It seems to me that the information that betting so heavily on FTX and SBF was an avoidable failure. So what could we have done ex-ante to avoid it?

You have to suggest things we could have actually done with the information we had. Some examples of information we had:

First, the best counterargument:

Then again, if we think we are better at spotting x-risks then these people maybe this should make us update towards being worse at predicting things.

Also I know there is a temptation to wait until the dust settles, but I don't think that's right. We are a community with useful information-gathering technology. We are capable of discussing here.

Things we knew at the time

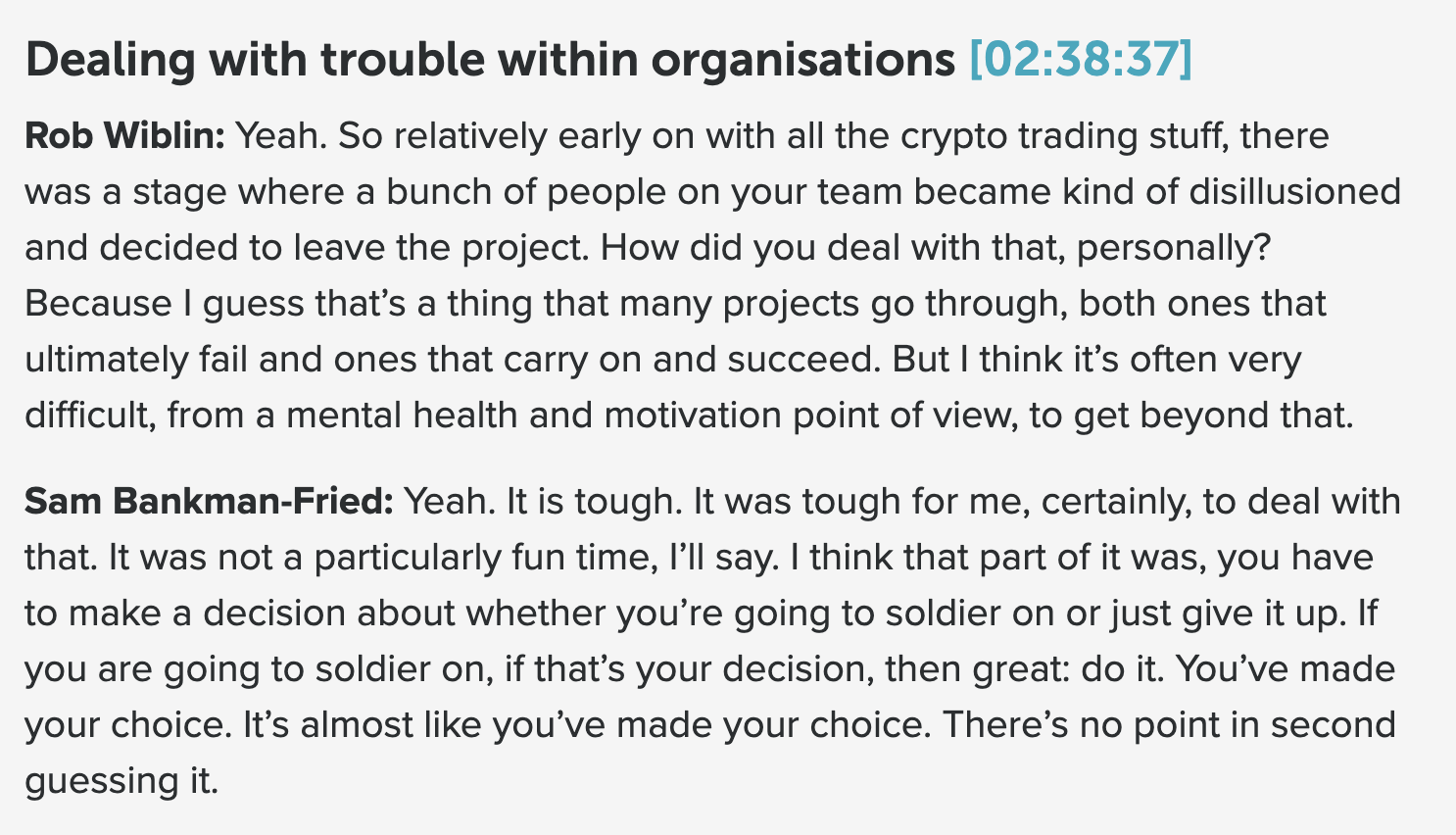

We knew that about half of Alameda left at one time. I'm pretty sure many are EAs or know them and they would have had some sense of this.

