I’m a grantmaker who previously spent a decade as a professional investor. I’ve recently helped some Open Phil, GiveWell, and Survival and Flourishing Fund grantees with their cash and foreign exchange (FX) management. In the EA community, we seem collectively quite bad at this. My aim with this post is to help others 80/20 their cash and FX management: for 20% of the effort (these 4 items below), we can capture 80% of the benefit of corporate best practices. This will often be a highly impactful use of your time: I think that for the median organization, implementing these suggestions will take 15 to 30 hours of staff time, but will be about as valuable as raising 5% more money.

My suggestions are:

- have more than one bank

- invest your cash in a government-guaranteed money market account, earning ~5%

- hold international currencies in the same proportions as your spending in those currencies

- watch out for FX fees: Wise and Monzo tend to be best

Have more than one bank

Have you ever had to call your largest donor while on vacation to inform them that your deposits are all at a bank that’s about to fail, so you might need a bailout? I can assure you that this is a deeply unpleasant experience that you want to avoid.

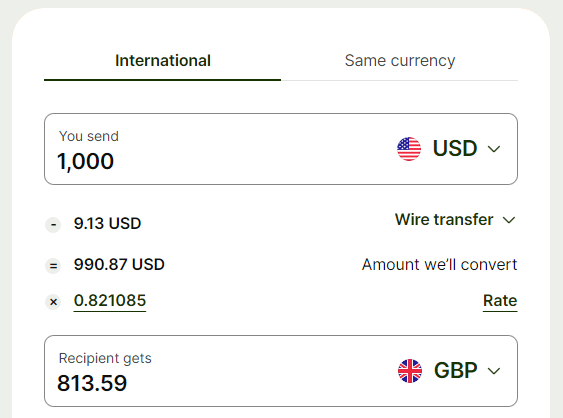

US bank failures by year, NYT

This year, we’ve seen the failures or severe distress of Silicon Valley Bank, First Republic, Credit Suisse, and Metro Bank, among others. While these banks were rescued with no losses to depositors, that’s not guaranteed. Bank runs do happen, banks do fail, and deposit insurance generally is intended to protect small depositors (up to $250k in the US, £85k in the UK).

One solution is to have at least two bank accounts. They should be linked so that you can easily transfer money from one to the other in case trouble brews. It’s a good idea for one bank to be a “systematically important financial institution”, colloquially “too big to fail”, like JP Morgan Chase, Bank of America, Citigroup, HSBC, or other banks that governments are likely to protect. If you must put all your eggs in one basket, choose a good basket (a strong major bank) and watch that basket (via news alerts or market observables). Wise and PayPal are not banks - operating out of Wise can be practical, but please keep most deposits at a regulated bank.

Opening a new bank account can take ~10 hours of staff time spread over a few months, as banks can be slow. Open a bank account before you definitely need one; in periods of banking stress, everyone is trying to open new bank accounts. Banks collapse quickly (often on the weekend after they encounter distress), and it typically takes weeks to open an account.

