Overview

We are excited to share our vision to:

- Better model cascading, systemic, tail and global catastrophic risks (GCRs)

- Develop novel financial products to mitigate GCRs

- Nudge the financial industry to invest more and rethink how it mitigates and adapts to GCRs

The ultimate goal is to move to a world where the financial industry prices in externalities and communities are resilient to GCRs and existential risks.

In this EA forum post $100trn opportunity, ESG investing, Sanjay wrote about why now is the time to influence the financial industry through ESG (Environment, Social, Governance) investing. He argues:

- Importance - Corporations cause substantial externalities and GCRs, and investors can influence these corporations and governments.

- Tractability - ESG investing is taking off and investors are increasingly more ESG-focused.

- Neglectedness - ESG investing is currently not high-impact, but could be.

In this post, we will focus on better modeling of risks to make ESG investing more impactful. We will show why improved modeling is important, neglected and tractable. The summary is:

- Importance - Cascading, systemic and GCRs typically aren’t priced into asset prices. By quantifying risks, the financial industry, and its $100T+, has an incentive to reduce these risks and invest in mitigation and resilience.

- Neglectedness - Current catastrophic modeling is insufficient and neglects cascading, systemic and GCRs.

- Tractability - There are new models and data and demand for improved modeling of climate risk, which provides an initial use case for other cascading, systemic, tail and GCRs.

As Sanjay argues, better modeling is one piece of the larger puzzle to influence the financial industry. Other actions include:

- Shifting the financial industry to adopt Universal Ownership

- Requiring standardized disclosures of climate and GCRs for risk assessment and planning

- Convincing asset owners to be more active and impact-focused

- Creating improved models and accurate analytics to create specific board resolutions to mitigate and plan for risks

Importance

New global catastrophic risks (GCRs) are emerging

With large scale production of nuclear weapons in the 1950s, for the first time humanity had the ability to kill hundreds of millions of people. This represents a robust trend that has continued to today: technological advancements, global economic growth, and increases in supply chain complexity, exposes civilization to destruction on an ever larger scale. Pandemics like COVID-19, cyber attacks, nuclear war and rogue AI are examples of these increased emerging risks.

These emerging risks are rarely accounted for in asset prices, although they theoretically decrease future cash flows and can be accounted for in the discount rate.

Due to climate change, natural disasters have increased in number and severity

According to the Institute for Economics and Peace, natural disasters have increased more than 10 times, from 39 incidents in 1960 to 396 in 2019. In 2021, weather disasters brought home the reality of climate change. For example, North America experienced the full gamut of extreme weather events, some of which regions have never been experienced before - Hurricane Ida, Pacific Northwest heatwave, the megadrought, Western wildfires, and extreme floods.

Furthermore, reported losses from 2010-2019 were $383M per day, seven times the amount reported from 1970-1979 of $49M per day. Many communities, especially in developing countries, are disproportionately affected by the impacts of these catastrophes. Yet, with over 400 natural catastrophes in 2019, only $71B out of the $232B of economic losses were insured.

Finally, although not considered a GCR, climate change can cascade into a catastrophic risk if it triggers one or more tipping points in the Earth’s climate system. Climate change is inherently complex and systemic where it can have follow-on effects across regions and cause large economic damages.

