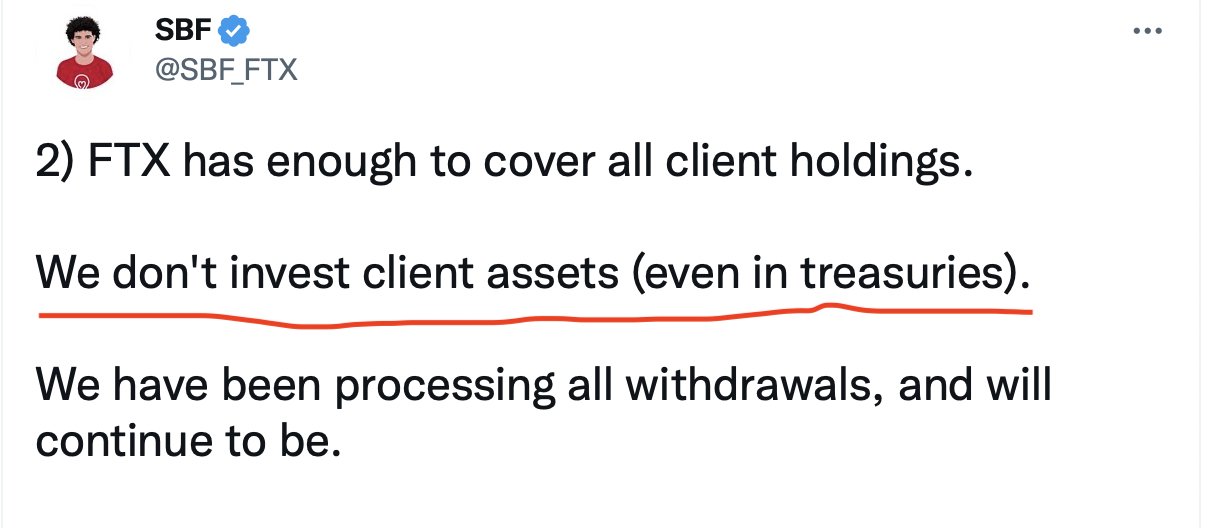

See: https://twitter.com/SBF_FTX/status/1590012124864348160

This is probably related to liquidity issues / solvency issues.

Sketch of timeline:

- A CoinDesk article comes out claiming that much of FTX and Alameda assets are just its own tokens ("TFF" or "SOL") and there is a circular relationship in assets between the two entities.

- Aggressive/hostile, but crisp analysis here: https://dirtybubblemedia.substack.com/p/is-alameda-research-insolvent

- As a hostile action, another exchange / leader ("CZ") publicly announced it was liquidating FTT token.

- FTT falls by about 26% on Nov 7.

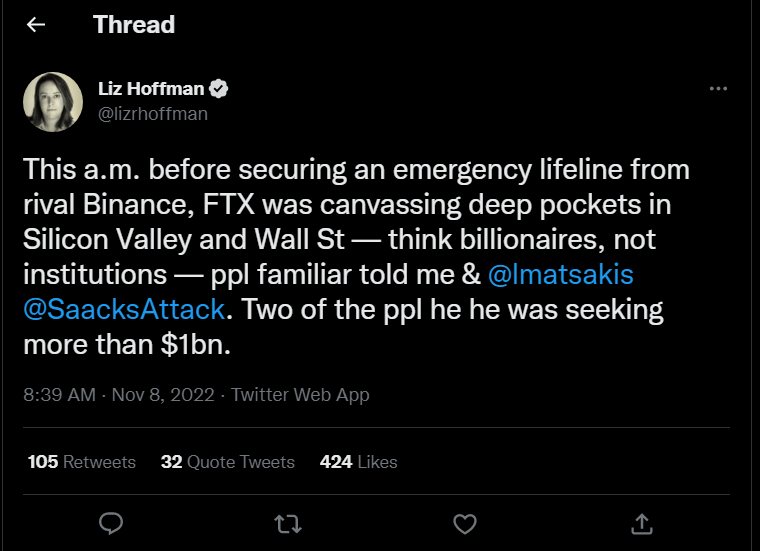

- There is probably further pressure on FTX, see HN discussion of FTX withdrawals: https://news.ycombinator.com/item?id=33518961

Without trying to make an affirmative statement about what happened at FTX or saying there wasn't any other factors, it seems likely that the idea "that customer funds solely belong to the customer and don't mix with other funds" is simplistic and effectively impossible in any leveraged trading system. In reality, what happens is governed by risk management/capital controls, that would almost always blow up in a bank run scenario of the magnitude that happened to FTX.

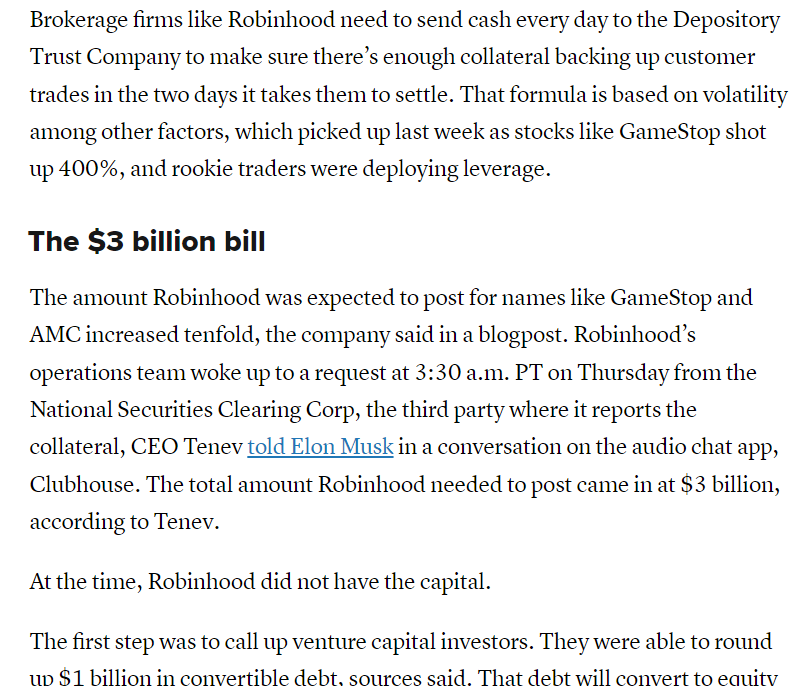

For example, Robinhood, which no one believes was speculating on customer funds, had a huge crisis in Jan 2021, that needed billions of dollars. This was just due to customer leverage (and probably bad risk management, the magnitudes seem much than what FTX faced this week).

https://www.cnbc.com/2021/02/03/why-investors-were-willing-to-write-robinhood-a-3-billion-check-during-the-gamestop-chaos-.html