Invest your cash in a government guaranteed money market account, earning ~5%

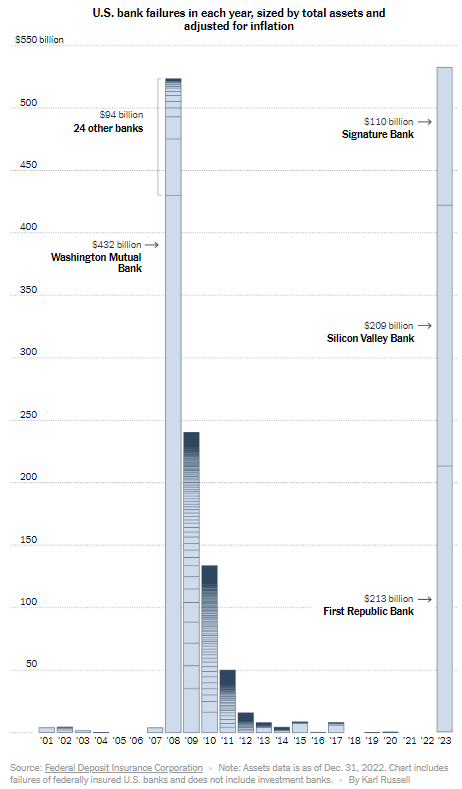

US average interest rates, FRED

From the Fed, we can see the average checking account (current account) earns 0.07% interest, the average savings account earns 0.45%, and the average money market account earns 5.33%. For years, checking accounts and money market accounts all earned 0%, so most organizations opened a checking account, which was the easiest. Now if you open the right checking account and check the “sweep to money market” box, you earn 76x the interest. Check the box. It’s free money.

There are other advantages to having your money in a money market account. If you have $1mm in your savings account:

- you can’t write checks out of it

- you earn 0.45% interest

- if the bank fails, the FDIC covers $250k

If you have $1mm in your checking account, with a daily sweep into a money market fund:

- you can write a $1mm check out of your account – the account is usually “fully checkable”

- you earn 5.33% interest

- if the bank fails, the money market account is backed by US government bonds, and you get all your money back

You earn $48,800 more a year, you don’t need to juggle money out of checking and into savings, and you’re insulated from bank failures. This seems like a free lunch. It is. You make $48,800 more a year because (roughly) your bank makes that much less.

“Sweeping” means that each day, excess cash is taken from your checking account and invested overnight, in this case by lending it to the US government. You get it back the next morning. Many organizations choose to sweep amounts over a peak daily spend (often payroll), to keep some cash in the checking account, but many money market accounts are “fully checkable” – you can write checks out of them for the full amount. Sweeping doesn’t require a separate brokerage account setup or manually moving money into savings / a fund. However, occasionally, a restricted grant may require income from that grant to also be restricted, which may create incremental paperwork. Different banks may offer different rates on their money market accounts: I think it’s not usually worth it to switch banks to chase an extra 0.2% - 0.4%.

Money market accounts are widely offered by reputable banks, primarily to their corporate clients. Recently, an OP grantee spent 5 hours of staff time opening this Chase Platinum Business Checking account which swept into this JPMorgan US Treasury Plus Money Market Fund. This makes them ~$40,000 more per month. YMMV based on your cash balances, but this is real and ongoing free money. Currently, sweep accounts are in demand and may take a while to open.

Most US money market funds by assets (~77% / $4.7tn) are invested in government bonds, and are designated “government”, “federal”, or “treasury”. I recommend these, as “prime” money market funds may invest in bank debt and make you exposed to bank failures again. “Tax exempt” funds are generally unsuitable for organizations. It’s normal for a bank to offer sweeps into money market funds managed by other institutions, often Fidelity, Vanguard, or JPMorgan. I recommend selecting among funds with at least $10bn under management, and choosing the highest available “SEC yield”. Equivalent vehicles also exist for EUR and GBP.

Hold FX in the same proportions as your spending

Suppose your organization spends 60% in USD, 20% in EUR, and 20% in GBP. If GBP has the best interest rate, should you keep all your cash in GBP? No, this has (approximately) 0 expected value by no arbitrage / covered-interest rate parity. By concentrating your holdings in GBP, you’re exposing your organization to GBP/USD and GBP/EUR foreign exchange risk: if the pound weakens by 7% (~1 standard deviation), you now have an unnecessary 7% shortfall for your USD and EUR spending.

The best practice is to hold FX in the same proportions as your spending in those currencies. That way, if a currency strengthens, your costs and the balance you’re holding to cover those costs both strengthen, and vice versa. This implies that if you are a UK organization with GBP expenses and you receive a USD grant, it’s in your best interest to convert it to GBP immediately.