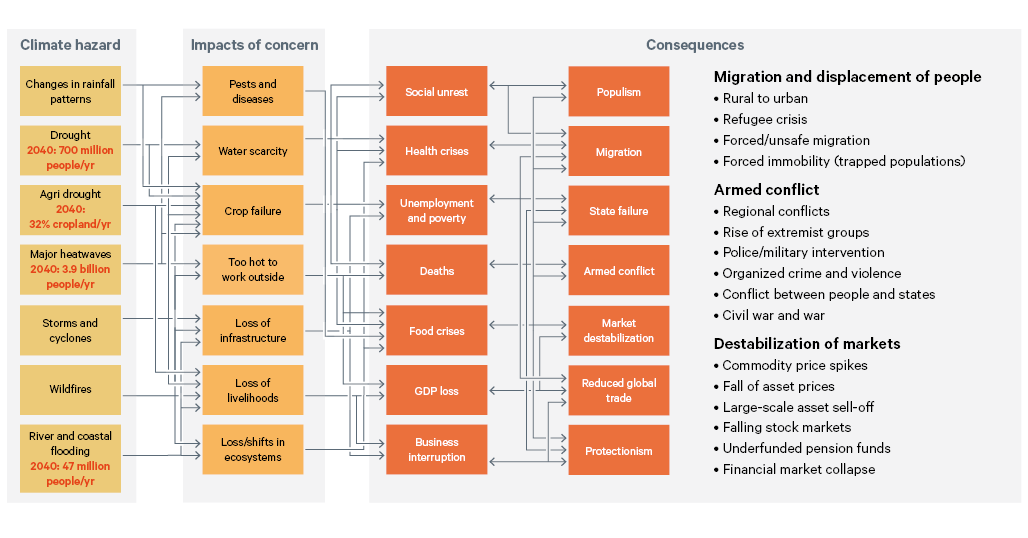

An expert elicitation exercise conducted by 70 diverse experts identified major dynamics and impacts from climate change, such as increases in migration, armed conflict and destabilization of markets. The figure below shows a summary diagram of the major systemic risk dynamics identified. (For a higher resolution picture, click here.)

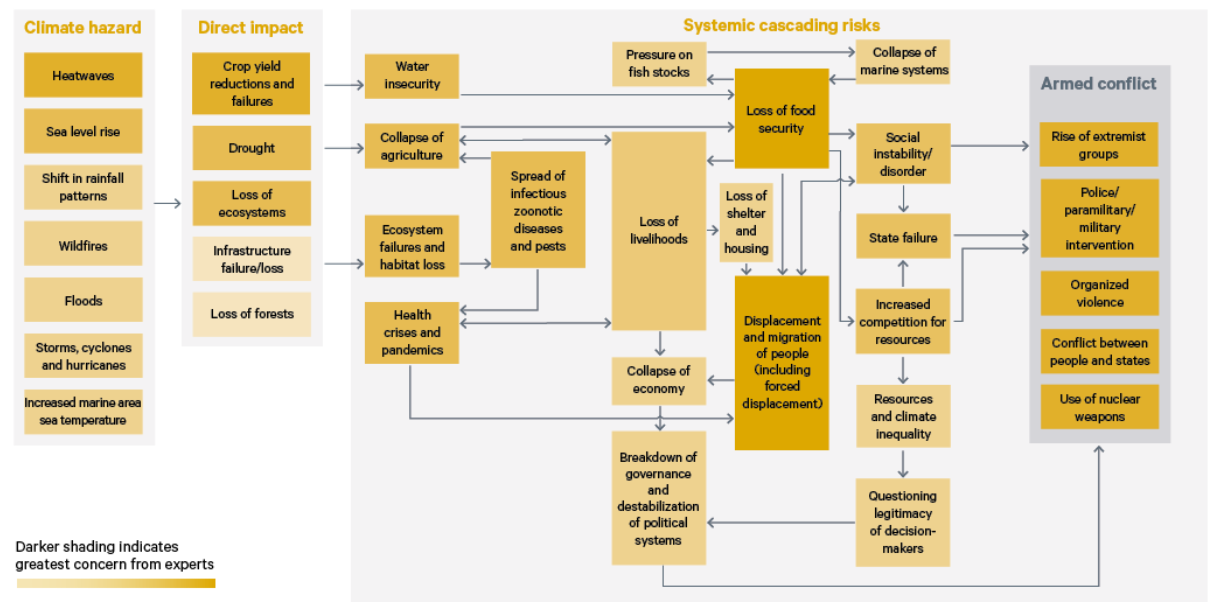

It has also been shown to be a risk factor for GCRs and can further amplify geopolitical tensions as it destabilizes economies and increases migration. The figure below shows how cascading systemic climate risks are likely to lead to greater national and international insecurity. (For a higher resolution picture, click here.)

New models are needed to mitigate and price in these emerging risks

We need to better model these risks we face so that we can effectively invest in resilience. Once we put a price tag on the risks, the market can reflect these risks in the price. So, reducing these risks will provide a return in the market. More directly, insurers can insure against these risks and are incentivized to decrease these risks.

