Tl;dr:

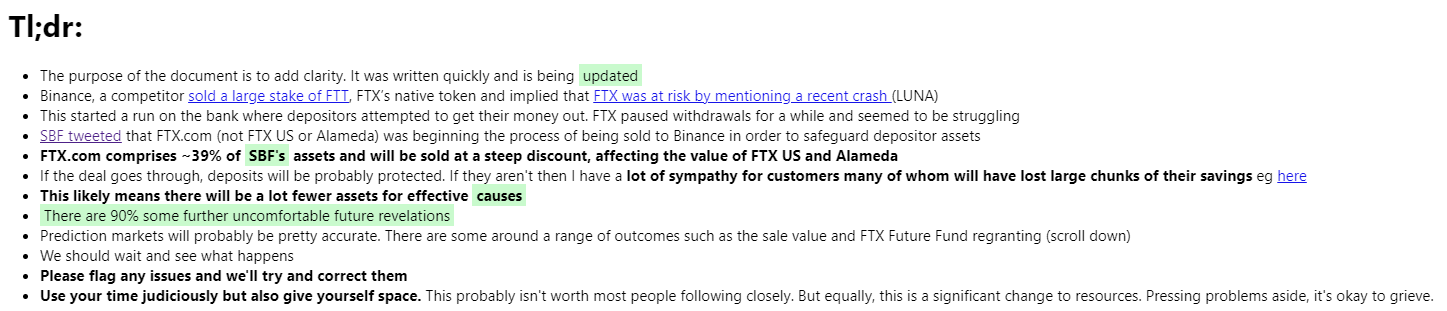

- The purpose of the document is to add clarity. It was written quickly and is being updated

- Binance, a competitor sold a large stake of FTT, FTX’s native token and implied that FTX was at risk by mentioning a recent crash (LUNA). This looks bad, but given what follows, the accusation was probably legitimate

- This started a run on the bank (FTX.com) where depositors attempted to get their money out.

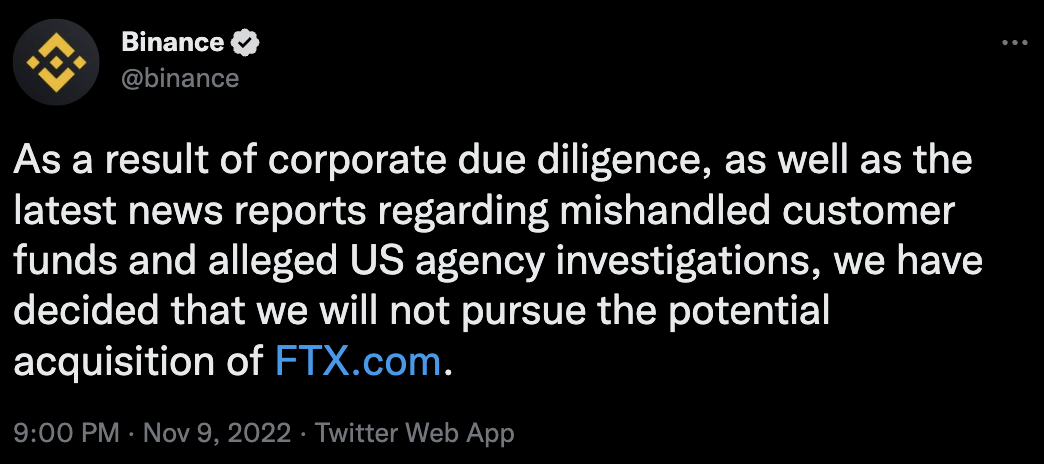

- SBF tweeted that FTX.com (not FTX US or Alameda) was beginning the process of being sold to Binance in order to safeguard depositor assets. Binance have since backed out of this and there are credible claims that funds customers deposited for safekeeping were being invested without their consent

- FTX.com comprises ~39% of SBF's assets and will likely be worthless (80%), probably FTX US (60%) will be too and probably Alameda also (85%).