Note: this holds for major market currencies (USD, GBP, EUR) without capital controls or pegs. If you have expenses in an emerging market currency, it may be better to hold the equivalent cash in a major market currency, since it may be the case that:

- it’s very difficult to maintain an EM currency bank account that earns interest, so it’s practically better to hold it in a major market currency

- because of capital controls, the EM currency steadily devalues

- the currency is pegged to another, for example HKD to USD, so it’s practically easier to hold the major currency

If your organization has minor proportional (<10%) or absolute spending in any currency, the above advice does not apply. The operational costs of maintaining a local currency bank account typically exceed the costs from having unhedged currency exposure.

Watch out for FX fees

FX fees are mostly hidden. FX providers routinely advertise “no fees” but make money by giving you a terrible rate. I have encountered FX costs ranging from 0.01% (awesome!) to 12% (terrible) for major currency pairs. You can’t manage what you don’t measure. Once you calculate the FX fees, you can comparison-shop for lower fees.

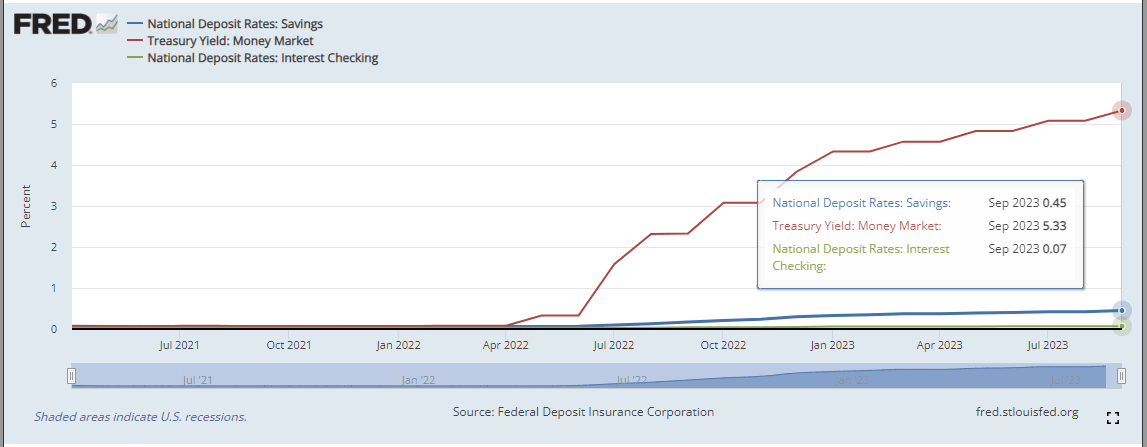

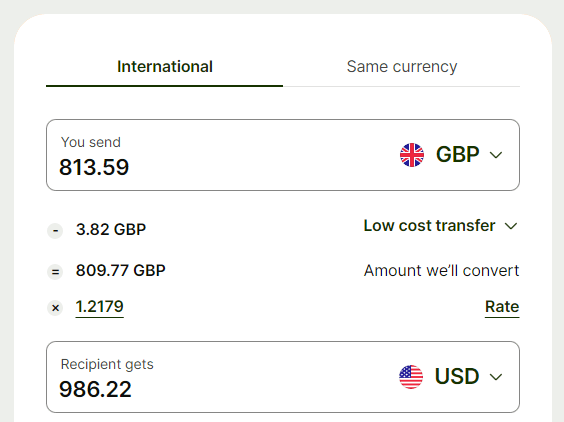

Calculating foreign exchange cost on Wise

Suppose you’re trying to understand the fees for converting USD to GBP through a certain provider. Plug in $1,000 USD, and see how much GBP you get. In the case of Wise, at the moment, you receive £813.59 GBP. Now plug that £813.59 GBP back in, and see how much USD you would receive - $986.22. You can see that for a round trip USD to GBP to USD transaction, you are paying $1000 - $986 = $14, or 1.4%.