Insurers and investors can increase resilience by:

- Developing innovative insurance products

- Optimizing disaster financing, risk pools and other loss reduction initiatives

- Identifying the most effective risk mitigation and risk avoidance strategies.

Some interventions that could increase resilience may include:

- Having backup communication systems for disaster scenarios

- Designing buildings to withstand higher wind speeds

- Upgrading drainage to cope with increased rainfall

In order to identify which interventions have the best return on investment, investors need to compare the cost of the intervention with the associated risk over the course of the investment. The right analytics will remove uncertainty and facilitate transactions. So, the market demands models for emerging risks so that capital can be deployed confidently.

These models could be helpful for:

- Insurance - to better price risk or open up new markets

- Large asset managers with long time horizons - to measure their risk exposure at an asset and portfolio level

- Green asset managers - to better price investment projects, such as green bonds

Moreover, at a corporation level, these risks can negatively impact business activities including the demand for goods and services, business operations, physical assets, technology, R&D and cost of capital. Improved modeling and advanced methodologies can reflect the impacts on the business valuation process. One such method is through discounted cash flow valuation. So, if the financial impacts are quantifiable like impacts on revenues, costs and capital expenditure, then these adjustments can be reflected in the cash flow adjustments. If the financial impacts are not directly estimable, the discount rate can be adjusted to account for the uncertainty.

Moreover, there are 2 different types of physical risks that corporation has:

- Direct (location, sector) - includes infrastructure and buildings, and sector-specific risks for like energy, agriculture

- Indirect (across the value chain) - supply chain, distribution, etc

Markets have traditionally priced in physical climate and weather-related risks based on actual loss experience. For example, catastrophe modeling took off after the devastating Hurricane Andrew in 1992. Markets are increasingly likely to price in anticipated risks based on improved analysis frameworks and increased awareness of these risks, especially with more frequent and severe climate events.

These advanced models can unlock the trillions of dollars available and leverage the financial industry's vast power to mitigate these risks.

Neglectedness

Few EA organizations are focused on influencing the financial industry

While there are many organizations trying to mitigate GCRs by attempting to influence policy, like CSET, Future of Life, CLTR and Simons Institute, few are looking to influence finance. While people in academia, like those in FHI, CSER and GCRI have models for GCRs, few are at a high enough resolution for insurers and investors. Finally, while the catastrophic modeling industry has localized models for the insurance industry, they focus on:

- Insurable climate risks

- Backwards-looking historical data

- 1 year time horizons

- Easy-to-quantify costs

To quantify physical risks to reprice assets and invest in resilience, we believe there is an opportunity to create climate models that focus on:

- All perils, anywhere in the world

- Forward-looking emissions scenarios

- 50+ years out

- Both direct (location, sector) and indirect (across the value chain) physical risks

Little attention is paid to cascading and systemic risks

During the 2008 global financial crisis, the focus was on the systemic risk of seemingly isolated risk that could grow and spread across heavily interconnected systems. But in the aftermath of the 2008 crisis, surprisingly little attention was paid to systemic risks outside of financial networks.

Catastrophic modeling focuses on insurable climate risks, and neglects other risks

Standard catastrophic modeling focuses on

- Tropical cyclone - wind, surge, rainfall flood

- Winter storm - wind, river flood, ice storm, freezing rain

- Severe convective storm - hail, tornado, wind

- Wildfire - ember and contact driven

However, there are many other risks that receive less investment because too frequent, too gradual, too complex or too difficult to model. Some examples include:

- Droughts, which are gradual and long-lasting, affect water supply, agriculture, energy, and supply chains

- Cyber attacks on critical infrastructure because of the difficulty of modeling the consequences

Catastrophic modelers also focus their efforts on the perils and regions that tend to drive insurance premiums, but the climate is a complex interconnected system with broader effects. According to the International Monetary Fund, the cost of natural disasters for small developing states, which are mostly uninsured, is more than four times that for larger countries, relative to the size of their economies. Modeling needs to capture all the consequences of climate change and other emerging risks.