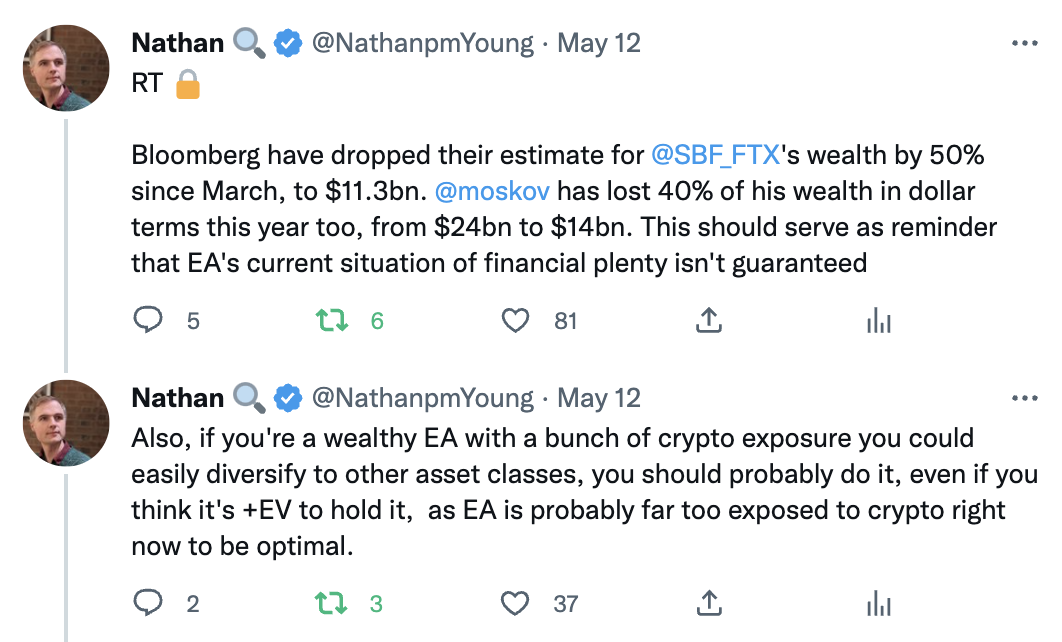

We knew that SBF's wealth was a very high proportion of effective altruism's total wealth. And we ought to have known that something that took him down would be catastrophic to us.

This was Charles Dillon's take, but he tweets behind a locked account and gave me permission to tweet it.

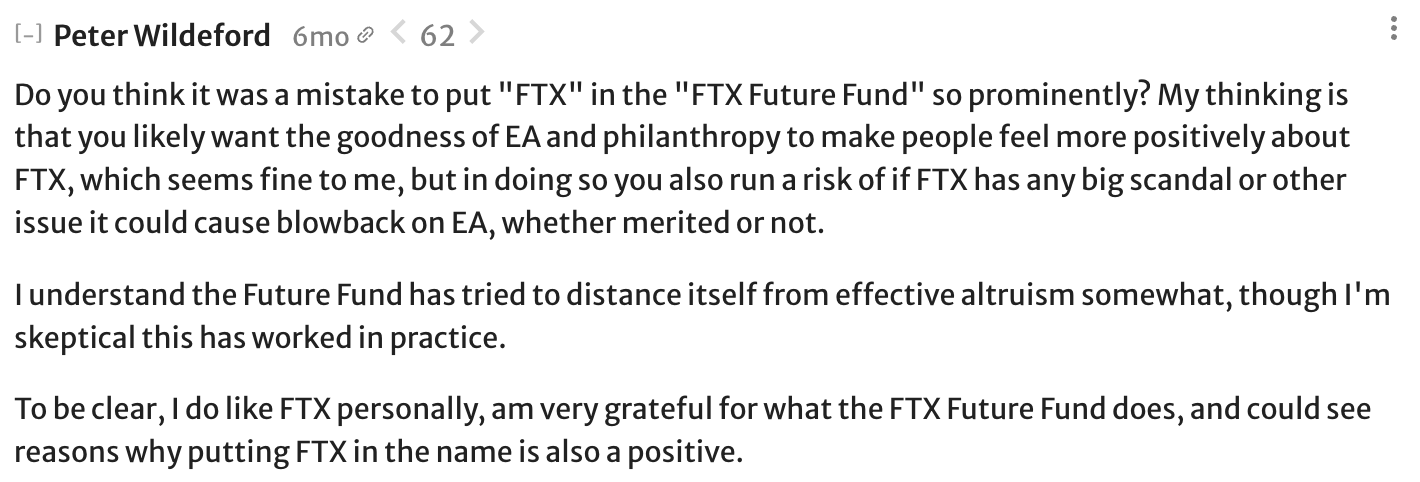

Peter Wildeford noted the possible reputational risk 6 months ago:

We knew that corruption is possible and that large institutions need to work hard to avoid being coopted by bad actors.

Many people found crypto distasteful or felt that crypto could have been a scam.

