Edit to add (9/1/2023): This post was written quickly and I judged things prematurely. I also regret not reaching out to Effective Ventures before posting it. Regarding my current opinion on the Abbey: I don't have anything really useful to say that isn't mentioned by others. The goal of this post was to ask a question and gather information, mostly because I was very surprised. I don't have a strong opinion on the purchase anymore and the ones I have are with high uncertainty. More thoughts in my case for transparent spending.

Yesterday morning I woke up and saw this tweet by Émile Torres: https://twitter.com/xriskology/status/1599511179738505216

I was shocked, angry and upset at first. Especially since it appears that the estate was for sale last year for 15 million pounds: https://twitter.com/RhiannonDauster/status/1599539148565934086

I'm not a big fan of Émile's writing and how they often misrepresent the EA movement. But that's not what this question is about, because they do raise a good point here: Why did CEA buy this property? My trust in CEA has been a bit shaky lately, and this doesn't help.

Apparently it was already mentioned in the New Yorker piece: https://www.newyorker.com/magazine/2022/08/15/the-reluctant-prophet-of-effective-altruism#:~:text=Last year%2C the Centre for Effective Altruism bought Wytham Abbey%2C a palatial estate near Oxford%2C built in 1480. Money%2C which no longer seemed an object%2C was increasingly being reinvested in the community itself.

"Last year, the Centre for Effective Altruism bought Wytham Abbey, a palatial estate near Oxford, built in 1480. Money, which no longer seemed an object, was increasingly being reinvested in the community itself."

For some reason I glanced over it at the time, or I just didn't realize the seriousness of it.

Upon more research, I came across this comment by Shakeel Hashim: "In April, Effective Ventures purchased Wytham Abbey and some land around it (but <1% of the 2,500 acre estate you're suggesting). Wytham is in the process of being established as a convening centre to run workshops and meetings that bring together people to think seriously about how to address important problems in the world. The vision is modelled on traditional specialist conference centres, e.g. Oberwolfach, The Rockefeller Foundation Bellagio Center or the Brocher Foundation.

The purchase was made from a large grant made specifically for this. There was no money from FTX or affiliated individuals or organizations." https://forum.effectivealtruism.org/posts/Et7oPMu6czhEd8ExW/why-you-re-not-hearing-as-much-from-ea-orgs-as-you-d-like?commentId=uRDZKw24mYe2NP4eq

I'm very relieved to hear money from individual donors wasn't used. And the <1% suggests 15 million pounds perhaps wasn't spent. Still, I'd love to hear and understand more about this project and why CEA thinks it's cost-effective. What is the EV calculation behind it?