That implies a 0.7% cost for a one-way transaction. For the same transaction ($1,000 from USD to GBP), PayPal charges 4.6%, Chase charges 3.5%, Wise charges 0.7%, and a brokerage account charges 0.2%. Rates are somewhat cheaper for large transactions: moving $1,000,000 to GBP on Wise costs 0.4% instead. For many charities, using Wise or Monzo for FX transactions is the low hanging fruit. For example, if you receive a EUR grant into your USD account, you pay the 3+% bank rate, but you can set up Wise to auto-convert and transfer to the USD account. If your program costs are in a different currency than your granted funds, moving away from a traditional bank can save you 3% of all program costs. If you have large FX volume, it may be worthwhile to open a brokerage account to allow you to further cut your FX fees.

For most charities, I expect implementing these four best practices will be cheap and worthwhile. For a broader discussion of running a financially sound charity, I like chapter 31 of Charity Entrepreneurship’s How to Launch a High-Impact Nonprofit (shared with permission).

Thank you to Derek Hopf, Ben Hoskin and others for helpful comments and suggestions and Amber Ace for editing. All remaining errors are mine.

Meta note: There is serious adverse selection in financial or investment advice you encounter on the Forum. To simplify, paid investment professionals usually face insurmountable legal and employer obstacles that prevent them from commenting, so what you read tends to be by unpaid amateurs. I can post this because I am no longer a professional investor, and I am providing unpaid general advice.

Thanks for writing this; I think my org is doing all of these things - but I will raise this with our finance team just to make sure.

I found this interesting:

This might be a little awkward, but to what degree is this an observation instead of an inference - have you generally seen well-received advice on the forum be pretty bad in a way that would be obvious to most financial advisors as opposed to just expecting this pattern based on the legal obstacles? I guess you won't want to do this, but if you could provide examples of financial advice that you think is incorrect but was well received, that would be pretty interesting to me (and I expect others). You can also message me directly if that's less awkward.

This is an observation, not an inference.

1) I recently compiled an (admittedly imperfect) list of the 10 senior investors most qualified to give EA investing advice. To avoid calling anyone out, [0 to 1] of the top 10 investing posts are authored by one of these senior folks, and scrolling quickly through top comments, [0 to 2] comments on these posts are by these senior folks.

2) I recently tried to gather 8 of the 10 to discuss investing strategy. 6 of us were able to meet, and our #2 and #3 deliverables coming out of that were “write a forum post on why not to get financial advice from the forum” and “create a basic advice doc”. This is #1, and when combined with the Charity Entrepreneurship book excerpt, hopefully is #2.

Some of what’s on the forum is thoughtful and interesting. But financial professionals structurally cannot refute what isn’t accurate. The most common failure mode is building castles in the sky – theorizing without a basis in reality / without chatting with any actual investors.

Hi JueYan,

I think it would be helpful if you could give examples of wrong advice.

An additional point supporting Advice 1:

Having multiple banks reduces your vulnerability to administrative FUBAR. It is a fact of life that operating in an unusual fashion in a regulated environment can occasionally cause headaches. When thinking about your org's cash, losing access to all of it is often qualitatively different to losing access to most of it. Having funds spread across multiple banks, while some overhead applies to set up, leaves you with some redundancy in case of institutional delay.

If you are operating as a non-profit, or a new org that goes through rapid user or revenue growth, the likelihood that you will experience a bureaucracy or ops failure that might restrict access to your cash increases. It's not high enough to be an overriding concern, but certainly well within the likelihood window of something as catastrophic as a bank failure when considering your options.

Thanks for writing this! It convinced me to do the investment sweep option for my org, and it's definitely been worth it so far.

This is perfectly written and very helpful -- thank you JueYan!

Thanks, really appreciated this post.

In case anyone is looking for a bank recommendation, I would recommend Mercury, for their excellent UX and good pricing model. We use them for both Manifold the for-profit, and Manifold for Charity. They do provide ~5% yield to for-profits through Mercury Treasury (we use a different interest provider but if we could do it over again, we would definitely choose Mercury Treasury instead). Unfortunately, they don't provide Treasury to nonprofits. Mercury can also do payments to intl accounts with a 1% FX exchange rate (worse than Wise, but Wise is kind of a PITA and kicked us off their platform :P). Referral link if interested: https://mercury.com/r/manifund

We do also have Stripe Opal for banking and other kinds of money movement, though that fits Manifold & Manifund because we do a significant amount of programmatic money movements -- most EA orgs won't need that.