FTX's Chief Compliance Officer, Daniel S. Friedberg, had behaved fraudulently In the past. This from august 2021.

In 2013, an audio recording surfaced that made mincemeat of UB’s original version of events. The recording of an early 2008 meeting with the principal cheater (Russ Hamilton) features Daniel S. Friedberg actively conspiring with the other principals in attendance to (a) publicly obfuscate the source of the cheating, (b) minimize the amount of restitution made to players, and (c) force shareholders to shoulder most of the bill.

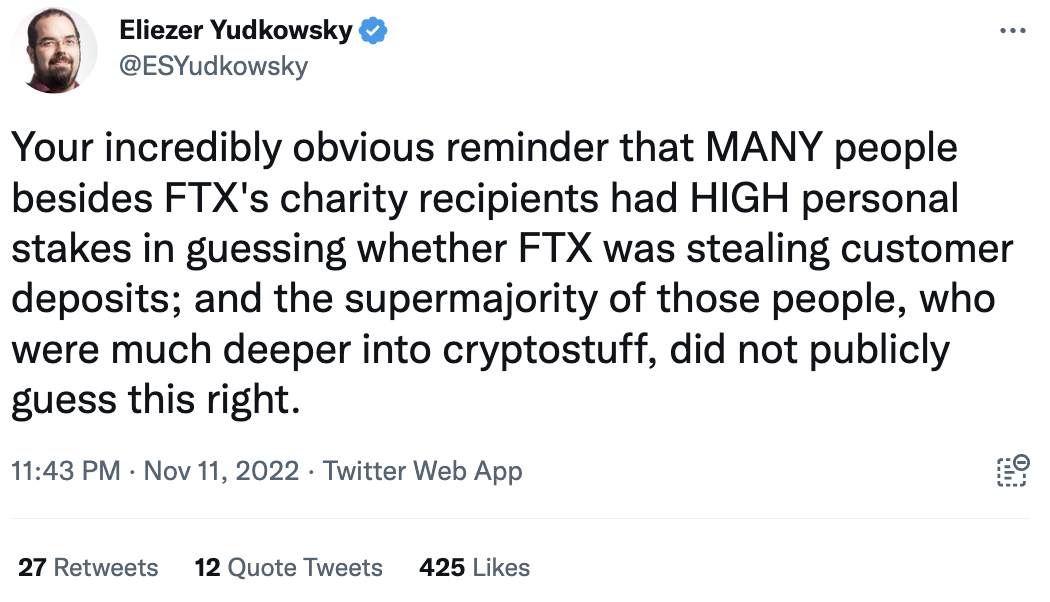

I have been quietly thinking "this is crypto money and it could vanish anytime." But I never said it out loud, because I knew people like Eliezer would say the kind of thing Eliezer said in the tweet above: "you're no expert, people way deeper into this stuff than you are putting their life savings in FTX, trust the market." It's a strangely inconsistent point of view from Eliezer in particular, who's expressed that his "faith has been shaken" in the EMH.

What Eliezer's ignoring in his tweet here is that the people who were skeptical of FTX, or crypto generally, mostly just didn't invest, and thus had no particular incentive to scrutinize FTX for wrongdoing. As it turns out, the only people looking closely enough at FTX were their rivals, who may have been doing this strategically in order to exploit vulnerabilities, and thus were incentivized not to spread this information until they were ready to trigger catastrophe. If there's money in scrutinizing a company, there's no money in releasing that information until after you've profited from it.

In my opinion, we need dedicated risk management for the EA community. The express purpose of risk management would be to start with the assumption that markets are not efficient, to brainstorm all the hazards we might face, without a requirement to be rigorously quantitative, to try and prioritize them according to severity and risk, and figure out strategies to mitigate these risks. And to be rude about it.

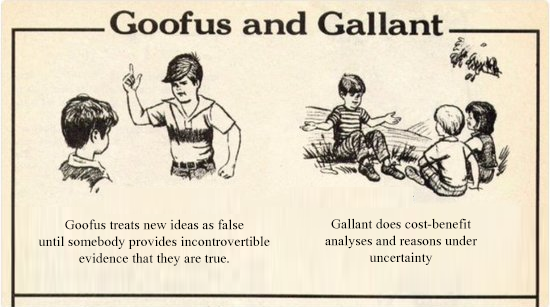

I think this does point to a serious failure mode within EA. Deference to leadership + insistance on quantitative models + norms of collegiality + lack of formal risk assessment + altruistic focus on other people's problems -> systemic risk of being catastrophically blindsided more than once.

Feel free to take credit for it!

I initially interpreted your comment as being only about things other than fraud. You're right that "person makes a lot of money in crypto" probably boosts the base rate for fraud by more than 10x, so your point is great. I think a lot of people, myself included, thought "surely he wouldn't do anything too blatant (despite crypto)."