For these climate risks, traditional catastrophic modeling uses historical data and neglects the influence of systemic risks

Catastrophic models rely on large amounts of historical data to determine the probability and severity of disaster events. However, this assumes a stationary climate. Scientists have long theorized that climate change is associated with these extreme weather events. The IPCC is more confident than ever that climate change is an influence, in their recent 2021 report. The Geneva Association recently stated: “While highly useful for today’s and next year’s portfolio management, catastrophe models are limited in providing decision-useful quantitative information over a longer-term, impeding progress toward a forward-looking climate change and exposure/vulnerability landscape.”

We believe that these systemic impacts are often neglected and need to be accounted for.

Catastrophic modeling typically focuses on the short-term and easy to quantify costs

The typical duration of insurance is one year, which forces on near-term risk assessment. Yet, it is crucial to look beyond this cycle because many stakeholders are looking for longer-term horizons for risk management, pricing, sustainability and regulatory response.

Most insurance focuses on easy to quantify damages like property damage from extreme events, yet there are secondary impacts that may be harder to quantify, such as loss of life, mass migrations, supply chain disruptions or distribution issues.

Within climate finance, most of the capital is focused on mitigation instead of adaptation

Climate mitigation is making the impacts of climate change less severe by preventing or reducing the emission of greenhouse gasses. On the other hand, climate adaptation is taking actions to prevent the damage that climate change may cause, through actions like infrastructure investments. Currently, climate adaptation finance represents only 5% of all climate finance or $500M is in climate adaptation, according to the Climate Policy Initiative. As mentioned before, modeling can help identify which interventions have the best return on investment.

Tractability (Why now?)

Because of COVID-19, the Overton WIndow has been opened for engagement in tail risks

COVID-19 has shown that the countries that were well-prepared, like Singapore, Hong Kong and South Korea, performed better because they understood the threat from fighting SARS and MERS. These countries made scientific investments to prepare and deal with pandemics beforehand. The COVID-19 pandemic also disrupted global supply chains and exposed their vulnerabilities.

Although assets prices increased through fiscal and monetary policies, according to Congressional Research Service, the economic losses from 2020 to 2022 are projected to be equivalent to 20% of 2019 global GDP, or about $18 trillion.

There is a global awareness of climate risks on the economy

Published annually since 2007, the World Economic Forum’s annual Global Risks Reports quantify the likelihood and impact of various risks. Climate change first made an appearance in the top 5 in 2011. In 2020, all of the top 5 risks by likelihood (extreme weather, climate action failure, natural disasters, biodiversity loss, and human-made environmental disasters) and 4 of the top 5 risks by impact (climate action failure, biodiversity loss, extreme weather, and water crises) had a climate component.

With new mandates, financial institutions are being forced to take climate change more seriously

New regulatory requirements, such as the Task Force on Climate-Related Financial Disclosures (TCFD), mandate financial institutions to disclose their exposure to climate change and Net Zero plans. This has put risk management higher on their agenda.

According to the 2021 RBC Global Asset Management Responsible Investment Survey of over 800 global investors, ESG is being widely adopted across the world. The top reasons for this are fiduciary duty (57%) and lower risks / increased returns (52%).

There is significant money flowing to climate mitigation

Mark Carney announced at COP26 that the assets under management of financial institutions committed to net-zero had increased from $5 trillion at the beginning of 2021 to $130 trillion in November 2021. It is worth noting that this money is focused on climate mitigation.

New data are available and better models of climate risks are being developed

Until recently, most models only predicted temperature and precipitation. However, academics have developed Earth System Models (ESMs) that simulate the world’s oceans, land, atmosphere and climate to provide a physically-based model of the planet.

Further advances in modeling techniques with more powerful computing allow us to better simulate the complexity of climate change and assess the regional impacts of various weather events.

The sixth Coupled Model Intercomparison Project (CMIP6), which supported the global climate model for the IPCC report in 2021, represents more than 7 years of innovation.

In 2021, COP26 saw the launch of the Global Risk modeling Alliance and Global Resilience Index Initiative that aim to:

- Provide a global, open reference, risk data developed using insurance risk modeling principles

- Provide shared standards and facilities applicable to a wide range of uses, like corporate risk disclosures, national adaptation planning and reporting

The NGFS, UNPRI, IMF and others are looking at the most effective methods to represent physical climate risk, with some methodologies published, and others in progress.