I’ve also heard that Mercury has a great user experience, but as you mentioned, sadly, they’re not available for nonprofits. For a for-profit, your money market sweep goes to the Vanguard Treasury Money Market Fund, which is awesome: a reputable provider, $59bn under management, and 5.24% yield*. Mercury also offers a multi-bank sweep option, where you can put your balance across say 20 banks, so you get 20x the $250k FDIC limit in government protection.

If it weren’t for these “invincibility”** features, Mercury may well have failed when Silicon Valley Bank and First Republic failed. Mercury serves mostly startups, who tend to have large balances (over the $250k FDIC limit) and who know each other (and can spark bank runs through their dense networks). Worse, it’s not a bank, and there’s no stock prices or bond prices*** to watch to see when they’re in trouble.

* note that if you got the same yield via a certificate of deposit instead of a money market account, that’s materially worse, since you’re not insulated from bank failures, and may not be able to redeem if the bank becomes distressed

** not actually invincible

*** observable measures of distress are a double-edged sword: you know when the bank is in trouble, but everyone does, so small concerns can snowball into a real large concern

Wise offers two services that are not that easy to differentiate. The first is a straight money transfer service, but the second is what they refer to as a "balance" which gives you access to a foreign bank account number.

In a tax group I've had some discussions about whether this requires FBAR reporting. Although the account is held by Wise, they are giving the user access to this account and giving the user the use of the account numbers. My personal opinion is that this requires FBAR reporting.

Also, the 10,000 limit for FBAR reporting is all accounts that a person has access to. Therefore an employee of an organization that has an account back home with 9500 USD equivalent will have to report the 500 USD in the account at work that they have access to.

Thanks for that! That seems reasonable. I'd like to point out that this advice only applies to US staff, who have an obligation to report their foreign accounts (above some balance). I'd assume only the folks who have access / authority over the account have a filing requirement, not all US staff in the org. My experience is that this level of FBAR reporting isn't onerous.

https://www.irs.gov/businesses/small-businesses-self-employed/report-of-foreign-bank-and-financial-accounts-fbar

You need this information, and only the last requires some math:

(As a US citizen with a UK bank account from working abroad, I file FBARs for my personal accounts.)

I tried to open a Chase Platinum Business Checking account for a 501(c)(3) that I created recently, but it appears that they are not available for nonprofits. If one selects “Corporation” in the dropdown menu on the left, one is forced to select either “S-Corporation” or “C-Corporation” in the dropdown menu on the right, neither of which, I believe, is appropriate for a nonprofit.

Separately, I successfully opened a Wise Business account, but it has two drawbacks: (1) three months ago, Wise “temporarily” deactivated Business cards; and (2) their interest feature is unavailable for non-US-based customers (like me).

Other options mentioned in the post or comments are also, unfortunately, not suitable for my case: e.g. Mercury is not available for nonprofits, and Monzo is only available for UK-based businesses.

I would be grateful for any recommendations.

Great article. Very concise, clear and actionable!

This is not an object-level comment, but great to see you on the Forum, JueYan!

Thanks for writing this up!

I asked Chase (our org's bank) about the money market sweep option, and they said theirs is not a money market sweep, but an investment sweep, going through funds with JP Morgan, and it's NOT FDIC-insured. The funds could increase or decrease in value; it's a risk just like investing is. Other than those differences, it sounded similar to what you were writing about.

Were you actually writing about a couple different things, or is there a way to find an FDIC-insured option like this?

This isn't FDIC insured, but the money market fund linked is just in US treasuries so presumably negligible risk.

There are some multi-institution accounts called Insured Cash Sweep you can find to get higher FDIC insurance limits, though I think they generally have lower interest rates. This one from Mercury is an example.