- SBF is attempting to raise funds to cover deposits. He will almost certainly fail. ( ~90%)

- It is therefore very likely to lead to the loss of deposits which will hurt the lives of 10,000s of people eg here

- Regardless, this likely means there will be a lot fewer assets for effective causes

- There are some prediction markets below for things that are less clear

- We should wait and see what happens

- Please flag any issues and we'll try and correct them

- Use your time judiciously but also give yourself space. This probably isn't worth most people following closely. But equally, this is a significant change to resources and expectations are going to shift a lot. Pressing problems aside, it's okay to grieve.

Longer version

There are three key entities here (prices according to Bloomberg, so probably wrong):

- FTX (The worldwide business) that composes about 39%

- FTX.US (FTX’s US arm) a crypto exchange that composes about 13% of SBF’s wealth

- Alameda, a hedge fund which composes 46%

Alameda was SBF’s original hedge fund and made markets for FTX. The behaviour of the two was correlated, and Alameda held large positions in FTT, FTX’s token. It seems likely there were deep irregularities in FTX.com's finances also. Coindesk reported Alameda were in trouble, and some internal documents were leaked. Alameda CEO, Caroline Ellison rebutted.

Binance left/was pushed out of an early funding round of FTX and were paid in FTT, FTX’s native token. It seems like there was bad blood. This week Binance said they were selling their FTT and referenced LUNA a coin that recently crashed. It is common for projects in crypto to fail, so when there is a sense they will, people withdraw their money rapidly. This started a run on FTX. As above, given what follows their accusation was not without merit.

SBF announced that FTX.com, the non-US business, had been agreed in principle to be sold. SBF talks about that here. Binance have now backed out of the deal citing "news reports regarding mishandled customer funds". SBF is currently trying to raise money to cover these deposits. If he doesn't many depositors will likely lose their money, which will ruin 1000s of lives. This will also likely lead to fewer resources for effective causes which may ruin far more lives, now and in the future. Both of these outcomes are terrible.

This is hard to hear. It is 95% at this point that there was serious unethical behaviour. I can't comment on crime because I don't understand the law, but my (Nathan's) sense is that these will turn out to be things we think ought to be crimes. This is likely to be really bad for depositors. Many of these are covered in more detail in prediction markets below which will stay accurate (whereas this text will be updated more slowly).

Twitter threads

The thread announcing serious issues.

The most recent thread from Binance.

Claims of immoral activity (transferring users funds to risky assets without their consent) - the Reuters report is here.

SBF's latest thread (ht Greg Colbourn)

Relevant forecasts

Here is a section of relevant forecasts to try and give people a picture of what might happen.

The other key question is what happens to the FTX Foundation. How much will it spend next year? 66%

Will the FTX Future Fund spend more than $300mn in 2023? 15%

Will the FTX Future Fund spend more than $600mn in 2023? If this is high, then individuals may have more job security.

What will Forbes estimate SBF's wealth at?

Thoughts on financial details (suggest in comments)

- OpenPhil

- $3 - 6 Bn 80% CI

- Dustin/Cari

- $6 - 10 Bn 80% CI

- FTX Foundation & Future Fund

- Founders Pledge

Final comments

- This is gonna get worse before it gets better

- In general, it's probably good to wait before making judgements, but also to seek to have clarity where it affects decisions.

While I agree that FTX.com has more than enough experience negotiating deals objectively, I also think that this decision considers the fear that CZ is creating.

This is because as long as FTT gains value after Binance's sell (due to speculation), then there is no need to agree to the deal. Whether FTT gains value is influenced by investor sentiments.

The deal with Binance shows that SBF does not expect FTT to appreciate after Binance's sell. This would be the case when fear is associated with FTT. This is what CZ is creating.

Based on this line of reasoning, it is not necessary to agree to the deal with Binance, if one can mitigate the fear being caused by CZ.

Market price manipulation is illegal, so, technically, CZ cannot do anything besides influencing investor sentiments. One can argue that mitigating CZ's ability to threaten can be the key here, because that is the only effective strategy to keep FTT value high.

One way to mitigate one's ability to threaten is disclosing their techniques, such as deliberate motivation of negative emotions by appeal to biases, possibly using Twitter bots, etc.

On one hand, ignoring Binance's offer had to be already thoroughly considered by FTX.com. On the other hand, introducing an external motivation to find a solution by 'making CZ sincerely contribute' or ignore him could improve the sentiments around FTT value and thus resolve the problem.