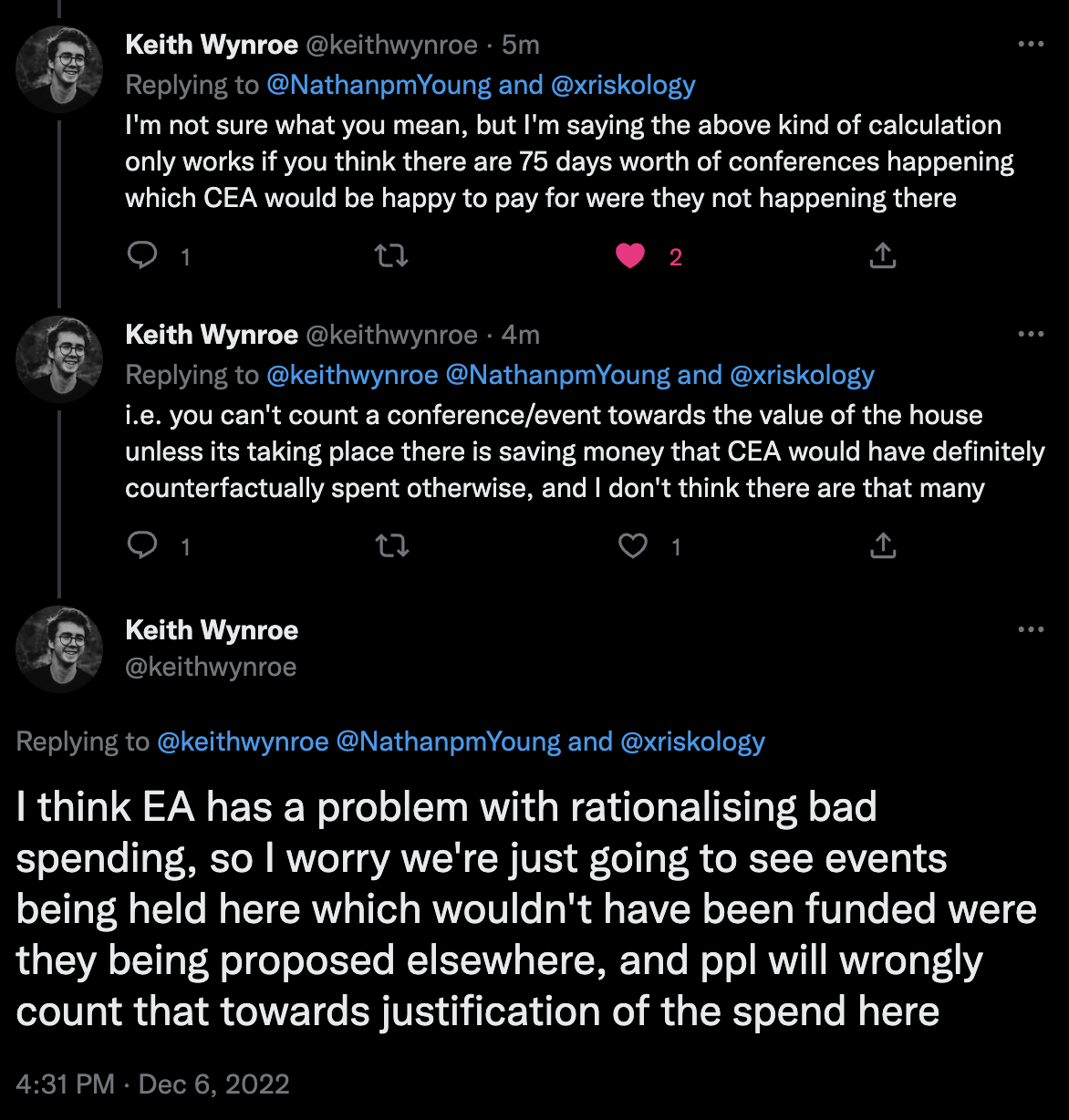

Like the New Yorker piece points out, with more funding there has been a lot of spending within the movement itself. And that's fine, great even. This way more outreach can be done and the movement can grow. But we don't want to be too self-serving, and I'm scared too much of this thinking will lead to rationalizing lavish expenses (and I'm afraid this is already happening). There needs to be more transparency behind big expenses.

Edit to add: If this expense has been made a while back, why not announce it then?

It's no concern of mine how OP spends its money, but since it's come up here: I don't think your cost estimate can be correct.

Firstly, OP doesn't have the asset, so its resale value is irrelevant to you. It's all very well to say that proceeds would be used for EVF's general funding which would funge against OP's future grants, but (a) there doesn't seem to be anything stopping EVF from using the proceeds for some specific project which OP wouldn't otherwise fund and (b) it's possible to imagine a scenario in which OP ceases to fund EVF and there's nothing to funge against. It seems to me that OP should just treat it as a grant of £15m (or whatever it was) to EVF. Presumably when you publish a grant report, that's what it will say.

Secondly, this has been discussed elsewhere, but the cost can't be a flat few million from EVF's perspective. Consider for example the case where the project is huge success and the property is held in perpetuity. Ex hypothesi it was a sound grant, but the whole £15m (or whatever) has been expended, plus some further amount for ongoing maintenance.

One possible counterfactual is that EVF buys the property and lets it for income. Gross rental yields in Oxfordshire are 4-5%, so EVF would receive a counterfactual income of at least £600k. In fact a property like that would be difficult to let as is: there are various ways one might generate income from it in practice, including running it as a conference centre for profit, but £600k pa should be an approximate floor on a reasonable commercial income (assuming the sale price to have been fair). By using the property for its own purposes EVF foregoes that income, so the cost to it is at least that much per year, and the total cost will depend on how long it's held. By definition, the income considered in perpetuity will capitalise at the fair purchase price.

But in fact EVF would never have bought the property for that purpose, for at least two reasons. Firstly, EVF doesn't endorse investing to give. Secondly, if EVF did want to invest £15m for income, buying a single property in Oxfordshire would not represente a prudent investment strategy. It's a very niche property and the resale value is going to depend on what purchasers happen to be in the market in the material time. Of course that might work out very favourably, but the opposite possibility is approximately equally likely.

Since in general EVF considers it can do better things with £15m than invest it for 4% yield, the opportunity cost must be higher than £600k pa. In fact EVF should probably know what it's discount rate is, which would make the calculation straightforward.