A number of frameworks are currently under development, so now would be a uniquely tractable time to influence them towards climate adaptation and other GCRs.

What do we aim to do?

1. Risk modeling and frameworks - Improved models for the cascading and systemic effects of global catastrophic risks (GCRs)

We aim to focus first on climate risk, and use it to create a framework to quantify and evaluate other GCRs. We choose these risks because they are global, emerging and have systemic impacts that require new modeling techniques and data to model. The large historical datasets that incumbents have are less useful. We are also considering cyber, pandemic, and food systems risks.

Climate risks are typically split into transition risks and physical risks. Transition risks are business-related risks that come from the shift towards a low-carbon and more climate-friendly future. Transition risks largely depend on political action and their occurrence is uncertain. As a result, they are relatively more straightforward to model as financial impacts.

In contrast, physical risks are risks from severe weather events, like flooding, droughts and storms. Physical risks are tougher to model than financial impacts because they are ever-changing and nonlinear.

We aim to quantify both direct (location, sector) and indirect (across the value chain) risks. As model developers, we will take the most advanced science coming out of academia and translate it into fit-for-business models and analytics. We will use an ensemble of ESMs from CMIP6 with various on-the-ground data sources to create high-definition models that will be useful at the local and regional levels.

With this information, asset owners and insurance companies can measure their exposure at an asset and portfolio level for fiduciary duty and lower risks / higher returns. Quantifying this exposure could also lead to significant increases in investments into the resilience of climate risks and other GCRs.

2. Financial innovation - Develop novel financial products to mitigate GCRs

We believe that with more financial interest, improved modeling and more data, there will be increased interest in financial innovations, such as new financial payout mechanisms. One example is the Locust Bond (a pre-paid procurement mechanism) proposed by ALLFED that, in the event that a threat from swarming locusts is detected, would payout in a successful control operation instead of a financial payout.

Capital market investors would be attracted to these financial products because they are not correlated with developed world asset prices. As mentioned before, these investments can also hedge against climate risks and GCRs.

3. Field building - Nudge the financial industry to invest more and rethink how it mitigates and adapts to GCRs and tail risks

As we look to build the new financial industry around GCRs, we will market and increase the understanding of these emerging and complex risks. We aim to bring together people from Effective Altruism, academia, and industry to focus on systemic risk modeling for a GCR-resilient world.

Moreover, as we enable more investments in interventions to be more resilient to GCRs, we hope to build a network of people in risk modeling, finance, and government to implement these long-term investments.

What is our plan?

1. Map and connect with the finance space

- Continue to connect with people in the finance space to understand the current situation, and validate our value proposition and theory of change

2. RED team this idea

- Bring together a group of people from a variety of backgrounds to challenge our assumptions and plans

3. Raise funding and hire a team

- Talk to aligned investors with a concrete plan to execute on

How can you help?

Connections in the finance space

- If you know anyone who has experience in asset management, modeling, financial product development or risk communication, we would love to connect with them

Feedback and RED team

- We greatly value your feedback and suggestions, particularly at this early stage. Please feel free to post your questions or comments, and let us know if you are interested in RED teaming this idea

Advisors and team members

- We will be looking for mission-aligned individuals from the effective altruism and finance communities who have an interest in our work. Especially valuable are modelers with experience in creating novel financial products

Funding

- We will be seeking funding later, and would love to be in contact with interested investors

Contact

Feel free to get in touch with me by emailing phil [at] eonv.org.

Acknowledgments

This post was done collaboratively with Sahil Shah. We want to express our gratitude to Noah James Wescombe, Sanjay Joshi, Jueyan Zhang, Mike Hinge, Yuli Jadov, Rob Lee Callum Higgins, Morgan Rivers and David Denkenberger for sharing their pearls of wisdom. We are also immensely grateful for their comments on an earlier version of this post, although any errors are our own.

References

- Joshi, S., 2021. The $100trn opportunity: ESG investing should be a top priority for EA careers. [online] Effective Altruism Forum. Available at:<https://forum.effectivealtruism.org/posts/4vRdt9Z9LsmaP7dHY/the-usd100trn-opportunity-esg-investing-should-be-a-top>.

