selection processes?

- Given the magnitude of positive spillovers for nearby non-recipients, are “control” households or villages in other GiveDirectly studies less insulated from the cash “treatment” than we’d previously thought?

- How should these results (i.e., moderately smaller direct effects for recipients than some previous GD studies, but new estimates of large indirect effects for non-recipients) inform how we think about GiveDirectly’s typical or average impact for this type of program?

We’re keen to hear what others make of the findings and looking forward to more discussion, experimentation, and learning.

[EDIT: I no longer endorse all of this comment. After looking more closely at the papers, I'm more confident that the spillover effects of the latest version of the program are neutral to positive (at least on humans – growth in meat consumption is an important caveat).]

Thanks for posting this.

Though not reported here, I was pleased to see that non-market effects were also recorded in the study, and that these were neutral or positive for both recipients (‘treated households’) and non-recipients.

For treated households, we find positive and significant effects for four of the six indices: psychological well-being, food security, education and security [i.e. crime rates]. Estimated effects are close to zero and not significant for the health index and female empowerment index. When looking at total effects including spillovers for the treated, we find a similar pattern for all but the security index. For untreated households, we find no significant effects of local cash transfers except for the education index, which is higher by 0.1 SD (p < 0.10). Importantly, we do not find evidence of adverse spillover effects for untreated households on any of the indices, with point estimates positive for all but the security index, which is indistinguishable from zero (-0.02 SD, SE 0.07).

I’m particularly interested in the “psychological wellbeing” index, which Appendix C1 says comprises a “weighted, standardized average of depression (10 question CES-D scale), happiness, life satisfaction, and perceived stress (PSS-4)”. I would like to know: (a) what measures were used for “happiness” and “life satisfaction”; (b) how the components of the index were weighted; and most of all (c) a breakdown of scores for each measure. I can’t find this information in the paper.

I’m asking because there is a fair amount of research suggesting that one person's income increase causes wellbeing declines among other members of the community (i.e. people feel worse when their neighbour gets richer), at least for some accounts of wellbeing. For instance, Haushofer, Reisinger, & Shapiro (2019) found that neighbours of GiveDirectly cash recipients experienced a decline in psychological wellbeing (seemingly measured by a similar index to the one used in the most recent study) about half as great as the psychological wellbeing benefit to the recipient. Depending on how many neighbours are affected by each transfer, this would seem to indicate that GiveDirectly may have a net negative effect on aggregate wellbeing. However, this effect was driven entirely by life satisfaction, an ‘evaluative’ or ‘cognitive’ measure; there were no negative spillovers on measures of ‘hedonic’ wellbeing, namely “happiness”, “stress”, and “depression”. As the authors note:

This result is intuitive: the wealth of one’s neighbors may plausibly affect one’s overall assessment of life, but have little effect on how many positive emotional experiences one encounters in everyday life. This result complements existing distinctions between these different facets of well-being, e.g. the finding that hedonic well-being has a “satiation point” in income, whereas evaluative well-being may not (Kahneman and Deaton, 2010).

Without seeing the disaggregated scores from the new study, it seems possible that there were non-trivial and statistically significant harms (or benefits) according to some components of the index. This matters to those with a preferred moral theory or conception of wellbeing, e.g. a classical utilitarian probably cares more about hedonic states than life evaluations, and a prioritarian more about severe states like depression than positive ones like happiness.

Very good comment. I am in favor of some of universal or conditional basic income, because the issue of 'relative deprivation' is very real.

the most extreme example is someone who gets rich by winning a lottery (in my area alot of people play the lottery, because they want to get rich quick and also tend to have low paying and unpleasant jobs--they spend alot of their low incomes on the lottery--which spposedly is used by the govt to pay for public education).

If someone wins the lottery, supposedly everyone is better off, because the winners will buy more stuff in the area (multiplier effect) and so on--and will be much happier themselves because don't have to worry about money. They can even quit an unpleasant job and pay for their kids' private school or college tuition. .

But then everyone they know will show up and ask for some money , and they are quickly miserable, and sometimes go broke--some spend most of their money on luxuries which they think will make them happier.

Also often the 'multiplier effect' doesn't really benefit or help much the people who also get money indirectly from the lottery. They just get a bit more than their own neighbors , who proceed to ask them for money. Cash transfers have to take into account the whole community.