- Chatham House, 2021. Climate change risk assessment 2021. Available at: <Climate change risk assessment 2021>.

- Institute for Economics & Peace., 2020. Ecological threat register 2020. Understanding ecological threats, resilience and peace. [online] ReliefWeb. Available at:<ETR_2020_web-1.pdf (reliefweb.int)>.

- Investor Leadership Network., 2021. Climate change physical risk toolkit. [online] ILN. Available at:<ILN-Climate-Change-Physical-Risk-Toolkit-v6.pdf (investorleadershipnetwork.org)>.

- Lenton, T.M., Rockström, J., Gaffney, O., Rahmstorf, S., Richardson, K., Steffen., W. & Schellnhuber, H.J., 2019. Climate tipping points - too risky to bet against. [online] Nature. Available at: <Climate tipping points — too risky to bet against (nature.com)>.

- Beard, S., Holt, L., Avin, S., Tzachor, A., Kemp, L., hÉigeartaigh, Ó. S., Torres, P., and Belfield, H., 2021. Assessing Climate Change’s Contribution to Global Catastrophic Risk. [online] GlobalChallenges. Available at:<Assessing-Climate-Changes-Contribution-to-GCR-authored.pdf (globalchallenges.org)>.

- Welburn, W.J., Strong, A., Nekoul, E.F., Grana, J., Marcinek, K., Osoba, A. O., Koirala, N., and Setodij, M. C., 2020. It's Not Just in the Financial Sector. [online] Rand corporation. Available at:<Systemic Risk: It's Not Just in the Financial Sector | RAND>.

- IMF Policy Paper., 2016. Small states’ resilience to natural disasters and climate change - role for the IMF. [online] International monetary fund. Available at:<Small States' Resilience to Natural Disasters and Climate Change - Role for the IMF; IMF Policy Paper, November 4, 2016>.

- Buchner, B., Clark, A., Falconer, A., Macquarie, R., Meattle, C., Tolentino, R., and Wetherbee, C., 2019. Global Landscape of Climate Finance 2019. [online] Climate Policy Initiative. Available at:<GLCF-2019.pdf (climatepolicyinitiative.org)>.

- Global Asset Management., 2021. Responsible Investment: ESG in a pandemic world. [online] RBC GAM. Available at:<Our latest independent research (rbcgam.com)>.

- World Economic Forum. Global Risks. [online] We Forum. Available at:<Home > Global Risks | World Economic Forum (weforum.org)>.

Interesting post, Phil!

I think it is worth having in mind more global warming might be good to mitigate the food shocks caused by abrupt sunlight reduction scenarios.

Why should we expect high returns? ILS / "Cat Bonds" don't seem to have especially high returns, and I'm not sure what the economic justification for them having high returns would be?

Good catch. Investors care about return vs risk. It also allows them to diversify and have lower risk / higher returns for their portfolio.

Lots of products aren't correlated to financial markets. (Betting on sports for example). That doesn't mean investors want to put money in.

Another point is that if they hedge against climate risk, and you think climate risk will materially affect the world, then you should expect these products to be correlated to the market. (But at least then they might have some excess return).

Is this an Eon V project? You use "we" throughout but don't explain who that is.

Yes, I imagine a new organization will be created, but for now, it falls under Eon V.

I'm not sure that this is important to your arguments, but -- do you have any evidence that this is actually the case?

Good question. It is likely fairer to say that risks are sometimes accounted for by increasing the discount rate, but how they come up with the discount rate is fairly qualitative.

Well, I certainly don't know any analyst claiming to consider GCRs when evaluating an asset, but maybe I should have searched better. I'd like to be proved wrong.

But it's actually hard to price worst-case scenarios: On Modeling and Interpreting the Economics of Catastrophic Climate Change | Martin Weitzman (harvard.edu)

I think "Weitzman's dismal theorem" is the climate economics version of "fanaticism" debates in EA. And this is one of the core objections of Stern against IAMs.

So I think it's fair to have a high credence that GCRs are not usually internalized into asset prices.